![]()

Preparing Projections for BalanceSheet

Preparing projections for a balancesheet involves forecasting the financial position of a business at a future date based on anticipated data and assumptions.

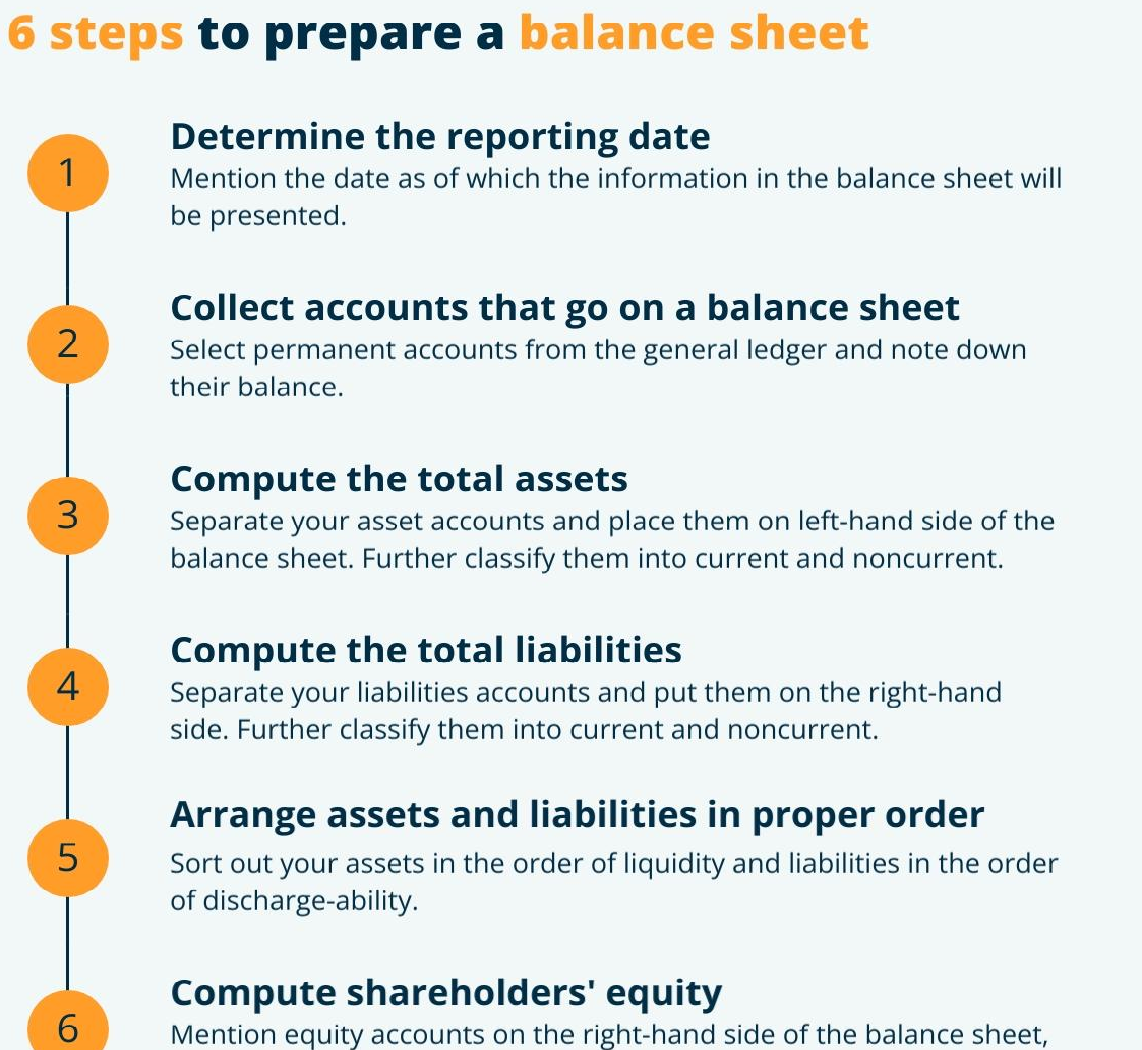

Here are the steps to prepare projections for a balance sheet:

1. Gather Historical Financial Data:

Collect the past financial statements, including balance sheets, income statements, and cash flow statements, for the business. Analyze the trends and patterns in the data to understand the historical performance and financial position of the business.Essential tips for creating balance sheet

2. Determine the Projection Period:

Decide on the period for which you want to project the balance sheet. It could be for the upcoming year, several years, or any specific time frame based on your needs and objectives.

3. Estimate Revenue and Expenses:

Project the revenue and expenses of the business for the projection period. Consider factors such as anticipated sales growth, pricing strategies, cost structures, and any other relevant factors that will impact the financial performance of the business. Use these estimates to determine the expected net income or loss for each period.

4. Forecast Assets:

Based on the projected revenue and expenses, estimate the changes in assets for each period. Consider categories such as cash, accounts receivable, inventory, property, plant, and equipment. Determine the expected inflows and outflows of assets based on factors like sales growth, capital investments, depreciation, and working capital requirements.

5. Estimate Liabilities and Equity:

Determine the changes in liabilities and equity for each period. Consider categories such as accounts payable, loans, accrued expenses, retained earnings, and additional capital injections. Estimate the changes based on anticipated expenses, financing arrangements, dividend payments, and other relevant factors.

6. Balance the Balance Sheet:

Ensure that the projected balance sheet maintains the fundamental accounting equation of Assets = Liabilities + Equity. Adjust the estimates for assets, liabilities, and equity to ensure they are in balance for each period.

7. Validate and Refine the Projections:

Review the projected balance sheet for reasonableness, coherence, and accuracy. Validate the projections against industry benchmarks, historical trends, and external factors that may influence the business. Make necessary adjustments and refinements to ensure the projections reflect a realistic financial position.

8. Document and Communicate:

Document the assumptions, methodology, and key findings of the projected balance sheet. Clearly communicate the limitations of the projections and the uncertainties associated with future outcomes. Share the projections with relevant stakeholders, such as management, investors, or lenders, to provide insights into the anticipated financial position of the business.

It’s important to note that projections for a balance sheet are based on assumptions and future expectations. They are subject to change as actual data becomes available and business conditions evolve. Regularly review and update the projections to ensure they remain relevant and useful for decision-making.

FAQs:

To visit https://www.incometax.gov.in

For further details access our website https://vibrantfinserv.com