Is the Requirement of an Original Invoice Under GST Mandatory?

The Goods and Services Tax (GST) regime has introduced a comprehensive system of taxation in India, aiming to simplify and streamline tax compliance for businesses. One of the crucial aspects of GST compliance is the requirement for invoices. A common query among businesses is whether an original invoice is mandatory under GST.

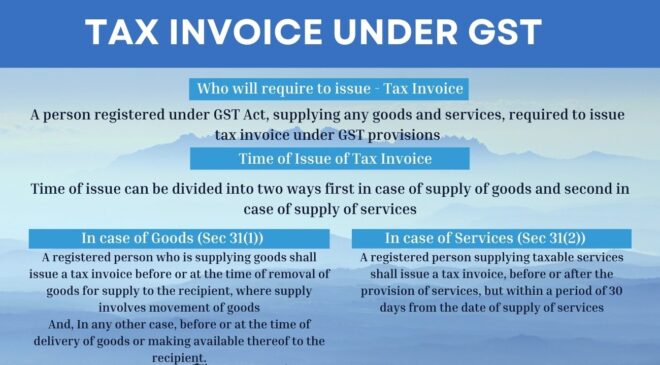

Understanding GST Invoice Requirements

Under GST, an invoice is a crucial document that acts as proof of transaction and is necessary for claiming Input Tax Credit (ITC). According to the GST laws, an invoice must be issued for every taxable supply of goods or services. The essential components of an invoice under GST include:

- GSTIN of the supplier and recipient

- Invoice number and date

- Description of goods or services

- Quantity and value of goods or services

- Taxable value

- Rate and amount of GST

- Signature or digital signature of the supplier

Original Invoice Requirement

The GST law mandates the issuance of an invoice for every supply of goods or services. However, the question arises whether the original invoice is strictly mandatory or if copies are sufficient.

Original vs. Duplicate Copies

-

Original Invoice:

- The original invoice is the first copy issued to the recipient of goods or services. It is essential for the recipient to claim Input Tax Credit (ITC).

- The original invoice should be issued in a format that adheres to GST regulations, containing all the necessary details.

-

Duplicate Copies:

- Under GST, the supplier must issue a duplicate copy of the invoice in certain scenarios, such as for delivery of goods or for record-keeping.

- The duplicate copy serves as a record for the supplier and helps maintain transparency in transactions.

Digital Invoices

With the advent of technology, digital invoices have become increasingly common. The GST regime allows for the issuance of e-invoices, which are electronically generated and validated. These digital invoices must comply with the GST invoice rules and be authenticated through a digital signature.

Legal Implications and Practical Considerations

-

Compliance:

- To ensure compliance with GST regulations, businesses must issue and retain the original invoice as required by law.

- The original invoice serves as a key document for both the supplier and recipient in claiming and verifying ITC.

-

Record-Keeping:

- Proper record-keeping is essential under GST. Businesses should maintain both original and duplicate copies of invoices for audit and verification purposes.

-

Dispute Resolution:

- In case of disputes or audits, having the original invoice can be crucial in providing evidence of transactions and tax compliance.

To visit: https://www.gst.gov.in/

FAQs

Related Topics

How will E-invoices help businesses to accurately file their GST compliance?

Contact: 8130555124, 8130045124

Whatsapp: https://wa.me/918130555124

Mail ID: operations@vibrantfinserv.com

Web Link: https://vibrantfinserv.com

FB Link: https://fb.me/vibrantfinserv

Insta Link: https://www.instagram.com/vibrantfinserv2/

Twitter: https://twitter.com/VibrantFinserv

Linkedin: https://www.linkedin.com/in/vibrant-finserv-62566a259/

For further details Visit: https://vibrantfinserv.com/service-detail-9.php