What is GST compliance portal

GST portal is the official online platform for GST compliance in India. It is the central repository for all GST-related activities, including registration, return filing, payment, and other compliance requirements. The Goods and Services Tax Portal provides various services and features to help taxpayers meet their GST obligations. Some key features of the GST compliance portal include:

GST Registration: Taxpayers can apply for GST registration through the portal by providing the required information and documents.

Return Filing: Taxpayers can file various GST returns, including GSTR-1, GSTR-3B, GSTR-9, and others, through the portal. The portal allows for online preparation, validation, and submission of returns.

To visit https://www.gst.gov.in/

Payment of Taxes: Taxpayers can make GST payments online through the portal using various modes of payment, such as net banking, debit cards, credit cards, etc.

E-way Bill Generation: The portal facilitates the generation of E-way bills for the movement of goods. Taxpayers can generate, update, and cancel E-way bills as per the applicable rules.

Compliance Dashboard: The Goods and Services Tax Portal provides a dashboard that displays important compliance-related information, including filing status, tax liability, ITC utilization, and more.

Grievance Redressal: Taxpayers can raise grievances or seek clarifications through the portal’s grievance redressal mechanism. They can also track the status of their complaints.

Helpdesk and FAQs: The portal offers a helpdesk facility to assist taxpayers with their queries and concerns. It also provides a comprehensive set of frequently asked questions (FAQs) to address common queries.

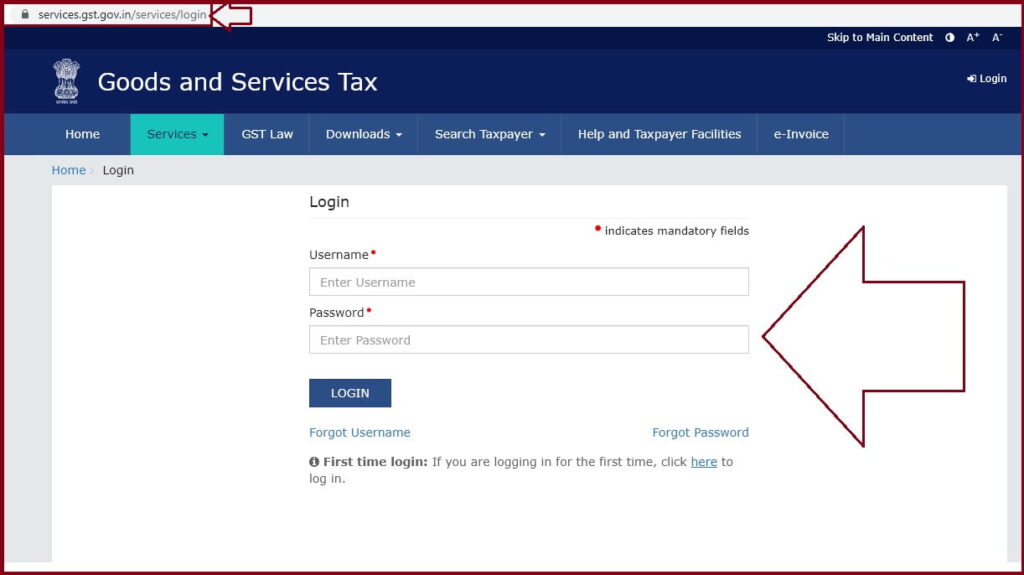

To access the GST compliance portal and utilize its services, taxpayers need to register and obtain login credentials. The portal can be accessed at https://www.gst.gov.in/.

It’s important to note that the GST compliance portal is periodically updated, and taxpayers should stay updated with the latest notifications and guidelines issued by the GST authorities to ensure smooth compliance with GST regulations.

For further details access our website https://vibrantfinserv.com