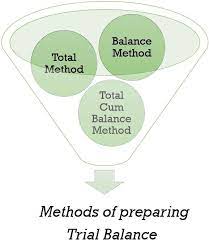

How many methods are there for preparing trial balance?

User Intent Users searching for this topic want to understand the different methods of preparing a trial balance in accounting. They might be students, professionals, or business owners looking for a detailed explanation, benefits, limitations, and comparisons of these methods. Introduction In the world of accounting, accuracy is crucial. One of the essential tools for… Read More »