User Intent

Many business owners, students, and finance professionals often confuse bookkeeping and accountancy. They search for a detailed comparison to understand their differences, applications, benefits, and limitations. This article serves as a complete guide for those looking to differentiate and apply these financial concepts effectively.

Book keeping VS Accountancy?

Introduction

In the world of finance, both bookkeeping and accountancy play a crucial role in maintaining financial health. However, these two concepts are not the same. Understanding their distinctions helps businesses make informed financial decisions and maintain compliance. In this article, we will explore the definitions, applications, benefits, and limitations of both bookkeeping and accountancy. We will also compare them in a detailed table to simplify their differences.

Definition

What is Bookkeeping?

Bookkeeping is the process of recording financial transactions systematically. It involves logging daily financial activities, such as sales, purchases, receipts, and payments. The primary objective of bookkeeping is to maintain accurate financial records for future reference and accounting purposes.

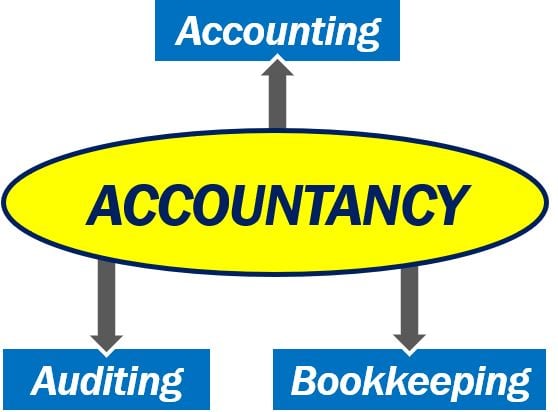

What is Accountancy?

Accountancy, also known as accounting, goes beyond bookkeeping. It involves analyzing, interpreting, summarizing, and reporting financial data. Accountants use bookkeeping records to prepare financial statements, tax returns, and business reports. They also provide strategic financial advice to businesses.

Application

How Bookkeeping is Applied?

Bookkeeping is essential for businesses of all sizes. It is primarily used to:

- Record transactions daily in journals or accounting software.

- Categorize expenses and revenues for accurate tracking.

- Reconcile bank statements to ensure financial accuracy.

- Generate invoices and track payments.

- Maintain general ledgers for financial transparency.

How Accountancy is Applied?

Accountancy takes bookkeeping data and turns it into meaningful insights. It is used for:

- Financial statement preparation (Balance Sheet, Profit & Loss Statement).

- Tax calculations and filings to comply with regulations.

- Auditing financial records to ensure compliance and accuracy.

- Forecasting and budgeting to guide business decisions.

- Advising on financial growth strategies for long-term success.

Benefits

Advantages of Bookkeeping

Ensures accurate financial records.

Helps businesses track cash flow effectively.

Assists in easy tax filing and audit preparation.

Reduces financial discrepancies and fraud risks.

Provides a structured system for financial transactions.

Advantages of Accountancy

Helps in strategic decision-making.

Provides insights for business growth and financial planning.

Ensures compliance with tax laws and regulations.

Facilitates financial forecasting and risk management.

Enhances business credibility for investors and stakeholders.

Limitations

Disadvantages of Bookkeeping

Requires manual effort if not automated.

Lacks the ability to provide financial insights.

Can be time-consuming without proper software.

Errors in bookkeeping can lead to financial misinterpretation.

Disadvantages of Accountancy

More complex and requires expertise.

Costly, as hiring professional accountants can be expensive.

Relies on bookkeeping data; inaccurate records affect results.

Time-consuming for businesses with poor financial management.

Comparative Table: Bookkeeping vs. Accountancy

| Features | Bookkeeping | Accountancy |

|---|---|---|

| Definition | Recording financial transactions | Analyzing and interpreting financial data |

| Scope | Limited to maintaining records | Involves financial reporting and strategy |

| Complexity | Basic financial entry | Advanced financial analysis |

| Users | Small business owners, clerks | Accountants, CFOs, financial managers |

| Output | Journals, ledgers, bank reconciliations | Financial statements, tax reports, forecasts |

| Decision-Making | No major role | Crucial for business growth |

| Tools Used | Spreadsheets, accounting software | ERP systems, tax software, financial models |

| Compliance | Not required | Must follow regulations and standards |

Conclusion

Book keeping VS Accountancy? In summary, bookkeeping and accountancy are interconnected yet distinct financial practices. Bookkeeping focuses on recording transactions, while accountancy involves analyzing and interpreting financial data. Businesses need both to maintain financial health and make informed decisions. Whether you are a business owner, student, or financial professional, understanding these differences will help you manage finances more efficiently.

Frequently Asked Questions (FAQs)

1. Can a business operate with just bookkeeping?

Yes, small businesses can function with only bookkeeping, but for growth and compliance, accountancy is necessary.

2. Do I need an accountant if I use bookkeeping software?

Bookkeeping software helps with records, but an accountant ensures compliance, financial analysis, and strategic planning.

3. Is bookkeeping harder than accountancy?

No, bookkeeping is more about data entry, while accountancy involves complex financial analysis and decision-making.

4. Can I do both bookkeeping and accounting for my business?

Yes, small business owners often do both, but as a business grows, hiring professionals is recommended.

5. What is the best software for bookkeeping and accounting?

Popular choices include QuickBooks, Xero, FreshBooks (for bookkeeping) and Sage, NetSuite, Tally (for accounting).

For further details access our website: https://vibrantfinserv.com

Book keeping VS Accountancy?