Statutory authority

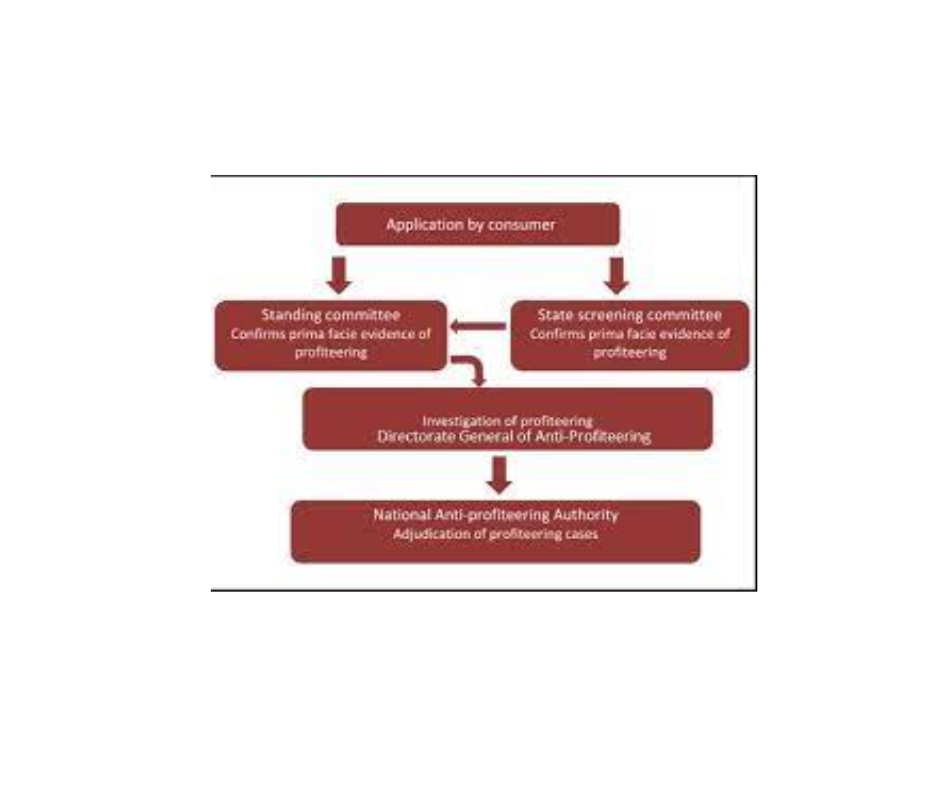

Statutory authority under the GST law to check unfair profiteering activities is the National Anti-Profiteering Authority (NAA). The NAA is a quasi-judicial body that was set up under the GST Act to ensure that the benefits of GST rate reductions and input tax credit are passed on to the end consumers by the businesses.

For more information to visit https://www.gst.gov.in/

The NAA has the power to investigate complaints of profiteering, issue orders to businesses to pass on the benefits of GST rate reductions and input tax credit to consumers, and impose penalties for non-compliance. The NAA comprises a chairman and four technical members. Who are experts in the fields of economics, law, and accountancy.

In summary, the National Anti-Profiteering Authority (NAA) is the statutory authority under the GST law to check unfair profiteering activities. It ensures that the benefits of GST rate reductions and input tax credit pass on to consumers by businesses.