What is the partnership firm of business

Introduction

In the world of business, selecting the right business structure is crucial for long-term success and operational efficiency. Among various business structures, a partnership firm is one of the most popular options for entrepreneurs seeking to collaborate and share responsibilities, profits, and risks. A partnership firm offers a balanced approach between sole proprietorship and a limited company, providing flexibility, shared control, and a straightforward setup process.

In India and globally, partnership firms have gained popularity due to their ease of formation, minimal regulatory requirements, and ability to pool resources and expertise from multiple partners. This article explores the concept of a partnership firm, its benefits, limitations, applications, and how it compares to other business structures. Additionally, a list of frequently asked questions (FAQs) will help clarify common doubts and provide deeper insights.

What is a Partnership Firm?

A partnership firm is a type of business entity formed when two or more individuals agree to carry on a business together and share profits and losses in a predetermined ratioIt operates under the regulations of the Indian Partnership Act, 1932. The agreement between partners is called a partnership deed, which defines the terms and conditions, including profit-sharing ratios, roles, responsibilities, and dispute resolution mechanisms.

Key Characteristics of a Partnership Firm

- Minimum Number of Partners: At least two partners are require to form a partnership firm.

- Maximum Number of Partners: As per the Companies Act, the maximum number of partners allowed is 50.

- Profit and Loss Sharing: Partners share profits and losses based on the terms outlined in the partnership deed.

- Unlimited Liability: Partners have personal responsibility for the debts and obligations of the business, meaning their personal assets can be used to settle business liabilities.

- Mutual Agency: Each partner can act on behalf of the partnership and bind other partners through their actions.

Importance of Partnership Firms

Partnership firms are essential for businesses where:

Two or more individuals bring complementary skills and capital.

Shared control and collective decision-making are required.

Businesses seek to leverage pooled resources and expertise.

Flexibility in management and profit distribution is important.

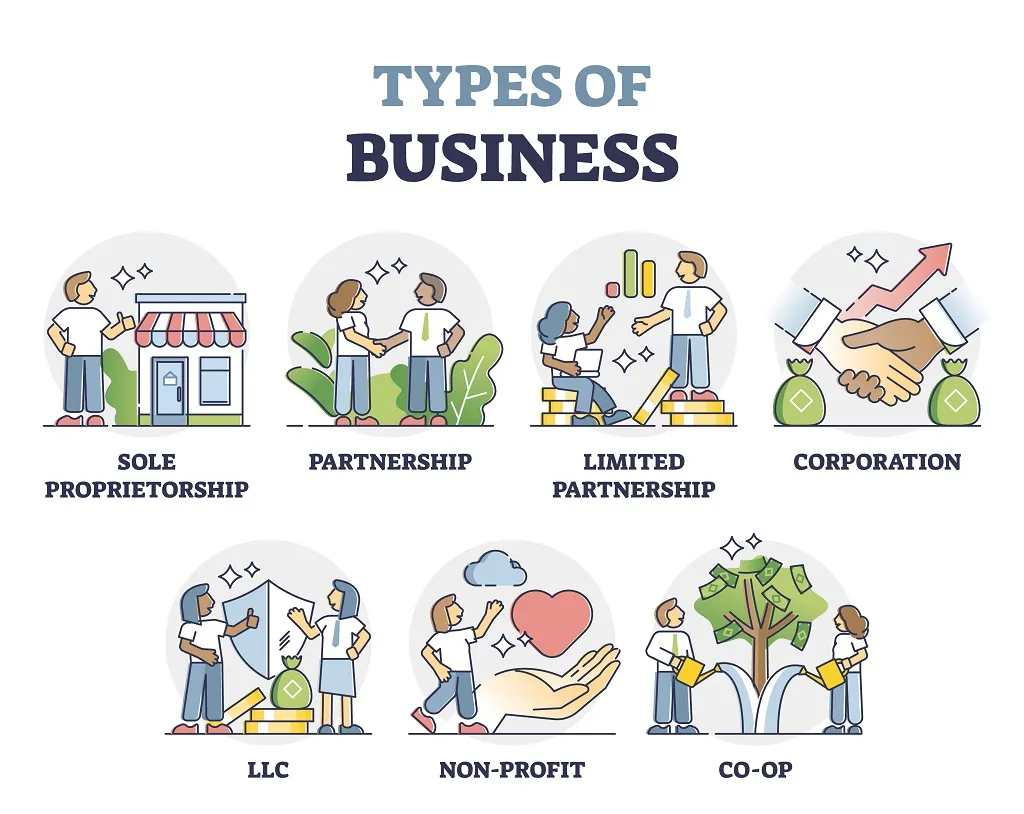

Types of Partnership Firms

Partnership firms can be broadly classified into two categories:

1. General Partnership

- All partners have unlimited liability.

- Partners participate equally in the management and profits/losses.

- Each partner acts as an agent for the firm and others.

2. Limited Partnership (LLP)

- Some partners have limited liability, restricted to their capital contribution.

- At least one partner must have unlimited liability.

- Partners with limited liability cannot participate in day-to-day management.

Benefits of a Partnership Firm

1. Easy Formation

- A partnership firm can be establish through a simple partnership deed.

- No mandatory registration (although registration provides legal benefits).

2. Shared Responsibility and Decision-Making

- Partners can divide responsibilities based on their skills and expertise.

- Decision-making becomes more effective due to shared knowledge.

3. Access to Greater Capital

- Multiple partners can contribute to the capital pool.

- Better financial stability compared to sole proprietorships.

4. Flexibility in Operations

- No rigid compliance requirements.

- Partners can modify the terms of the partnership through mutual consent.

5. Tax Benefits

- Partnership firms are taxed at a flat rate (currently 30% in India).

- Profit distribution among partners is not subject to additional tax.

Limitations of a Partnership Firm

1. Unlimited Liability

- Partners are personally liable for business debts, which can extend to their personal assets.

2. Risk of Disputes

- Disagreements among partners can disrupt business operations.

- A poorly defined partnership deed can lead to legal complications.

3. Limited Growth Potential

- Raising large amounts of capital is difficult due to the absence of public investment options.

4. Lack of Perpetuity

- A partnership firm dissolves upon the death, bankruptcy, or withdrawal of any partner unless stated otherwise in the deed.

Application of Partnership Firms

Partnership firms are widely used across various industries due to their simplicity and operational flexibility:

| Industry | Example | Nature of Business |

|---|---|---|

| Professional Services | Law firms, accounting firms | Legal and financial consulting |

| Retail and Wholesale | Grocery stores, clothing outlets | Joint ownership in retail operations |

| Manufacturing | Small-scale production units | Shared production facilities and costs |

| Construction | Real estate development firms | Joint investment and project execution |

| Trading | Import-export businesses | Collective investment and trade management |

Comparative Table: Partnership Firm vs Other Business Structures

| Feature | Sole Proprietorship | Partnership Firm | Limited Liability Partnership (LLP) | Private Limited Company |

|---|---|---|---|---|

| Number of Owners | 1 | 2 to 50 | 2 or more | 2 to 200 |

| Liability | Unlimited | Unlimited | Limited (except designated partners) | Limited to capital |

| Registration | Not mandatory | Not mandatory (but beneficial) | Mandatory | Mandatory |

| Management | Single owner | Joint decision-making | Partners as per agreement | Board of Directors |

| Continuity | Ends with death of owner | Ends with death or exit of partner | Continues after partner exit | Continues after shareholder exit |

| Taxation | Personal tax rate | Flat 30% + surcharge and cess | Flat 30% + surcharge and cess | Corporate tax rate |

Legal and Taxation Requirements

- Partnership Deed: The deed should cover profit-sharing ratios, capital contribution, dispute resolution, and exit strategy.

- PAN (Permanent Account Number): The partnership firm should obtain a PAN for taxation purposes.

- GST Registration: If turnover exceeds the threshold limit, GST registration is required.

- Income Tax: Profits are taxed at a flat rate of 30% (plus surcharge and cess).

- Audit Requirements: No mandatory audit unless turnover exceeds ₹1 crore.

Conclusion

A partnership firm is an ideal business structure for individuals looking to collaborate, pool resources, and share business risks and profits. While it offers advantages like easy formation, shared decision-making, and tax benefits, the unlimited liability of partners and potential for disputes can be challenging. A well-drafted partnership deed, clear communication, and defined roles can help mitigate risks and ensure smooth business operations. For small to medium-sized businesses, partnership firms provide the right balance between flexibility and shared responsibility.

Frequently Asked Questions (FAQs)

1. What is the minimum number of partners required to form a partnership firm?

A minimum of two partners is require.

2. Is registration of a partnership firm mandatory?

No, but registration provides legal protection and advantages in case of disputes.

3. Can a partnership firm have more than 50 partners?

No, the maximum number of partners allowed is 50.

4. How are profits share in a partnership firm?

Profits are shared as per the terms of the partnership deed.

5. What happens if a partner leaves the partnership firm?

The firm dissolves unless stated otherwise in the deed.

6. Are partners personally liable for the firm’s debts?

Yes, partners have unlimited liability.

7. Can a partnership firm be converted into an LLP or a company?

Yes, it can be converted into an LLP or a company through legal procedures.

8. What is the tax rate for partnership firms in India?

The tax rate is 30% plus applicable surcharge and cess.

9. Can a minor be a partner in a partnership firm?

A minor cannot be a partner but can benefit from the profits.

10. How can disputes between partners be resolve?

Disputes are resolve based on the terms outlined in the partnership deed.

More information to visit- https://www.incometax.gov.in

further details access our website https://vibrantfinserv.com

more information to visit- https://www.incometax.gov.in

further details access our website https://vibrantfinserv.com