Introduction

Bookkeeping is the foundation of any successful business. It involves the systematic recording, organizing, and managing of financial transactions to ensure that a company’s financial health remains strong and transparent. Without accurate bookkeeping, businesses would struggle to track expenses, manage budgets, and prepare financial reports, which are essential for decision-making and strategic planning.

In the modern business environment, bookkeeping plays a crucial role in helping businesses maintain financial stability and comply with regulatory requirements. Whether you are a small business owner, a freelancer, or managing a large corporation, understanding the different types of bookkeeping can help you determine which method best suits your business needs.

Definition of Bookkeeping

Bookkeeping is the process of systematically recording and organizing a business’s financial transactions. It includes tracking income, expenses, assets, and liabilities to maintain a clear financial record. Bookkeeping ensures that all financial information is accurate and up to date, which is essential for preparing financial statements, filing taxes, and monitoring business performance.

Key Elements of Bookkeeping:

- Recording Transactions: Capturing all financial transactions, including sales, purchases, receipts, and payments.

- Classifying Transactions: Organizing transactions into categories such as assets, liabilities, income, and expenses.

- Reconciling Accounts: Matching recorded transactions with bank statements and correcting any discrepancies.

- Preparing Financial Reports: Generating financial statements such as balance sheets, profit and loss statements, and cash flow statements.

Types of Bookkeeping

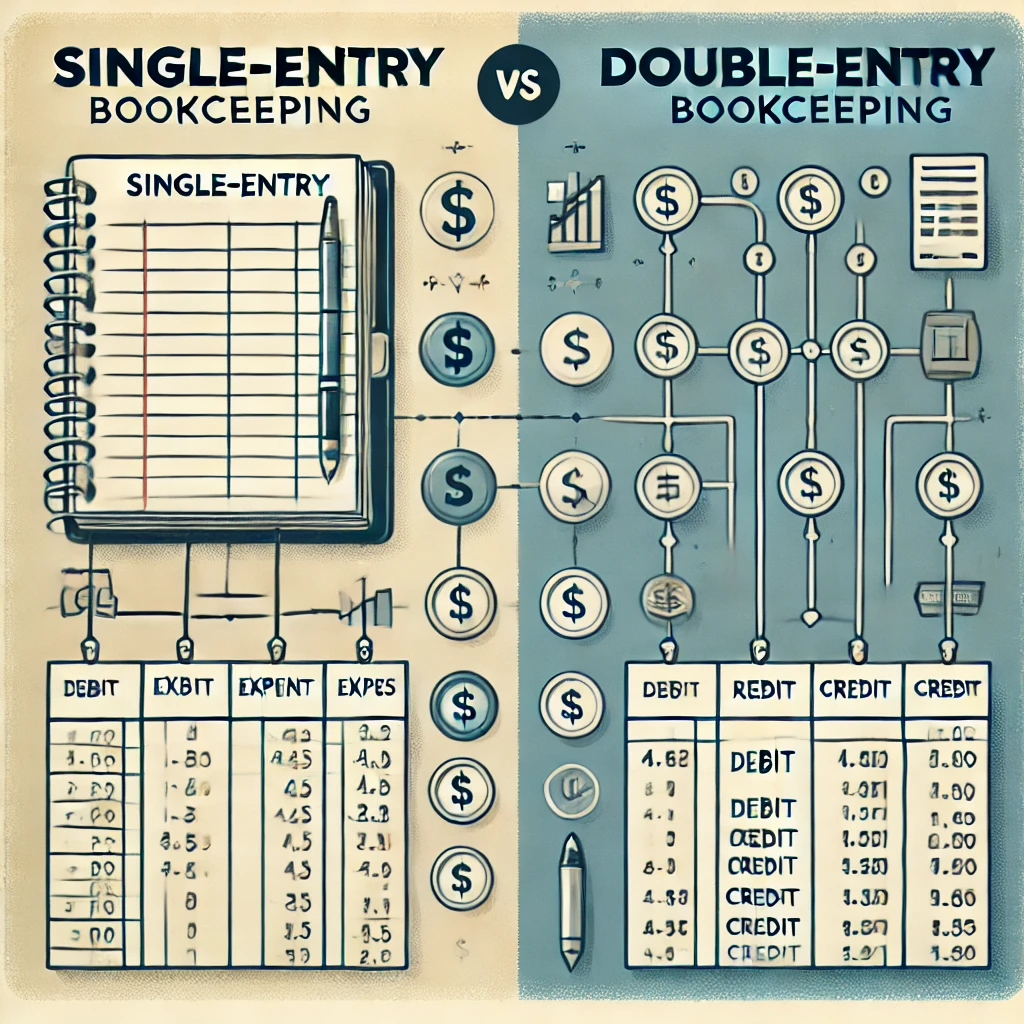

The two primary types of bookkeeping are Single-Entry Bookkeeping and Double-Entry Bookkeeping.. Let’s explore each in detail:

1. Single-Entry Bookkeeping

Single-entry bookkeeping is the simplest form of bookkeeping, primarily used by small businesses and sole proprietors. In this method, transactions are recorded only once, either as an income or an expense.

How It Works:

- Each transaction is recorded in a cash book or ledger.

- Transactions are noted as either an inflow (income) or an outflow (expense).

- No formal balancing of accounts is required.

Example:

If a business receives $1,000 for a sale, it would simply record this amount as income in the cash ledger.

Benefits:

Easy to use and manage.

Suitable for small businesses with minimal transactions.

Less time-consuming and cost-effective.

Usage:

- Small businesses

- Freelancers

- Self-employed professionals

Limitations:

No formal tracking of assets and liabilities.

Not suitable for businesses with complex financial structures.

Higher risk of errors due to lack of double-checking.

2. Double-Entry Bookkeeping

Double-entry bookkeeping is a more advanced and accurate method. It requires recording each transaction in two accounts: a debit and a credit.

How It Works:

- Every transaction affects at least two accounts: one is debited, and the other is credited.

- The total debits and credits must always balance.

- Provides a complete view of a business’s financial position.

Example:

If a business sells goods worth $1,000:

- Debit: Cash account (+$1,000)

- Credit: Sales account (+$1,000)

Benefits:

Provides a clear and accurate financial picture.

Helps detect and prevent errors.

Essential for preparing financial statements.

Meets legal and regulatory requirements.

Usage:

- Medium and large businesses

- Corporations

- Businesses with complex financial operations

Limitations:

More complex and time-consuming.

Requires knowledge of accounting principles.

Higher cost of maintenance due to professional involvement.

Application of Bookkeeping

Bookkeeping is widely used across different industries and business models. Its application extends to various business functions, including:

1. Financial Management

Accurate bookkeeping helps businesses monitor cash flow, manage expenses, and allocate resources efficiently.

2. Tax Preparation

Bookkeeping ensures that all income and expenses are accurately recorded, making tax filing easier and more accurate.

3. Business Analysis

Detailed bookkeeping records allow businesses to analyze profitability, cost structures, and overall performance.

4. Investor and Lender Confidence

Well-maintained financial records enhance the credibility of a business and make it easier to secure investments and loans.

5. Compliance and Auditing

Accurate records help businesses comply with government regulations and prepare for audits.

Comparative Table of Bookkeeping Types

| Aspect | Single-Entry Bookkeeping | Double-Entry Bookkeeping |

|---|---|---|

| Complexity | Simple | Complex |

| Accuracy | Lower | Higher |

| Cost | Low | High |

| Usage | Small businesses, freelancers | Medium to large businesses |

| Number of Entries | One entry per transaction | Two entries per transaction |

| Financial Tracking | Basic (income and expenses) | Comprehensive (assets, liabilities, equity) |

| Error Detection | Difficult | Easier |

| Preparation for Audits | Not suitable | Suitable |

| Legal Compliance | Limited | Meets regulatory standards |

Benefits of Bookkeeping

Financial Clarity: Provides a clear picture of a business’s financial health.

Budget Management: Helps in planning and controlling business expenses.

Profitability Tracking: Identifies profit and loss trends.

Tax Efficiency: Ensures accurate tax filing and reduces tax liabilities.

Business Growth: Facilitates better decision-making and strategic planning.

Limitations of Bookkeeping

Time-Consuming: Maintaining detailed records requires time and effort.

Human Error: Manual entry can lead to mistakes.

Cost: Hiring professional bookkeepers can be expensive.

Software Dependency: Businesses may need to invest in accounting software.

Conclusion

Bookkeeping is an essential practice for any business, regardless of its size or industry. While single-entry bookkeeping offers simplicity and is ideal for small businesses, double-entry bookkeeping provides a more comprehensive and accurate financial view, making it suitable for larger and more complex businesses. Choosing the right type of bookkeeping depends on the size, complexity, and financial goals of your business.

Understanding the strengths and limitations of each bookkeeping method enables business owners to make informed decisions, improve financial management, and ensure compliance with regulatory requirements. Whether you’re starting a small business or managing a large corporation, effective bookkeeping will help you achieve financial stability and long-term success.

FAQs:

What is single-entry bookkeeping?

Single-entry bookkeeping records one entry per transaction, usually for simple businesses or personal finances.

What is double-entry bookkeeping?

Double-entry bookkeeping records each transaction in two accounts: debit and credit, ensuring the books are always balance.

What is accrual-base bookkeeping?

Accrual-base bookkeeping records income and expenses when they are earn or incur, not when cash changes hands.

What is cash-base bookkeeping?

Cash-based bookkeeping records transactions only when cash is receive or paid, ideal for small businesses.

What is full-charge bookkeeping?

Full-charge bookkeeping involves managing all bookkeeping functions, including payroll, taxes, and financial reporting.

What is virtual bookkeeping?

Outsourced bookkeeping refers to hiring a third-party service provider to handle bookkeeping tasks.

What is forensic bookkeeping?

Forensic bookkeeping involves investigating financial records for legal purposes, often related to fraud or disputes.

What is project-base bookkeeping?

Project-based bookkeeping tracks income and expenses for specific projects separately from the main financial records.

What is cloud bookkeeping?

Cloud bookkeeping uses online software to record and manage financial transactions in real-time, accessible from any device.