What is set off in GST?

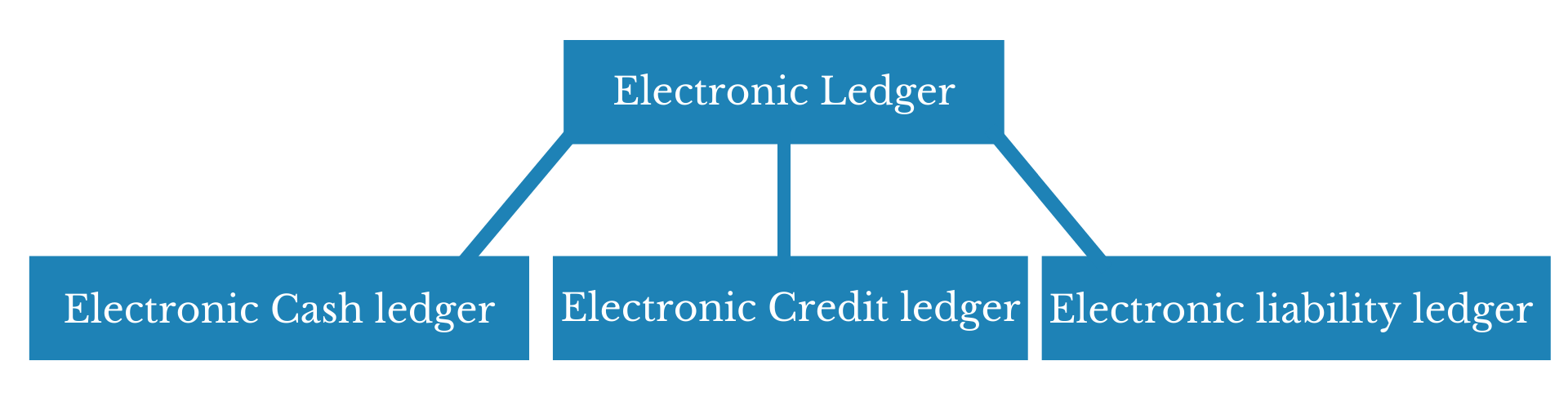

Set off in GST Set off in GST refers to the process of adjusting the tax liability of a registered person by utilizing the input tax credit (ITC) available to them. Input tax credit is the credit that a registered person can claim for the GST paid on their purchases, which can set off… Read More »