![]()

GST compliance for SEZ units:

GST compliance for SEZ units:

Special Economic Zone units in India have specific GST compliance requirements.

Here are some key aspects of regarding this topic:

GST Registration:

Special Economic Zone GST procedures are required to obtain a separate GST registration as “SEZ unit” under GST. This registration is different from regular GST registration.

Supply of Goods or Services:

SEZ units may supply goods or services to other Special Economic Zone units, entities outside the SEZ, or within the same SEZ. The supplies made to other SEZ units or entities outside the Special Economic Zone are considered as zero-rated supplies.

Import of Goods or Services:

SEZ units may import goods or services without payment of Integrated Goods and Services Tax (IGST) under a letter of undertaking (LUT) or bond.

Input Tax Credit (ITC):

SEZ units can avail input tax credit on inputs, input services, and capital goods used in the course of their business activities. However, ITC cannot be claimed on goods or services used for exempt supplies.

Documentation and Record Keeping:

SEZ units must maintain proper records of invoices, documents, and other related records to support the eligibility for zero-rated supplies and availing input tax credit.

Compliance with SEZ Rules:

In addition to GST compliance, SEZ units also require to comply with the rules and regulations specified under the SEZ Act and SEZ Rules.

It is important for SEZ units to understand and adhere to the specific GST compliance requirements applicable to them. It is advisable to consult with a qualified tax professional or seek guidance from the official GST authorities to ensure proper compliance with GST regulations for SEZ units.

FAQs:

What is an SEZ unit?

An SEZ unit is a business operating within a Special Economic Zone, enjoying tax benefits and incentives under specific regulations.

2. Is GST applicable to SEZ units?

SEZ units are generally exempt from GST on exports and certain supplies. However, they must comply with GST regulations for other transactions.

3. Can SEZ units claim input tax credit (ITC)?

Yes, SEZ units can claim input tax credit on goods and services used for export or within the SEZ.

4. What are the GST rates for SEZ units?

SEZ units are generally not required to pay GST on supplies made to other SEZ units or for exports, but they must comply with GST on domestic purchases.

5. How do SEZ units file GST returns?

SEZ units file GST returns using Form GSTR-1 (outward supplies) and Form GSTR-3B (summary of inward and outward supplies) on the GST portal.

6. Are SEZ units required to issue tax invoices?

Yes, SEZ units must issue tax invoices for supplies made to domestic customers, but not for exports or supplies to other SEZ units.

7. What is the procedure for claiming GST refunds for SEZ units?

SEZ units can claim GST refunds on input tax credits through the GST refund application process on the GST portal.

8. Are SEZ units exempt from GST on services?

SEZ units are typically exempt from GST on services used for export purposes or within the SEZ, subject to specific conditions.

9. What records must SEZ units maintain for GST compliance?

SEZ units must maintain records of all supplies, invoices, input tax credits, and GST refunds, in line with GST compliance requirements.

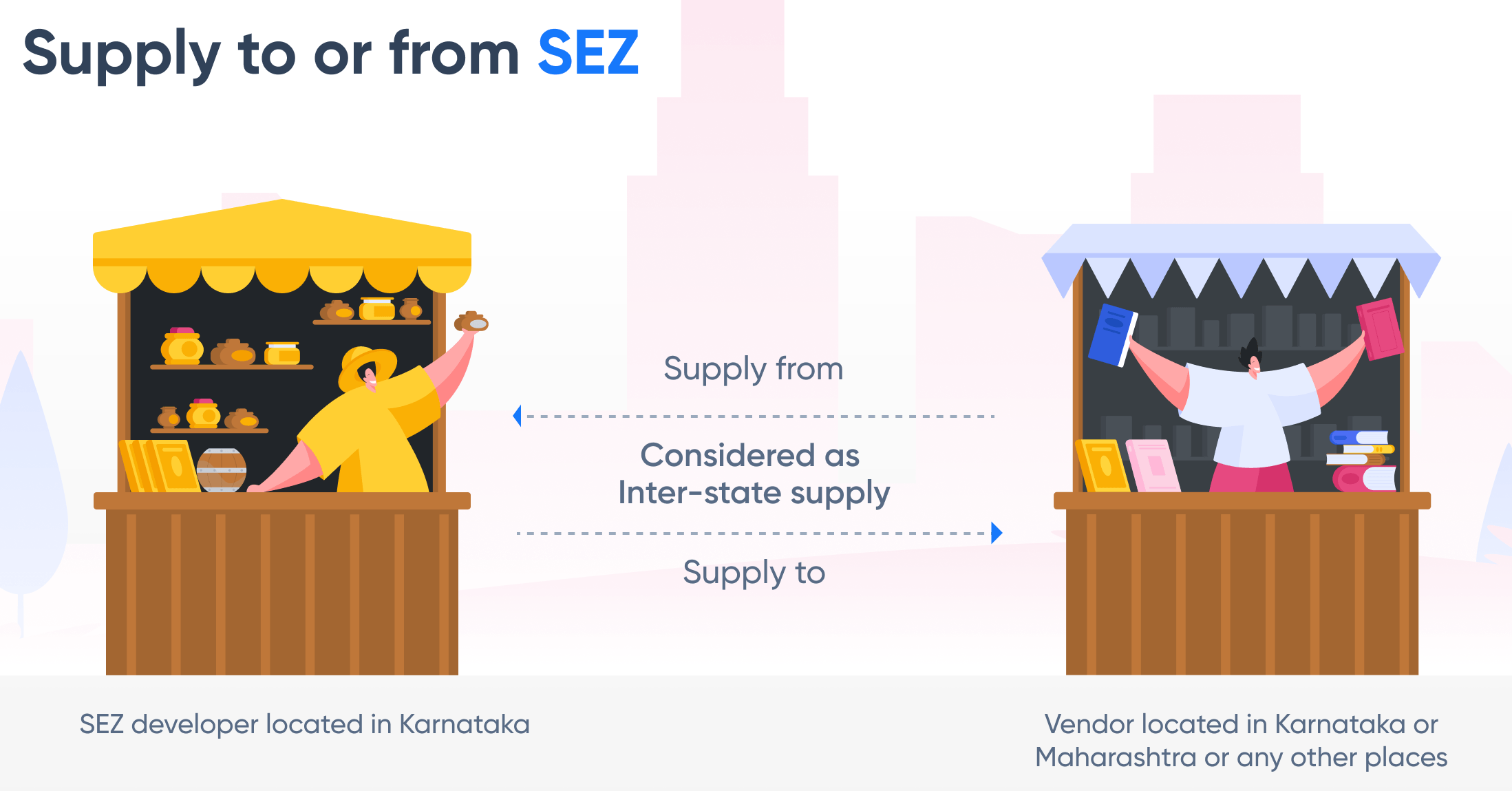

10. Can SEZ units make inter-state supplies?

Yes, SEZ units can make inter-state supplies, but they must follow GST regulations and may be eligible for exemptions or special procedures

For further details access our website https://vibrantfinserv.com

To visit https://www.gst.gov.in/