![]()

Company Registration

Company registration or incorporation in India involves several steps and legal formalities to establish a business entity legally recognized under Indian law.

Here’s a comprehensive overview:

1. Choose the Type of Company:

Select the appropriate legal structure for your business, such as:

a). Private Limited Company

b). Liability Partnership (LLP)

c). One Person Company (OPC)

d). Public Limited Company Limited

e). Partnership Firm

f). Sole Proprietorship

2. Name Reservation:

Choose a unique name for your company and check its availability on the Ministry of Corporate Affairs (MCA) website. Reserve the name by filing Form SPICe+ (for companies) or Form RUN (for LLPs) with the MCA.

3. Obtain Digital Signature Certificate (DSC):

Directors of the company need to obtain a Digital Signature Certificate for online filing of documents with the MCA.

4. Director Identification Number (DIN):

Directors must obtain a DIN by filing Form DIR-3 with the MCA. This is a unique identification number required for all directors of a company.

5. Drafting of Memorandum of Association (MoA) and Articles of Association (AoA):

Prepare the MoA and AoA, which define the objectives and rules governing the company’s operations, respectively.

6. File Incorporation Documents:

Prepare and file incorporation documents with the MCA, including Form SPICe+ (for companies) or Form FiLLiP (for LLPs), along with supporting documents such as MoA, AoA, and identity/address proofs of directors/partners.

7. Payment of Fees:

Pay the requisite incorporation fees to the MCA based on the authorized capital of the company.

8. Certificate of Incorporation:

Once the ROC verifies the documents and approves the application, they issue a Certificate of Incorporation. This signifies the formation of the company.

9. PAN and TAN Application:

Apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the company. These are required for taxation purposes.

10. GST Registration:

Depending on the nature of your business, you may need to register for Goods and Services Tax (GST) with the GST Network (GSTN).

11. Compliance:

Ensure compliance with other regulatory requirements such as obtaining necessary licenses and permits, opening a bank account, maintaining statutory registers, and adhering to tax and regulatory filings.

12. Commencement of Business:

After obtaining the Certificate of Incorporation, if applicable, file a declaration for commencement of business with the ROC within 180 days of incorporation.

It’s advisable to seek professional guidance from legal and financial experts or consult with a company registration service provider to ensure compliance with all legal requirements and streamline the registration process for your company in India.

FAQ’s on Company Registration:

Q1. What are company registration documents

Ans: Company registration documents in India:

- Identity proof of directors and subscribers (PAN, Aadhaar, Passport, or Driver’s License)

- Address proof of directors and subscribers (Aadhaar, Passport, Voter ID, or Driver’s License)

- Proof of registered office address (Utility bills, rental agreement, or property tax receipt)

- Memorandum of Association (MoA) outlining company objectives

- Articles of Association (AoA) defining internal rules and regulations

- Certificate of Incorporation approved by the Registrar of Companies (RoC)

- Director Identification Number (DIN) for directors

- Digital Signature Certificate (DSC) for online filing

- Additional documents as required (NOC, consent letters, affidavits, etc.)

- Ensure all documents are accurate and up-to-date before submission to the RoC.

Q2. How to check company is registered or not?

Ans: Steps to check if a company is registered in India:

- Visit the Ministry of Corporate Affairs (MCA) website.

- Go to the “MCA Services” section.

- Select “View Company/LLP Master Data” option.

- Enter the company’s Corporate Identity Number (CIN) or name.

- Submit the query.

- View the company’s registration status and details.

Q3. Does company registration number need to be on invoice?

Ans: Yes, the company registration number (CIN) needs to be mentioned on invoices issued by a registered company in India.

It’s a legal requirement to include the CIN on invoices to provide transparency and identification of the company to its customers and regulatory authorities.

Q4. Where to download company registration certificate?

Ans: To download a company registration certificate in India:

- Visit the Ministry of Corporate Affairs (MCA) website.

- Sign in to your existing account or register for a new account if needed.

- Navigate to the “View Company/LLP Master Data” section.

- Enter the company’s Corporate Identity Number (CIN) or name.

- Select the option to view/download the registration certificate.

- Download the certificate in PDF format.

Q5. Which company registration is best for startup?

Ans: For startups in India, registering as a Private Limited Company is often considered the best option due to its advantages:

- Limited Liability: Shareholders’ liability is limited to their share capital, protecting personal assets.

- Funding: Easier to raise funds from investors compared to other structures.

- Credibility: Pvt. Ltd. lends credibility and trustworthiness to the startup.

- Growth Potential: Allows for easy scalability and expansion.

- Tax Benefits: Eligible for tax deductions and exemptions under government schemes.

- Separate Legal Entity: Provides a distinct legal identity separate from its owners.

Q6. Do i need to register my company?

Ans: Yes, registering your company is typically necessary to ensure legal compliance, protect personal assets, access funding, and establish credibility.

Q7. Can i register a company under another company?

Ans: Yes, you can register a subsidiary company under another company, which would typically be its parent company. This is a common practice in business, particularly for expanding operations or segregating different business activities.

Q8. Company registration for tenders?

Ans: To register a company for tenders:

- Ensure your company is legally registered and compliant with relevant regulations.

- Obtain necessary registrations such as GST, PAN, and TAN.

- Register on the e-procurement portal of the concerned authority or organization.

- Complete the registration process by providing required details and documents.

- Await approval and verification of your registration.

- Once approved, participate in tenders by submitting bids through the portal.

- Adhere to tender guidelines and deadlines for submission.

- Continuously monitor the portal for new tender opportunities and updates.

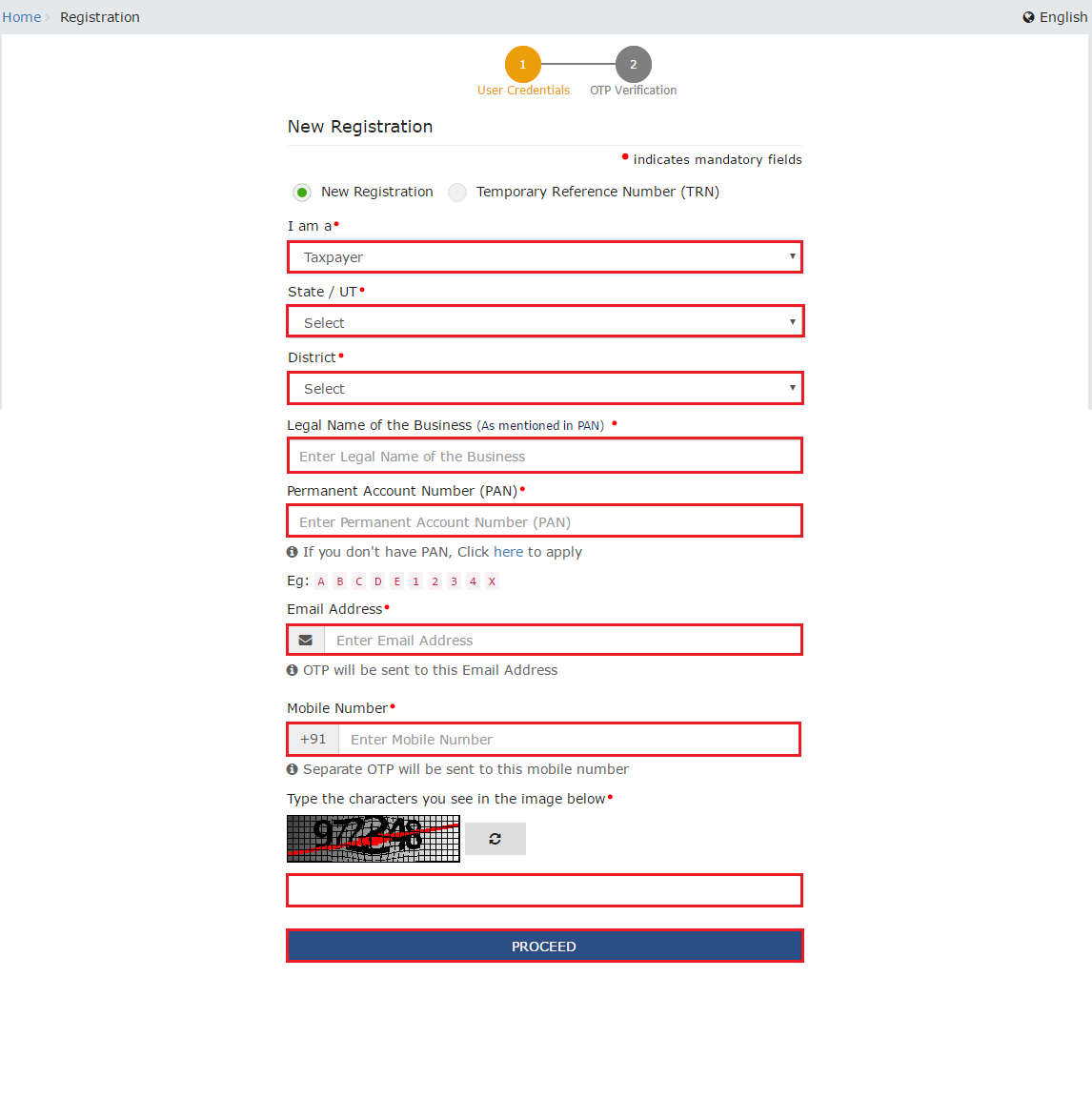

Q9. How to get a company registered for GST?

Ans: To register a company for GST:

- Visit the GST portal (www.gst.gov.in).

- Click on “Register Now” under the “Taxpayers” tab.

- Fill out the registration form with required details such as PAN, email, and mobile number.

- Verify your email and mobile number using OTP.

- Complete the registration form with business details, such as legal name, address, and business type.

- Upload required documents, including PAN, proof of business address, and identity/address proof of promoters/partners/directors. Submit the application.

- Await verification and approval from the GST authorities.

- Upon approval, receive your GST registration certificate containing your GSTIN.

Q10. Company registration with roc?

Ans: Company registration with the Registrar of Companies (RoC) involves several steps:

- Choose a unique name and obtain approval from the RoC.

- Draft and submit the essential incorporation paperwork, such as the Memorandum of Association (MoA) and Articles of Association (AoA).

- Obtain Digital Signature Certificates (DSC) and Director Identification Numbers (DIN) for directors.

- Submit the incorporation application along with required documents online through the MCA portal.

- Pay the prescribed fees for registration.

- Await verification and approval from the RoC.

- Upon approval, receive Certificate of Incorporation (CoI) and Corporate Identity Number (CIN) for the company.

- Ensure compliance with all legal requirements and guidelines provided by the RoC throughout the registration process.

Q11. Company registration and trademark?

Ans: Company registration and trademark registration are two separate processes but both are important for protecting your business identity and brand. Trademark Registration:

- Conduct a trademark search to ensure your desired trademark is available for registration.

- File a trademark application with the Trademark Registry along with the necessary documents and fees.

- The application undergoes examination and publication in the Trademark Journal.

- If there are no objections or oppositions, the trademark is registered and a registration certificate is issued.

- Trademark registration provides exclusive rights to use the trademark in connection with the goods/services it represents and helps protect against unauthorized use by others.

- Both company registration and trademark registration provide legal protection and recognition for your business, helping to establish and safeguard your brand identity.

Q12. What is Company registration act 1956?

Ans: The Companies Act, 1956 was a legislation in India that governed the incorporation, management, and regulation of companies. Here’s a brief overview:

- Incorporation: The Act provided procedures for incorporating different types of companies such as private limited, public limited, and unlimited companies.

- Management and Administration: It laid down rules regarding the management structure, duties, and responsibilities of directors, shareholders, and officers of the company.

- Corporate Governance: The Act prescribed corporate governance norms and requirements for conducting board meetings, maintaining statutory registers, and filing annual returns.

- Winding Up and Insolvency: It provided provisions for voluntary and involuntary winding up of companies and procedures for dealing with insolvency and liquidation.

- Mergers and Acquisitions: The Act regulated mergers, amalgamations, and acquisitions of companies, including approval processes and shareholder rights.

- Investor Protection: It included provisions for the protection of investors’ interests, such as disclosure requirements, shareholder rights, and mechanisms for resolving disputes.

The Companies Act, 1956 was replaced by the Companies Act, 2013, which introduced several reforms and updates to corporate laws in India.

For further details access our website: https://vibrantfinserv.com