![]()

Introduction

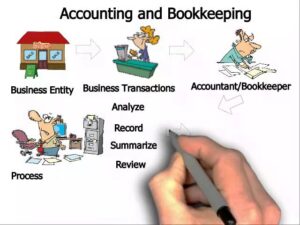

In the world of business and finance, the terms bookkeeping and accounting are often used interchangeably. However, they represent two distinct yet interconnected processes essential for maintaining a business’s financial health. Bookkeeping is the foundation of the accounting process, providing the essential data and records that accountants use to analyze and interpret financial performance. Without proper bookkeeping, accounting would lack the accurate and organized data needed to generate financial reports, ensure compliance, and support strategic decision-making.

Understanding why bookkeeping is a part of accounting is crucial for businesses of all sizes. Bookkeeping involves recording daily financial transactions, while accounting takes this recorded data, organizes it, and analyzes it to provide insights into the financial health of the business. This article explores the definition, importance, benefits, limitations, applications, and relationship between bookkeeping and accounting to provide a comprehensive understanding of why bookkeeping is an integral part of accounting.

What is Bookkeeping?

Bookkeeping involves systematically recording and organizing a business’s financial transactions. It involves maintaining accurate records of income, expenses, sales, purchases, and other financial activities on a daily basis. The goal of bookkeeping is to ensure that all financial transactions are properly documented, classified, and available for reference when needed.

Example:

- If a business sells a product for ₹5,000, the bookkeeper will record it as revenue in the books.

- If the business pays ₹2,000 for office supplies, the bookkeeper will record it as an expense.

Bookkeeping forms the foundation of financial accounting by providing the raw financial data that accountants use to prepare reports and financial statements.

What is Accounting?

Accounting is a broader process that involves analyzing, summarizing, and interpreting the financial data collected through bookkeeping. It includes the preparation of financial statements such as the balance sheet, profit and loss statement, and cash flow statement. Accounting helps business owners and stakeholders understand the financial health of a business and make informed decisions.

Example:

- After the bookkeeper records a ₹5,000 sale, the accountant will classify it under revenue and analyze how it impacts the business’s profitability.

- If expenses are rising, the accountant will recommend cost-cutting measures based on the data provided by the bookkeeper.

Why Is Bookkeeping a Part of Accounting?

Bookkeeping and accounting are interdependent. Bookkeeping provides the raw data, while accounting processes and interprets that data to provide valuable insights. Without accurate bookkeeping, accounting processes would be flawed, leading to incorrect financial reporting and poor business decisions.

Key Reasons Why Bookkeeping Is a Part of Accounting:

- Foundation of Financial Data – Bookkeeping provides the data that accounting relies on for analysis and reporting.

- Compliance and Accuracy – Proper bookkeeping ensures that financial records comply with tax laws and regulations.

- Decision-Making Support – Accurate bookkeeping helps accountants generate insights for strategic business decisions.

- Audit and Transparency – Bookkeeping creates a clear financial trail that supports audits and internal reviews.

- Performance Tracking – Bookkeeping allows businesses to track revenue, expenses, and profitability accurately.

Benefits of Bookkeeping in Accountings

✅ 1. Accurate Financial Records

Bookkeeping ensures that all transactions are recorded systematically, reducing the chances of errors and discrepancies.

✅ 2. Improved Financial Planning

With accurate records, accountants can provide better forecasts and financial strategies.

✅ 3. Regulatory Compliance

Accurate bookkeeping helps businesses comply with tax laws and avoid penalties.

✅ 4. Better Cash Flow Management

Bookkeeping helps businesses track inflows and outflows, improving cash flow management.

✅ 5. Easier Tax Filing

Well-maintained books simplify the tax filing process by providing clear records of income and expenses.

Limitations of Bookkeeping

❌ 1. Limited Financial Insight

Bookkeeping records transactions but does not provide analysis or insights into business performance.

❌ 2. Time-Consuming

Manual bookkeeping can take up a lot of time and is susceptible to human mistakes

❌ 3. Requires Specialized Knowledge

Accurate bookkeeping requires an understanding of accounting principles and financial practices.

❌ 4. Not Suitable for Decision-Making

Bookkeeping alone does not provide the analytical insights needed for strategic decisions.

Applications of Bookkeeping in Accountings

Bookkeeping applies to various aspects of business operations and financial management:

- Financial Reporting – Accountants use bookkeeping records to generate financial reports like balance sheets and profit and loss statements.

- Tax Filing – Bookkeeping records help calculate taxable income and ensure timely tax filing.

- Budgeting and Forecasting – Accurate bookkeeping data helps accountants create budgets and financial forecasts.

- Audit and Compliance – Bookkeeping records are essential for internal and external audits.

- Business Performance Analysis – Accountants use bookkeeping data to analyze profit margins, cash flow, and operational efficiency.

Comparative Table: Bookkeeping vs. Accounting

| Aspect | Bookkeeping | Accounting |

|---|---|---|

| Definition | Recording financial transactions | Analyzing and interpreting financial data |

| Objective | Maintain accurate financial records | Provide financial insights for decision-making |

| Focus | Day-to-day transactions | Financial health and performance |

| Skills Required | Data entry, basic accounting knowledge | Analytical thinking, financial expertise |

| Outcome | Accurate records of financial activities | Financial reports and strategic insights |

| Frequency | Daily basis | Monthly, quarterly, or annually |

| Level of Complexity | Simple to moderate | Complex |

| Decision-Making Role | No | Yes |

| Example | Recording sales and expenses | Preparing profit and loss statements |

Conclusion

Bookkeeping and accounting are closely connected and essential for effective financial management. Bookkeeping serves as the foundation for accounting by ensuring that financial transactions are accurately recorded and organized. Without proper bookkeeping, accounting would lack the accurate data needed for financial analysis and decision-making. Businesses that invest in reliable bookkeeping processes benefit from improved financial planning, better compliance, and more accurate financial insights. While bookkeeping focuses on data entry and record-keeping, accounting leverages that data to provide strategic guidance and financial oversight. Understanding the relationship between bookkeeping and accounting is key to maintaining a business’s financial health and ensuring long-term success.

FAQs

1. What is the main purpose of bookkeeping?

The main purpose of bookkeeping is to record and organize financial transactions systematically to maintain accurate financial records.

2. How is bookkeeping different from accounting?

Bookkeeping involves recording transactions, while accounting involves analyzing and interpreting those transactions to generate financial insights.

3. Can a business survive without bookkeeping?

No, without bookkeeping, a business would lack accurate financial data needed for tax filing, compliance, and decision-making.

4. What are the most common bookkeeping methods?

The two main methods are the single-entry system and the double-entry system.

5. How often should bookkeeping be done?

Bookkeeping should be done daily or at least weekly to ensure accurate and up-to-date records.

6. Is bookkeeping mandatory for all businesses?

Yes, most businesses are legally required to maintain accurate financial records for tax and compliance purposes.

7. Can bookkeeping be automated?

Yes, modern accounting software can automate bookkeeping tasks like data entry and financial reporting.

8. What are the consequences of poor bookkeeping?

Poor bookkeeping can lead to financial misstatements, tax penalties, and poor business decisions.

9. Do small businesses need professional bookkeepers?

Small businesses can manage bookkeeping themselves or hire professional bookkeepers depending on their financial activity and complexity.

10. How does bookkeeping affect tax filing?

Accurate bookkeeping simplifies tax filing by providing a clear record of income and expenses, ensuring proper tax calculation.

For more information visit this site: https://www.mca.gov.in/

For further details access our website: https://vibrantfinserv.com