Introduction

In today’s fast-paced business environment, efficient financial management is critical for the success and growth of any business. Bookkeeping, which involves the systematic recording, organizing, and tracking of financial transactions, plays a key role in managing business finances. However, managing bookkeeping in-house can be time-consuming, costly, and complex, especially for small and medium-sized businesses (SMBs).

Outsourcing bookkeeping services has become a popular solution for businesses aiming to streamline their operations, reduce costs, and gain access to expert financial insights. By outsourcing, companies can focus on their core business activities while ensuring their financial records are accurate and up to date. This article explores the definition, benefits, limitations, applications, and key comparative factors of outsourcing bookkeeping services to help businesses make informed decisions.

What is Outsourcing of Bookkeeping Services?

Outsourcing bookkeeping services refers to the practice of hiring an external professional or a specialized firm to handle the financial recording and management of a business’s accounts. These services typically include:

- Recording daily financial transactions

- Reconciling bank statements

- Managing accounts payable and receivable

- Preparing financial statements

- Tax filing and compliance

Outsourcing allows businesses to transfer the responsibility of managing financial records to qualified professionals or agencies, ensuring accuracy and compliance with financial regulations.

Example:

A small business owner struggling with managing cash flow decides to hire a bookkeeping service provider. The outsourced firm handles daily financial recording, reconciles bank statements, and provides monthly financial reports. This enables the business owner to focus on strategic decisions rather than administrative work.

Importance of Outsourcing Bookkeeping Services

Outsourcing bookkeeping services can significantly impact a business’s financial health and operational efficiency. Here’s why it matters:

Cost Savings – Reduces the need to hire and train an in-house team, saving costs on salaries and infrastructure.

Expertise and Accuracy – Professional bookkeepers bring industry expertise, ensuring error-free records and compliance.

Scalability – As business grows, bookkeeping needs increase—outsourcing allows seamless scalability.

Improved Focus on Core Business – Delegating bookkeeping allows business owners to concentrate on strategic goals.

Access to Advanced Technology – Outsourcing firms use the latest accounting software and automation tools, improving efficiency.

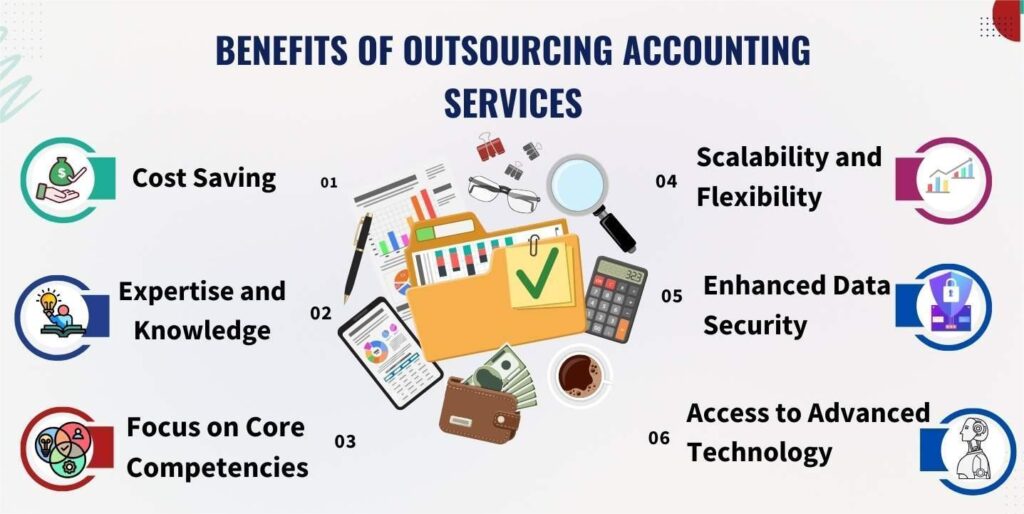

Key Benefits of Outsourcing Bookkeeping Services

✅ 1. Cost Efficiency

- No need to hire and train full-time employees.

- Reduces overhead costs such as salaries, benefits, office space, and equipment.

- Flexible pricing models based on the volume of work.

✅ 2. Access to Expertise and Experience

- Outsourcing firms specialize in bookkeeping and accounting.

- Professionals have up-to-date knowledge of financial regulations and industry standards.

- Expert handling of complex financial transactions reduces errors and risks.

✅ 3. Focus on Core Business Activities

- Frees up management time to focus on business growth and strategic initiatives.

- Reduces administrative workload for business owners and managers.

- Improves overall business productivity.

✅ 4. Enhanced Accuracy and Compliance

- Professionals ensure accurate financial records.

- Timely submission of tax reports and compliance with government regulations.

- Reduced risk of audits and penalties due to incorrect reporting.

✅ 5. Scalability and Flexibility

- Services can be scaled up or down depending on business needs.

- Easy to adjust to seasonal fluctuations and business growth.

- No need to hire or fire staff during peak or low seasons.

✅ 6. Improved Financial Insights and Reporting

- Detailed financial reports for better decision-making.

- Monthly and quarterly financial analysis to track performance.

- Identifies cost-saving opportunities and profit leaks.

✅ 7. Better Data Security and Backup

- Professional firms use encrypted software and secure data storage.

- Regular data backups prevent loss of financial records.

- Controlled access to financial data enhances confidentiality.

Limitations of Outsourcing Bookkeeping Services

❌ 1. Loss of Control

- Less direct oversight over financial data.

- Dependence on the outsourcing firm for data access and updates.

❌ 2. Confidentiality and Data Security Risks

- Risk of data breach or misuse if security protocols are weak.

- Need for robust confidentiality agreements with the service provider.

❌ 3. Communication Barriers

- Time zone differences may delay responses.

- Misunderstandings can arise due to lack of direct interaction.

❌ 4. Quality Dependency

- Quality of service depends on the expertise of the outsourcing firm.

- A poorly chosen service provider may cause financial inaccuracies.

Application of Outsourcing Bookkeeping Services

Outsourcing bookkeeping services can benefit a wide range of businesses and industries, including:

- Small Businesses – Reduces operational costs and provides expert handling of financial records.

- Startups – Ensures accurate financial tracking from the beginning, supporting growth.

- E-commerce Companies – Manages high-volume transactions and reconciliations.

- Professional Service Firms – Handles client billing, expenses, and financial compliance.

- Nonprofits – Ensures transparency and proper fund allocation.

Comparative Table of In-House vs. Outsourced Bookkeeping

| Criteria | In-House Bookkeeping | Outsourced Bookkeeping |

|---|---|---|

| Cost | High (Salaries, benefits, office space) | Lower (Flexible pricing models) |

| Expertise | Depends on in-house skill level | Access to professional expertise |

| Scalability | Limited by team size | Easily scalable |

| Data Security | Dependent on internal IT infrastructure | Professional firms use secure systems |

| Control | High control over processes | Less direct control |

| Technology | Depends on budget and IT infrastructure | Access to advanced tools and automation |

| Flexibility | Limited | High |

| Compliance | Dependent on in-house knowledge | Ensured by professional expertise |

Conclusion

Outsourcing bookkeeping services offers a strategic advantage for businesses seeking to improve financial accuracy, reduce operational costs, and focus on core business activities. While outsourcing can pose some challenges, such as loss of control and communication barriers, the benefits of cost efficiency, scalability, expertise, and improved compliance often outweigh the limitations. Choosing a reputable outsourcing partner with a proven track record can help businesses streamline financial processes, enhance reporting, and ensure long-term financial health.

Top 10 FAQs on Outsourcing Bookkeeping Services

1. What is outsourcing of bookkeeping services?

Outsourcing bookkeeping services means hiring an external firm to manage financial recording and reporting.

2. Why should I outsource bookkeeping instead of handling it in-house?

Outsourcing saves costs, ensures accuracy, and allows you to focus on core business activities.

3. Is outsourcing bookkeeping safe?

Yes, if you choose a reputable firm with strong data security protocols and confidentiality agreements.

4. How much does outsourcing bookkeeping cost?

Costs vary based on the volume of work and complexity, but it’s generally more cost-effective than hiring full-time staff.

5. How do I choose a reliable outsourcing firm?

Check client reviews, industry experience, and data security measures before hiring.

6. Can small businesses benefit from outsourcing bookkeeping?

Yes, small businesses can save costs and gain access to professional expertise.

7. Will I lose control over my financial data?

You may have less direct control, but regular reporting and communication ensure transparency.

8. What software do outsourcing firms use?

Popular tools include QuickBooks, Xero, FreshBooks, and NetSuite.

9. Can I scale the services based on business growth?

Yes, most outsourcing firms offer scalable service models.

10. How quickly can I expect financial reports?

Most firms provide monthly or quarterly reports, with real-time access to financial data.

More information to visit- https://www.incometax.gov.in

further details access our website https://vibrantfinserv.com

more information to visit- https://www.incometax.gov.in

further details access our website https://vibrantfinserv.com