Health or Medical Insurance

The Insurance in India is a type of insurance policy that provides financial coverage for medical expenses incurred due to illness, injury, or hospitalization.

Key aspects of Health or Medical Insurance in India:

1. Types of Policies:

Health insurance policies in India come in various forms, including individual health insurance, family floater plans, senior citizen health insurance, and group health insurance provided by employers or associations.

2. Coverage:

Health insurance policies typically cover hospitalization expenses, including room charges, doctor’s fees, diagnostic tests, surgeries, medications, and pre- and post-hospitalization expenses.

Some policies may also cover additional benefits like ambulance charges, day-care procedures, and alternative treatments.

3. Network Hospitals:

Many health insurance providers have tie-ups with network hospitals where policyholders can avail cashless treatment.

In cashless facilities, the insurer settles the medical bills directly with the hospital, making it convenient for the policyholder.

4. Premiums:

The premium for health or Medical insurance policies in India depends on factors such as the age of the insured individuals, sum insured, coverage features, and pre-existing health conditions.

Premiums may also vary based on the type of policy and the insurer’s underwriting guidelines.

5. Pre-existing Conditions:

Most health insurance policies have a waiting period for pre-existing conditions, during which coverage for such conditions may be restricted or excluded.

The waiting period typically ranges from 1 to 4 years, depending on the insurer and policy terms.

6. Claim Process:

Policyholders can file health insurance claims for reimbursement of medical expenses incurred or avail cashless treatment at network hospitals.

The claim process usually involves submitting medical bills, diagnostic reports, and other necessary documents to the insurance company.

7. Renewal and Portability:

Health insurance policies in India are typically renewable annually, allowing policyholders to continue their coverage by paying the renewal premium.

Additionally, policyholders have the option to port their health insurance policies to another insurer without losing continuity benefits.

8. Government Schemes:

The Government of India has also launched various health insurance schemes to provide affordable healthcare coverage to citizens, such as Ayushman Bharat – Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) and Rashtriya Swasthya Bima Yojana (RSBY).

9. Tax Benefits:

Premiums paid towards health insurance policies are eligible for tax deductions under Section 80D of the Income Tax Act, offering tax benefits to policyholders.

It’s essential to carefully compare different health or Medical insurance policies, understand the coverage features, exclusions, and terms and conditions before purchasing a policy.

Additionally, regularly reviewing and updating your health insurance coverage to align with changing healthcare needs is advisable.

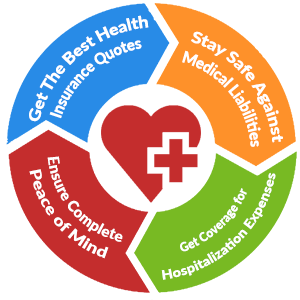

Benefits of Health or Medical Insurance Plan :

FAQ’s on Health/ Medical Insurance:

1. Is care health insurance good?

Ans: Care Health Insurance, previously recognized as Religare Health Insurance is generally considered a reputable health insurance provider in India. They offer a range of health insurance products with comprehensive coverage options, including individual health insurance, family floater plans, and critical illness insurance.

Care Health Insurance is known for its efficient claim settlement process, wide network of hospitals, and customer-centric approach.

However, the suitability of Care Health Insurance for you depends on factors such as your healthcare needs, budget, and preferences.

It’s essential to compare their policies with other insurers and carefully review the coverage features, terms, and premiums to determine if Care Health Insurance meets your requirements.

2. Is health and medical insurance the same?

Ans: “health insurance” and “medical insurance” are often used interchangeably to refer to insurance policies that provide coverage for medical expenses. Both terms essentially refer to the same type of insurance, which helps individuals pay for healthcare services and medical treatments.

3. Which types of health insurance plans are available?

Ans: Some common types of health insurance plans include:

a) Individual Health Insurance

b) Family Floater Plans

c) Senior Citizen Health Insurance

d) Group Health Insurance

e) Critical Illness Insurance

f) Hospital Cash Plans

g) Maternity Insurance

h) Personal Accident Insurance

4. Which insurance is good for health?

Ans: There isn’t a one-size-fits-all answer to which health insurance is best, as it depends on individual needs, preferences, and circumstances.

However, reputable health insurance providers in India include Care Health Insurance (formerly Religare Health Insurance), ICICI Lombard General Insurance, Star Health and Allied Insurance, and HDFC ERGO General Insurance, among others.

It’s essential to compare policies, coverage, premiums, and customer reviews to determine which insurance provider and plan best suit your requirements.

Additionally, consider factors such as network hospitals, claim settlement ratio, and customer service quality when making your decision.

5. What is medical health insurance policy?

Ans: A medical health insurance policy is a contract between an individual and an insurance company that provides financial coverage for medical expenses incurred due to illness, injury, or hospitalization.

It typically covers costs such as hospitalization, doctor’s fees, diagnostic tests, surgeries, medications, and pre- and post-hospitalization expenses.

Policyholders pay premiums to the insurance company, and in return, the insurer covers eligible medical expenses up to the policy’s limits.

6. Medical health insurance for family?

Ans: Medical health insurance for a family, often referred to as a family floater plan, provides coverage for the entire family under a single policy.

It offers financial protection against medical expenses incurred due to illness, injury, or hospitalization for all covered family members.

With a family floater plan, the sum insured can be utilized by any family member as needed, making it a convenient and cost-effective option for comprehensive healthcare coverage for the entire family.

7. Health care insurance for senior citizens?

Ans: Health insurance for senior citizens is specifically designed to provide medical coverage for elderly individuals, typically aged 60 years and above.

These policies offer protection against age-related illnesses, medical expenses, and hospitalization costs.

They may include features such as higher coverage limits, coverage for pre-existing conditions, and additional benefits tailored to the healthcare needs of seniors.

8. Health care insurance companies?

Ans: Some reputable health insurance companies in India include:

a) Care Health Insurance, previously recognized as Religare Health Insurance

b) ICICI Lombard General Insurance

c) Star Health and Allied Insurance

d) HDFC ERGO General Insurance

e) Apollo Munich Health Insurance (now merged with HDFC ERGO)

f) Max Bupa Health Insurance

g) Bajaj Allianz General Insurance

h) Reliance Health Insurance

These companies offer a range of health insurance policies with varying coverage options, premiums, and benefits. It’s essential to compare policies from different insurers to find the one that best suits your healthcare needs and budget.

9. Health care insurance meaning?

Ans: Health care insurance is a type of insurance policy that provides financial coverage for medical expenses incurred due to illness, injury, or hospitalization.

It helps individuals mitigate the financial burden of healthcare costs by reimbursing or directly paying for eligible medical treatments, procedures, and services.

10. Care health insurance agent commission chart?

Ans: Specific commission charts for Care Health Insurance agents may not be publicly available or consistent across all regions. Commission structures can vary based on factors such as the type of policy sold, the premium amount, and individual agreements between agents and the insurance company.

For further details access our website: https://vibrantfinserv.com