What is the Difference Between Proprietorship and Private Limited?

Many entrepreneurs face a crucial decision when starting a business: Should they register as a Sole Proprietorship or a Private Limited Company? Each structure has its own advantages and challenges, making it essential to understand the differences before choosing the best fit. This guide provides an in-depth comparison, covering definitions, applications, benefits, limitations, and a detailed comparative table to help business owners make informed decisions.

Introduction

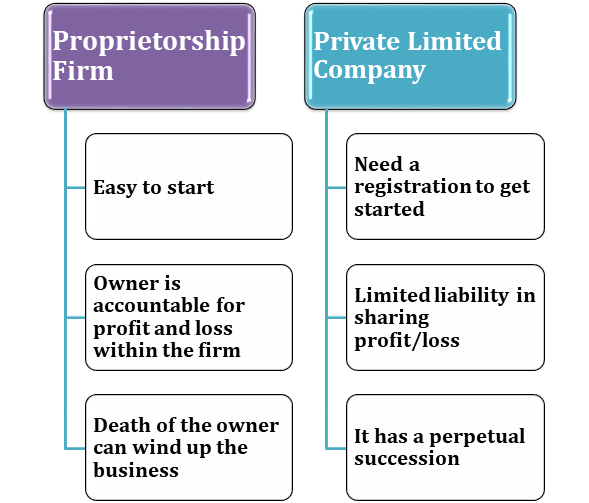

Business structure plays a significant role in financial management, legal compliance, and long-term growth. The right choice depends on factors like investment needs, taxation, liability, and operational control. While Proprietorship is simple and ideal for small businesses, a Private Limited Company offers greater scalability and legal protection. Let’s break down the key differences.

Definition

Sole Proprietorship

A Sole Proprietorship is a single-owner business where the owner and the business are legally the same entity. This means that all profits, liabilities, and taxes are directly tie to the owner.

Private Limited Company (Pvt Ltd)

A Private Limited Company is a separately registered legal entity that requires at least two shareholders and directors. It provides limited liability protection and is governed by corporate laws.

Application in Detail

Proprietorship

- Small retail shops and local businesses

- Freelancers and independent consultants

- Home-based businesses (baking, tailoring, crafts)

- Small traders and service providers

- Individual professionals (doctors, accountants, photographers)

Pvt LtdÂ

- Startups seeking external funding

- Businesses planning for long-term growth

- IT companies, manufacturing units, and e-commerce platforms

- Service-based firms (marketing agencies, fintech startups, consultancy firms)

- Companies that want a professional corporate structure

Benefits in Detail

Advantages of Sole Proprietorship

- Simple Setup & Low Cost: Minimal paperwork and registration costs.

- Complete Control: The owner has full decision-making authority.

- Minimal Compliance: No need for audits, board meetings, or extensive legal formalities.

- Tax Benefits: The income is taxed as personal income, avoiding corporate tax.

- Flexibility: Easy to start, modify, and dissolve without legal complications.

Advantages of Private Limited Company

- Limited Liability: Shareholders’ personal assets are protected from business liabilities.

- Fundraising Capability: Eligible for venture capital, angel investors, and loans.

- Separate Legal Identity: The company exists as a distinct entity, ensuring credibility.

- Perpetual Succession: The business continues even if shareholders change.

- Tax Optimization: Certain tax benefits and deductions available for corporations.

Limitations in Detail

Disadvantages of Sole Proprietorship

- Unlimited Liability: The owner is personally responsible for all debts and losses.

- Limited Growth Potential: Difficult to secure external funding.

- Lack of Business Continuity: The business ceases to exist if the owner passes away.

- Taxation Challenges: Higher tax rates in some cases, as income is taxed as personal earnings.

- Less Market Credibility: Not preferred by investors and banks for large-scale operations.

Disadvantages of Pvt Ltd

- Complex Setup Process: Requires registration, legal documentation, and compliance.

- Higher Costs: Legal, accounting, and maintenance expenses are significant.

- Strict Compliance: Annual audits, board meetings, and regulatory filings are mandatory.

- Ownership Restrictions: Shares cannot be publicly traded; only private investors can participate.

- Decision-Making Delays: Requires board approvals for critical business decisions.

Comparative Table

| Feature | Sole Proprietorship | Private Limited Company |

|---|---|---|

| Ownership | Single owner | Minimum 2 shareholders |

| Legal Identity | Not separate | Separate entity |

| Liability | Unlimited (personal) | Limited to shares |

| Taxation | Individual tax rate | Corporate tax rate |

| Compliance Requirements | Minimal | High (audits, filings) |

| Business Continuity | Ends with owner | Perpetual existence |

| Funding Options | Limited (self-funded) | Investors, venture capital |

| Decision Making | Quick and independent | Requires board approvals |

| Market Credibility | Low | High |

Conclusion

Choosing between a Sole Proprietorship and a Private Limited Company depends on your business goals. If you seek simplicity, full control, and minimal compliance, a proprietorship is a good choice. However, if you aim for long-term growth, investor funding, and legal protection, a Private Limited Company is the better option.

For small businesses and freelancers, a proprietorship is convenient. But if you plan to scale, attract investments, or create a structured corporate identity, a Private Limited Company is the recommended choice. Understanding these differences will help you make an informed decision based on your vision and financial strategy.

Related Topics

what is sole proprietorship form of business?

What is a sole proprietor business license?

Can a sole proprietorship have multiple businesses?

For further details visit:Â https://vibrantfinserv.com/

Contact:Â Â Â Â 8130555124, 8130045124

Whatsapp:Â Â https://wa.me/918130555124

Mail ID:Â Â Â Â Â Â operations@vibrantfinserv.com

Web Link:Â Â Â https://vibrantfinserv.com

FB Link:Â Â Â Â Â Â https://fb.me/vibrantfinserv

Insta Link:Â Â https://www.instagram.com/vibrantfinserv2/

Twitter:Â Â Â Â Â Â https://twitter.com/VibrantFinserv

Linkedin:Â Â Â https://www.linkedin.com/in/vibrant-finserv-62566a259/