ITR 1 Vs. ITR 4

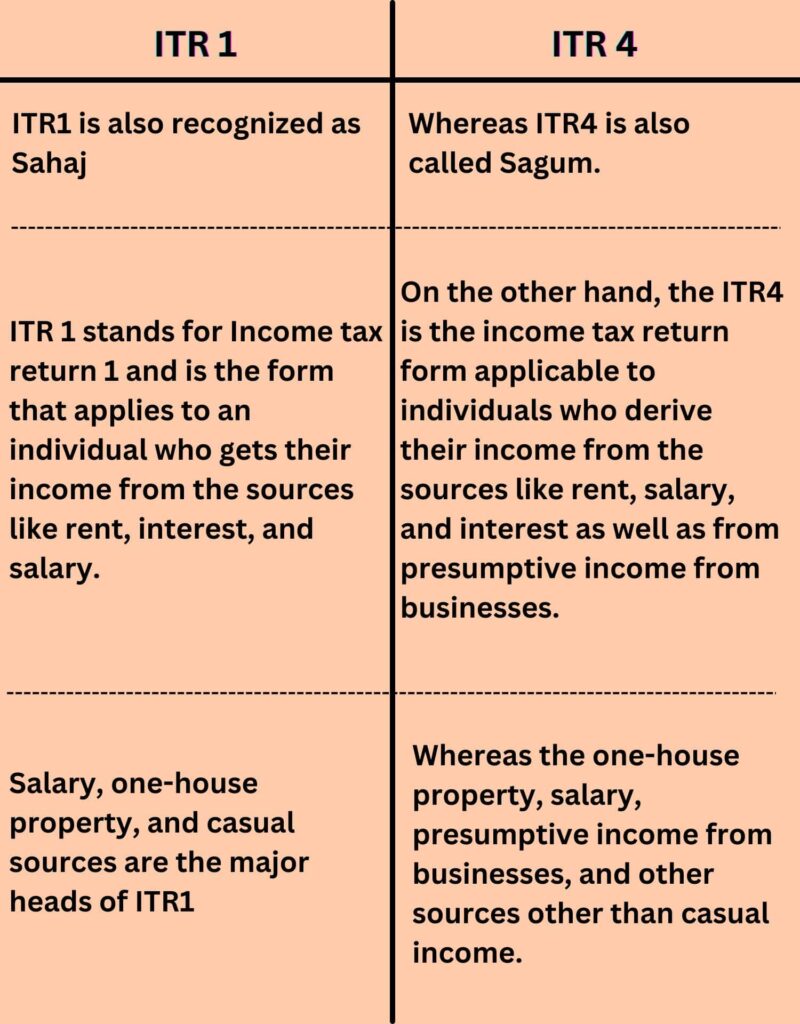

ITR 1 Vs. ITR 4 are two different income tax return forms in India, applicable to different types of taxpayers.

Here are the key differences between ITR-1 (Sahaj) and ITR-4 (Sugam):

Applicability:

ITR-1:

It is applicable to individuals who are residents of India and have income from salary, one house property, other sources (excluding lottery winnings and income from horse races), and total income up to Rs. 50 lakh.

ITR-4:

It is applicable to individuals, HUFs, and partnership firms (excluding Limited Liability Partnerships) who have presumptive income from a business or profession and whose total income is up to Rs. 50 lakh.

Source of Income:

ITR-1:

Taxpayers filing ITR-1 can report income from salary, one house property, and other sources (such as interest income, pension income, etc.). They cannot have income from business or profession.

ITR-4:

Taxpayers filing ITR-4 can have presumptive income from a business or profession under sections 44AD, 44ADA, or 44AE. They can also report income from salary, house property, and other sources.

Presumptive Taxation Scheme:

ITR-1:

It does not offer the option for presumptive taxation. Taxpayers need to report their actual income from various sources.

ITR-4:

It is specifically designed for taxpayers opting for the presumptive taxation scheme. They need to report their income based on the prescribed percentage of gross receipts or turnover.

Books of Accounts:

ITR-1:

Taxpayers filing ITR-1 are not required to maintain books of accounts or provide detailed financial statements.

ITR-4:

Taxpayers filing ITR-4 under the presumptive taxation scheme are not required to maintain detailed books of accounts. However, they need to maintain a summary of their income, expenses, and details of assets and liabilities.

Tax Audit:

ITR-1:

Taxpayers filing ITR-1 are not required to get their accounts audited.

ITR-4:

Taxpayers filing ITR-4 under the presumptive taxation scheme exempt from tax audit irrespective of their turnover.

For more information to visit https://www.incometax.gov.in

Reporting of Income and Expenses:

ITR-1:

Taxpayers filing ITR-1 have a simplified reporting requirement. They need to provide a consolidated summary of their income from various sources and cannot claim certain deductions.

ITR-4:

Taxpayers filing ITR-4 need to report their income and expenses in detail, including deductions and allowances.

However, It is important to carefully choose the correct ITR form based on your specific income sources, taxability, and eligibility. If you are unsure about the appropriate form to use or have complex income situations, it is advisable to consult a qualified chartered accountant or tax professional for guidance.

For further details access our website https://vibrantfinserv.com