![]()

Bank Loan

Getting a personal bank loan typically involves several steps.

Here is a basic guide to help you about the process:

1. Check your credit score:

Prior to seeking a loan, it’s crucial to know your credit score. Banks use this to determine your creditworthiness and the terms of the loan they may offer you.

2. Research loan options:

Different banks offer different types of personal loans with varying interest rates, terms, and conditions. Research multiple banks and lenders to find the best option for your needs.

3. Gather necessary documents:

Typically, you’ll need to provide documents such as identification (passport, driver’s license), proof of income (pay stubs, tax returns), and proof of residence (utility bills, rental agreement).

4. Compare interest rates and terms:

Once you’ve found a few lenders that you’re interested in, compare their interest rates, repayment terms, fees, and any other relevant factors to choose the best option.

5. Apply for the loan:

You can usually apply for a personal loan online, over the phone, or in person at a bank branch. Complete the application form and furnish it alongside the necessary documentation.

6. Wait for approval:

After you submit your application, the bank will review your information and make a decision on whether to approve your loan. The duration of this process can vary, ranging from a few hours to several days.

7. Review the loan offer:

If your loan is approve, the bank will send you a loan offer outlining the terms and conditions of the loan.

Review this carefully to make sure you understand the interest rate, repayment schedule, and any fees associated with the loan.

8. Accept the loan offer:

If you’re happy with the terms of the loan, you can accept the offer either electronically or by signing a loan agreement.

9. Receive the funds:

Once you’ve accept the loan offer, the bank will typically deposit the funds directly into your bank account. Depending on the bank, this could happen on the same day or within a few business days.

10. Repay the loan:

Make sure to repay the loan according to the agreed-upon terms to avoid late fees and negative effects on your credit score.

Remember to borrow only what you need and can afford to repay comfortably to avoid getting into financial difficulties.

FAQ’s on Bank Loan:

Q1. What are bank loan interest rates?

Ans: Bank loan interest rates vary widely depending on factors like the type of loan, borrower’s creditworthiness, and prevailing market conditions. However, they typically range from around 3% to 36% for personal loans, 3% to 10% for auto loans, 2% to 5% for mortgages, 3% to 7% for federal student loans, and 4% to 20% for small business loans.

2. Are bank loans bad?

Ans: Bank loans themselves are not inherently bad. They serve as an important financial tool that allows individuals and businesses to access funds for various purposes, such as buying a home, starting a business, or covering unexpected expenses. However, how you use and manage a bank loan can determine whether it has positive or negative consequences.

3. Can personal loan be used for tax exemption?

Ans: In general, personal loans cannot be used for tax exemption purposes. Unlike certain types of loans, such as home mortgages or student loans, the interest paid on personal loans is typically not tax-deductible.

However, there are exceptions and specific circumstances where personal loans may be used for tax purposes, such as using the loan proceeds for qualifying business expenses or investment purposes.

4. Can personal loan be transferred to another person?

Ans: Personal loans are typically non-transferable between individuals. When you take out a personal loan, the terms and conditions of the loan agreement are based on your personal financial situation, credit history, and ability to repay the loan.

Therefore, it’s generally not possible to transfer the responsibility for repaying the loan to another person.

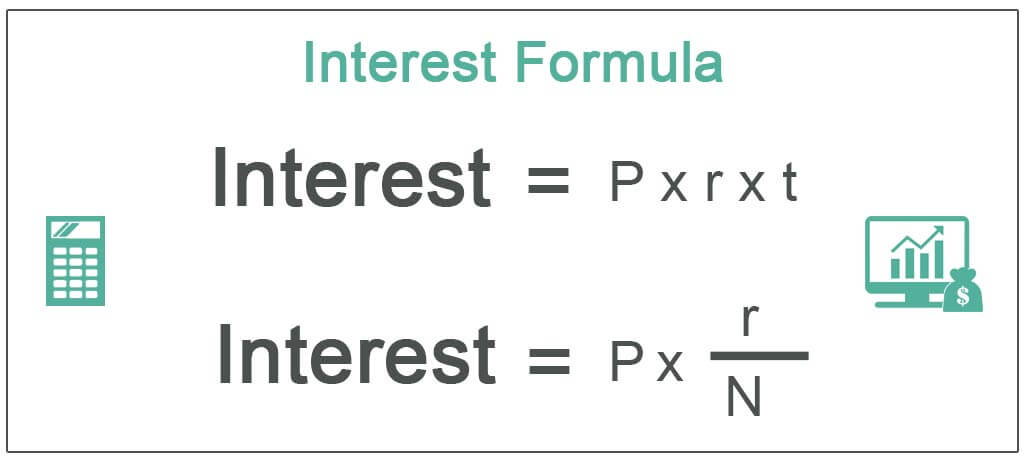

5. How bank loan interest is calculate?

Ans: Bank loan interest is typically calculate using one of two common methods: simple interest or  compound interest. Simple Interest: With simple interest, the interest is calculate only on the initial principal amount borrowed.

compound interest. Simple Interest: With simple interest, the interest is calculate only on the initial principal amount borrowed.

The formula for simple interest is:

Interest = Principal × Rate × Time

Where: Principal is the initial amount borrow. Rate is the annual interest rate (expressed as a decimal).

Time is the time period for which the loan is borrowed, usually expressed in years.

Compound Interest: With compound interest, interest is calculated on both the initial principal amount and on any accumulated interest from previous periods.

The formula for compound interest is:

A = P(1 + r/n)^(nt)

Where: A is the total amount after interest has been apply. P represents the original loan sum (initial principal r represents the yearly interest rate, denoted as a decimal. n is the number of times interest is compounded per unit time (usually per year). t denotes the duration for which the funds are invested, measured in years.

This formula calculates the future value of the loan, including both the principal and the accumulated interest.

6. How bank loan emi is calculate?

Ans: EMI (Equated Monthly Installment) for a bank loan is calculate using a standard formula that takes into account the loan amount, interest rate, and loan tenure (the period over which the loan is repaid).

Here’s the formula:

EMI = [P x R x (1+R)^N] / [(1+R)^N – 1]

Where: EMI = Equated Monthly Installment P = Loan amount (principal) R = Represents the monthly interest rate, calculated by dividing the annual interest rate by 12 and presenting it as a decimal.) N = Loan tenure in months.

The formula calculates the fixed monthly payment that a borrower needs to make to repay the loan amount over the specified loan tenure, including both the principal amount and the accrued interest.

7. How to get bank loan?

Ans: Please refer above full article.

8. Which bank loan interest rate is low?

Ans: The lowest interest rates on loans in India vary depending on factors such as the type of loan, loan amount, repayment tenure, and borrower’s creditworthiness.

However, some banks and financial institutions that often offer competitive interest rates on loans include State Bank of India (SBI), HDFC Bank, ICICI Bank, and Axis Bank.

It’s essential to compare loan offers from multiple banks and financial institutions to find the lowest interest rate that suits your needs and eligibility.

Additionally, loan interest rates may change over time due to economic factors and policy changes, so it’s advisable to check with banks for the most current rates.

9. Which bank loan is best for home loan?

Ans: State Bank of India (SBI), HDFC Bank, ICICI Bank, Axis Bank, and LIC Housing Finance are among the top banks offering competitive home loan options in India.

However, the “best” bank for a home loan depends on factors such as interest rates, loan amount, eligibility criteria, customer service, and loan features.

It’s essential to compare offers from multiple banks, consider your financial needs and preferences, and choose the option that best suits your requirements.

10. How much bank loan can i get for business?

Ans: The amount of bank loan you can get for a business depends on various factors such as your business plan, creditworthiness, collateral, business revenue, debt-to-income ratio, and industry factors.

There is no fix maximum loan amount, as it varies based on these factors and the policies of individual banks. To determine the loan amount you’re eligible for, consult with banks, provide comprehensive documentation, and demonstrate your ability to repay the loan.

11. Bank loan for students?

Ans: Banks typically offer student loans to finance higher education expenses. These loans can cover tuition fees, books, living expenses, and other education-related costs.

Students or their parents may apply for these loans, and eligibility often depends on factors like creditworthiness, income, and enrollment status.

Interest rates and repayment terms vary, with some loans offering deferred repayment options until after graduation.

12. Bank loan for marriage?

Ans: Yes, you can typically get a bank loan for marriage-related expenses. Many banks and financial institutions offer personal loans specifically for wedding purposes.

These loans can help cover various expenses associated with weddings, such as venue rental, catering, decorations, attire, and other related costs. To obtain a bank loan for marriage, you will need to follow the standard loan application process

13. Bank loan for commercial property?

Ans: Yes, you can typically get a bank loan to finance the purchase of commercial property. Banks and financial institutions often offer commercial real estate loans specifically designed for businesses and investors looking to acquire commercial properties such as office buildings, retail spaces, warehouses, or industrial facilities.

14. Bank loan for agriculture land purchase?

Ans: In India, banks offer loans specifically designed for the purchase of agricultural land. These loans, often referred to as agricultural loans or farm loans, are tailored to meet the financing needs of farmers and agricultural businesses seeking to purchase land for farming or related purposes.

15. Bank loan and bank overdraft difference?

Ans: Bank Loan: Provides a lump sum amount for a specific purpose, repaid in fixed installments over a predetermined period with interest.

Bank Overdraft: Allows account holders to withdraw more money than available in their account, typically for short-term needs, with interest charged only on the overdrawn amount for the duration it’s outstanding.

16. Documents require for bank loan?

Ans: The documents typically required for a bank loan include: For identification verification, acceptable documents include Aadhaar card, passport, or driver’s license.

For address validation, utility bills or a rental agreement are required. Income proof (such as salary slips, income tax returns, or business financial statements)

Bank statements Employment proof (such as employment letter or business registration documents)

Property documents (for collateral-based loans) Any other specific documents requested by the bank, depending on the type of loan and your individual circumstances.

17. Bank loan age limit?

Ans: The age limit for bank loans typically ranges from 18 to 70 years, depending on the type of loan and the bank’s policies.

For further details access our website: https://vibrantfinserv.com