Life Insurance

Life insurance plays a crucial role in providing financial security and protection to individuals and their families against unforeseen circumstances such as death, disability, or critical illness.

Overview of various aspects of life insurance in India:

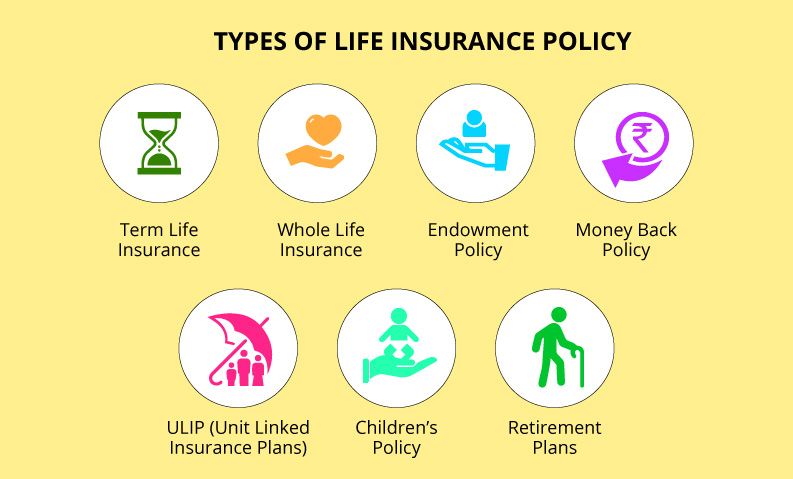

Types of Life Insurance Policies:

1. Term Insurance:

Provides coverage for a specific period (term) and pays out a death benefit to the nominee in case of the insured’s demise during the policy term.

2. Whole Life Insurance:

Offers coverage for the entire life of the insured and includes a savings component with a cash value that grows over time.

3. Endowment Plans:

Combines insurance coverage with a savings or investment component, providing both a death benefit and a maturity benefit.

4. Money Back Policies:

Provides periodic payouts (survival benefits) during the policy term in addition to the death benefit.

5. Unit Linked Insurance Plans (ULIPs):

A hybrid product that offers both insurance coverage and investment opportunities in equity, debt, or balanced funds.

6. Pension Plans:

Also known as retirement or annuity plans, these policies provide a regular income stream to policyholders after retirement.

Regulatory Framework:

The Insurance Regulatory and Development Authority of India (IRDAI) is the regulatory body that governs the insurance sector in India.

IRDAI ensures fair practices, protects policyholders’ interests, and promotes growth and development in the insurance industry.

Key Players:

India’s life insurance sector includes both public and private sector insurance companies.

Life Insurance Corporation of India (LIC), a state-owned enterprise, is the largest and oldest life insurance company in India.

Private sector insurers such as HDFC Life, ICICI Prudential, SBI Life, and Max Life are prominent players in the market.

Premium Payment Options:

Premiums for life insurance policies can be paid annually, semi-annually, quarterly, or monthly, depending on the policy terms and conditions.

Some policies offer flexible premium payment options, allowing policyholders to choose the frequency and mode of premium payments.

Tax Benefits:

Contributions made towards life insurance premiums qualify for tax benefits under Section 80C of the Income Tax Act, 1961.Maturity proceeds and death benefits received from life insurance policies are tax-free under Section 10(10D) of the Income Tax Act, subject to certain conditions.

Underwriting and Claims Process:

Insurers assess the risk associated with an individual’s health, lifestyle, occupation, and other factors before issuing a policy (underwriting).

In the event of a claim, the nominee or beneficiary needs to submit the necessary documents, such as the death certificate and policy details, to the insurance company to initiate the claims process.

Riders and Add-On Benefits:

Life insurance policies often offer riders or add-on benefits such as accidental death benefit, critical illness cover, waiver of premium, and disability benefit, which can be availed for an additional premium.

Financial Planning Tool:

Life insurance serves as a critical component of financial planning, helping individuals safeguard their family’s financial future, achieve long-term goals, and create a legacy for future generations.

In summary, life insurance in India offers a wide range of products and benefits tailored to meet the diverse needs of policyholders, providing financial security and peace of mind to millions of families across the country.

FAQ’s on Life Insurance

1. Are life insurance policies worth it?

Ans: Life insurance policies can be worth it for many people, providing financial protection for loved ones in the event of the insured’s death.

They offer peace of mind and can help cover expenses like funeral costs, outstanding debts, mortgage payments, and ongoing living expenses for dependents.

However, whether a life insurance policy is worth it depends on individual circumstances, financial goals, and family needs.

It’s essential to assess your situation carefully and consider factors such as coverage amount, premium affordability, and long-term financial plans before purchasing a policy.

2. Are life insurance policies tax free?

Ans: Life insurance policies’ death benefits are typically tax-free for beneficiaries. However, there can be exceptions, such as if the policy was transferred for valuable consideration or if the estate is the beneficiary.

Additionally, any interest or gains earned on the policy’s cash value may be subject to taxation.

3. Are life insurance premiums tax deductible?

Ans: Life insurance premiums are generally not tax-deductible for individuals. However, there are some exceptions for certain types of policies and specific circumstances, such as if the policy is used for business purposes or if it’s part of an estate planning strategy.

4. Are life insurance policies good investments?

Ans: Life insurance policies can offer some investment benefits, particularly certain types of permanent life insurance policies like whole life or universal life.

These policies have a cash value component that accumulates over time and can be accessed through policy loans or withdrawals.

However, life insurance policies are primarily designed to provide financial protection for loved ones in the event of the insured’s death rather than as investment vehicles.

While they can offer some tax advantages and guaranteed returns, the investment aspect of life insurance policies may not always provide the same growth potential or liquidity as other investment options.

5. Are life insurance premiums refundable?

Ans: Life insurance premiums are generally not refundable. Once you pay the premium, the insurer is typically not obligated to refund it, regardless of whether you continue the policy or not.

However, some policies may offer a free look period during which you can cancel the policy and receive a full premium refund if you change your mind shortly after purchasing it.

Additionally, certain types of policies, like term life insurance, are paid for a specific coverage period and do not offer refunds if the insured outlives the term.

It’s very important to review the policy terms and conditions carefully before purchasing life insurance to understand any refund options or limitations.

6. Are life insurance dividends taxable?

Ans: Life insurance dividends are generally not taxable as income if they are consider a return of premium.

However, if the dividends exceed the total premiums paid into the policy, they may be subject to taxation as ordinary income or capital gains, depending on the specific circumstances and the type of policy.

7. Can life insurance policy be cancelled?

Ans: Yes, life insurance policies can typically be canceled by the policyholder at any time. Cancelling a policy is known as “surrendering” it.

When a policy is surrendered, the coverage ends, and any cash value or accumulated savings within the policy may be returned to the policyholder, subject to surrender charges or fees outlined in the policy terms.

However, it’s important to note that surrendering a policy may have financial consequences, such as loss of coverage and potential tax implications.

Additionally, surrendering a policy may not be the best option for everyone, so it’s advisable to carefully consider the decision

8. What life insurance means?

Ans: Life insurance is a contract between an individual (the policyholder) and an insurance company.

In return for consistent premium payments, the insurance firm disburses a one-time lump sum, termed as the death benefit, to the appointed beneficiaries upon the demise of the insured individual.

This financial protection helps ensure that the policyholder’s loved ones are financially secure in the event of their death.

insurance policies can vary in terms of coverage duration, premium amounts, and additional features, offering options to suit different needs and preferences.

9. Life insurance for senior citizens?

Ans: Life insurance for senior citizens is typically available, but it may come with higher premiums and limited coverage options compare to policies for younger individuals.

Some insurers offer specific products tailored to seniors, such as guaranteed issue or simplified issue policies, which may have simplified underwriting requirements and guaranteed acceptance regardless of health conditions.

It’s essential for seniors to carefully consider their coverage needs, affordability, and health status when selecting a insurance policy.

10. Life insurance for parents?

Ans: Life insurance for parents provides financial protection for their dependents in case of the parent’s death. It ensures that beneficiaries receive a lump sum payment, known as a death benefit, which can help cover expenses such as mortgage payments, childcare, education costs, and other living expenses.

Parents can choose from various types of insurance policies, such as term life or permanent insurance, depending on their needs, budget, and preferences.

It’s essential for parents to carefully assess their family’s financial situation and consider factors like coverage amount, premium affordability, and future needs when selecting a insurance policy.

11. Life insurance for home loan?

Ans: Life insurance for a home loan, often referred to as mortgage protection insurance, is a type of insurance that helps cover the outstanding balance of a mortgage in the event of the borrower’s death.

If the borrower passes away, the insurance policy pays off some or all of the remaining mortgage balance, ensuring that the borrower’s family can keep the home without facing financial strain.

This type of insurance can provide peace of mind to homeowners and their families, knowing that their home will be protect in case of unforeseen circumstances.

12. Life insurance and general insurance difference?

Ans: Insurance primarily provides financial protection to beneficiaries in the event of the insured person’s death, typically offering a lump-sum payment (death benefit). It is design to provide financial security to dependent and loved ones.

On the other hand, general insurance, also known as property and casualty insurance, covers a wide range of non-life risks such as property, health, travel, automobile, and liability.

General insurance policies protect against losses and damages to assets, liabilities, and risks that are not related to the insured person’s life or health.

In essence, insurance focuses on protecting against the financial consequences of death, while general insurance safeguards against various risks and liabilities unrelated to life or health.

13. Life insurance age limit?

Ans: The age limit for purchasing insurance can vary depending on the insurance company and the type of policy. However, in general, most insurers offer insurance policies to individuals up to a certain age, often ranging from 65 to 75 years old.

Some insurers may offer policies specifically designed for seniors, with higher age limits or tailored features to accommodate older applicants.

It’s essential to note that the availability of insurance and the terms offered may vary based on factors such as the applicant’s age, health status, and the desired coverage amount.

Additionally, premiums for older individuals may be higher due to increased risk factors associated with age.

If you’re considering purchasing insurance and are concerned about age limitations, it’s advisable to research different insurance providers, policies, and options available to find the best fit for your needs.

For further details access our website: https://vibrantfinserv.com