Interstate GST and Intrastate GST

Interstate GST and Intrastate GST

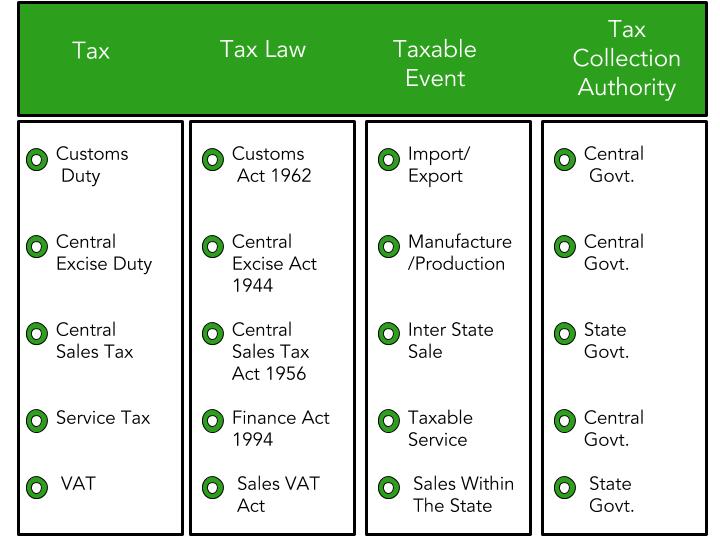

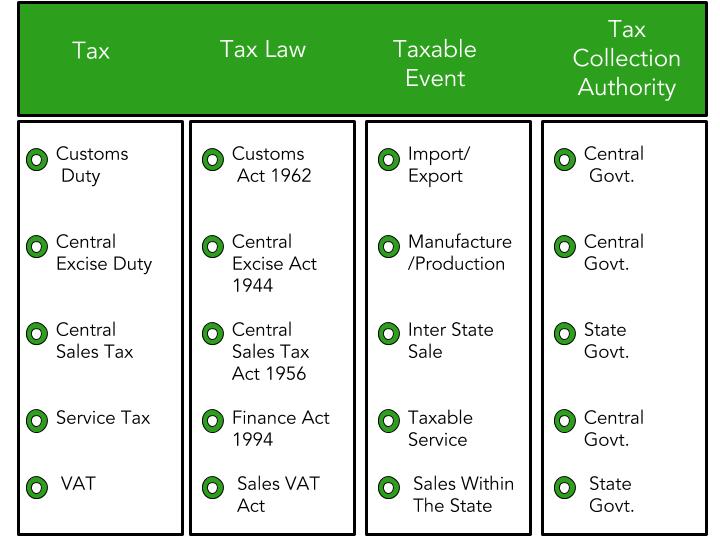

GST is applicable to both interstate GST and intrastate GST transactions, each with its own set of tax rates and regulations. GST, which stands for Goods and Services Tax, is a comprehensive indirect tax introduce in India on July 1, 2017. It replaced multiple indirect taxes levied by the central and state governments, creating a unified tax structure throughout the country.

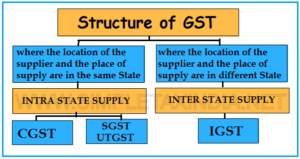

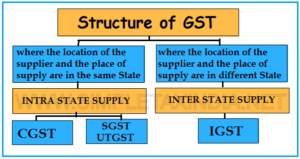

Interstate GST applies to the supply of goods or services between different states, as well as to transactions involving union territories or foreign countries. When goods or services are supply from one state to another, the tax collected is known as Integrate GST (IGST). The central government collects IGST, and later distributes it to the respective state governments based on the destination of the goods or services.

On the other hand, intrastate GST, also known as State GST (SGST), is levy on the supply of goods or services within the same state. The state government collects SGST, which is applicable when both the supplier and recipient are locate within the boundaries of the same state. In addition to SGST, Central GST (CGST) is collect by the central government on intrastate transactions.

For more information visit this site: https://www.gst.gov.in/

In summary, the key distinction between interstate GST and intrastate GST is that the former applies to transactions between different states or union territories, while the latter applies to transactions within the same state. The tax collected on inter-state transactions is call IGST, whereas on intra-state transactions, both SGST and CGST are levy.

FAQs:

1. What is Intrastate GST?

Ans: Intrastate GST is the tax levied on the supply of goods and services within the same state. It consists of CGST (Central GST) and SGST (State GST).

2. What is Interstate GST?

Ans: Interstate GST is the tax applicable on the supply of goods and services between two different states. It is referred to as IGST (Integrated GST).

3. How is Intrastate GST calculated?

Ans: Intrastate GST is calculated as the sum of CGST and SGST, each typically at 9% (for a total of 18%) on the transaction value.

4. How is Interstate GST calculated?

Ans: Interstate GST (IGST) is calculated at a rate that is the same as the combined rate of CGST and SGST, usually at 18% for most goods and services.

5. When is Intrastate GST applicable?

Ans: Intrastate GST is applicable when the supply of goods or services occurs within the same state or union territory.

6. When is Interstate GST applicable?

Ans: Interstate GST applies when goods or services are supplied from one state to another state or union territory.

7. Who collects Intrastate GST?

Ans: Intrastate GST is collected by the respective state government, with half (SGST) going to the state and the other half (CGST) to the central government.

8. Who collects Interstate GST?

Ans: Interstate GST is collected by the central government, which subsequently distributes the revenue to the states involved in the transaction.

9. How is ITC claimed for Intrastate and Interstate GST?

Ans: Input Tax Credit (ITC) can be claimed for both Intrastate and Interstate GST, provided the goods or services are used for taxable supplies.

10. What is the difference in filing returns for Intrastate and Interstate GST?

Ans: Both Intrastate and Interstate GST are reported in different sections of GST returns. Intrastate transactions are recorded under CGST and SGST, while Interstate transactions are recorded under IGST.

For further details access our website: https://vibrantfinserv.com

Interstate GST and Intrastate GST

Interstate GST and Intrastate GST