![]()

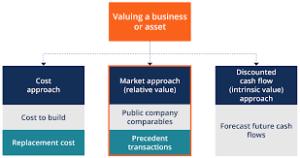

Asset valuation methods

Asset valuation methods is the recording of assets at market value depends on the accounting framework being used. In general, assets are typically recorded at their historical cost or fair value, depending on the circumstances and accounting standards followed by an organization.

Based on the historical cost principle, assets are initially recorded on the balance sheet at their original purchase price or cost. This cost is typically adjusted for any depreciation or impairment over time.

For more information to visit: https://www.mca.gov.in

Fair value:

Fair value accounting is an alternative approach where assets are recorded at their current market value. This value represents the price at which an asset could be exchanged between knowledgeable, willing parties in an arm’s length transaction. This approach requires periodic reassessment of asset values, and any changes in fair value can recognize in the financial statements.

The choice between historical cost and fair value accounting depends on various factors, including the nature of the asset and the accounting standards applicable to the organization. For example, certain financial instruments, such as marketable securities or derivatives, may require to measure at fair value.

It’s important to note that accounting standards can differ across jurisdictions.┬Ā And different standards may be applicable to specific industries or types of organizations. The specific requirements for asset valuation should determine depend on the applicable accounting framework and relevant guidelines or regulations.

For further details access our website: https://vibrantfinserv.com