![]()

GST compliance for export of services ?

Place of Supply:

Determine the place of supply for the services provided. In the case of of services, the place of supply is considered to be outside India.

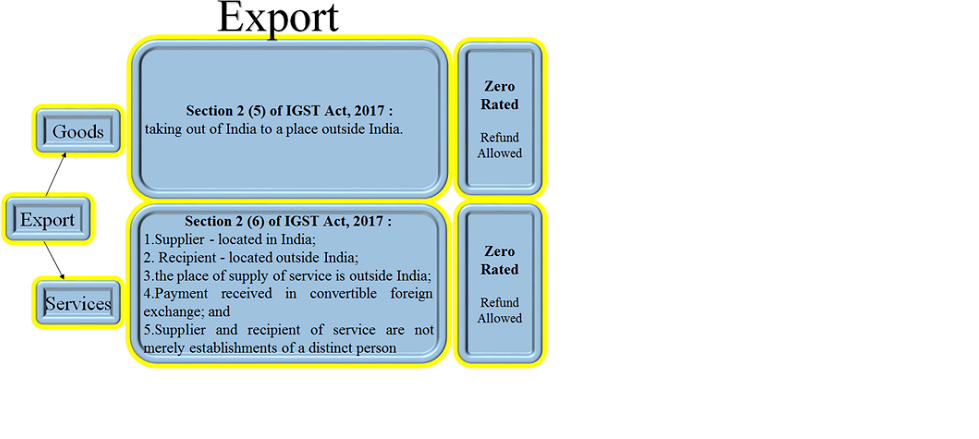

Export of Services:

To qualify as export of services, certain conditions need to be met. The services should be provided to a recipient located outside India, the payment should be received in convertible foreign exchange, and the services should not be specifically restricted from export under any regulations.

GST Registration:

of services does not require a separate GST registration. However, it is advisable to obtain GST registration voluntarily to claim input tax credits and comply with other relevant provisions.

Invoice Requirements:

Issue a GST-compliant invoice for export of services. The invoice should include specific details such as the supplier’s GSTIN, customer’s details (including their address outside India), description of services, currency, value of services, and applicable tax rate (which would be zero-rated for exports).

Letter of Undertaking (LUT):

If you choose to export services without payment of Integrated Goods and Services Tax (IGST), you need to furnish a Letter of Undertaking (LUT) or bond with the tax authorities. The LUT serves as a declaration that you will comply with the export requirements and refund any tax benefits availed.

Export Declaration:

Submit export declarations as required by the customs authorities, providing necessary details of the exported services. This helps in establishing the export nature of the services and facilitates the proper documentation process.

Input Tax Credit (ITC) and Refund:

Exporters of services can claim input tax credit on inputs, input services, and capital goods used for providing the exported services. The accumulated input tax credit can utilize for payment of output tax liabilities or claimed as a refund as per the applicable provisions.

Compliance with Return Filing:

Exporters of services need to comply with GST return filing requirements, such as filing GSTR-3B (summary return) and GSTR-1 (outward supplies) on a regular basis. The frequency and types of returns to be filed may vary base on turnover and other factors.

For further details visit:В https://vibrantfinserv.com/service-detail-9.php

Therefore, It is important to note that the above information provides a general overview, and the specific compliance requirements may vary based on the nature of services, industry sector, and other factors. It recommends to consult with a tax professional or refer to official GST resources for accurate and updated compliance obligations for export of services.

FAQs:

Contact:В В В В 8130555124, 8130045124

Whatsapp:В В https://wa.me/918130555124

Mail ID:В В В В В В operations@vibrantfinserv.com

Web Link:В В В https://vibrantfinserv.com

FB Link:В В В В В В https://fb.me/vibrantfinserv

Insta Link:В В https://www.instagram.com/vibrantfinserv2/

Twitter:В В В В В В https://twitter.com/VibrantFinserv

LinkedIn:В В В https://www.linkedin.com/in/vibrant-finserv-62566a259/