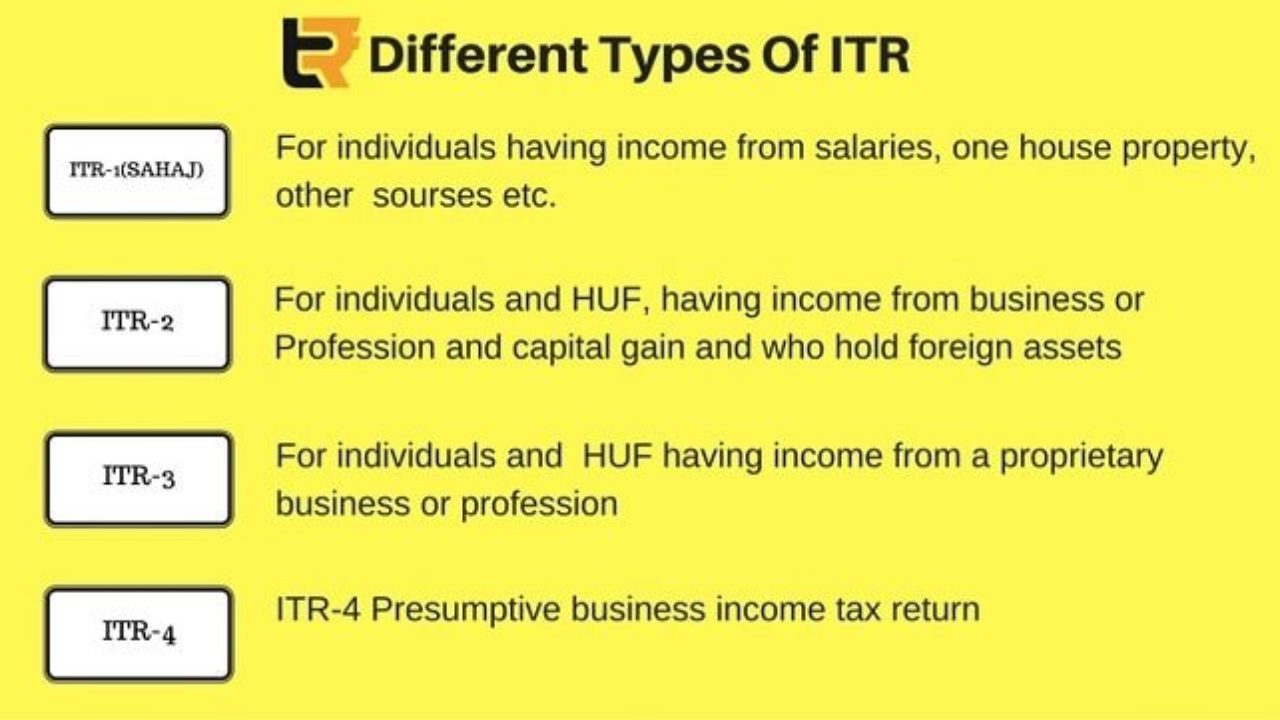

ITR 3 vs ITR 4 difference

ITR 3 vs ITR 4 difference are two different income tax return forms in India, applicable to different types of taxpayers.

Here are the key ITR 3 vs ITR 4 difference.

Applicability:

ITR-3: This form is specifically applicable to individuals and Hindu Undivided Families (HUFs) who generate income from a business or profession.

ITR-4: It is applicable to individuals, HUFs, and partnership firms (excluding Limited Liability Partnerships) who have presumptive income from a business or profession.

Calculation of Income:

ITR-3: Taxpayers filing ITR-3 need to provide details of their business or professional income, including profit and loss statement, balance sheet, and other financial statements.

ITR-4: Taxpayers filing ITR-4 can opt for the presumptive taxation scheme under sections 44AD, 44ADA, or 44AE. They need to declare their income based on a specified percentage of gross receipts or turnover, without the need for maintaining detailed books of accounts.

Books of Accounts:

ITR-3: Taxpayers filing ITR-3 are require to maintain books of accounts as per the provisions of the Income Tax Act. They need to prepare financial statements and maintain records of their business transactions.

ITR-4: Taxpayers filing ITR-4 under the presumptive taxation scheme are not required to maintain detailed books of accounts. However, they need to maintain a summary of their income, expenses, and details of assets and liabilities.

Tax Audit:

ITR-3: Taxpayers filing ITR-3 may be required to get their accounts audited if their business turnover exceeds the specified threshold limits.

ITR-4: Taxpayers filing ITR-4 under the presumptive taxation scheme are exempted from tax audit irrespective of their turnover.

Presumptive Taxation Scheme:

ITR-3: It does not offer the option for presumptive taxation. Taxpayers need to report their actual business or professional income.

ITR-4: It is specifically design for taxpayers opting for the presumptive taxation scheme. They need to report their income based on the prescribed percentage of gross receipts or turnover.

Reporting of Income and Expenses:

ITR-3: Taxpayers filing ITR-3 need to report their income and expenses in detail, including deductions and allowances.

ITR-4: Taxpayers filing ITR-4 have a simplified reporting requirement. They need to provide a consolidated summary of their income and expenses without the need for detailed disclosure.

It is important to carefully choose the correct ITR form based on your specific income sources, business structure, and taxability. If you are unsure about the appropriate form to use or have complex income situations, it is advisable to consult a qualify chartered accountant or tax professional for guidance.

To visit https://www.incometax.gov.in