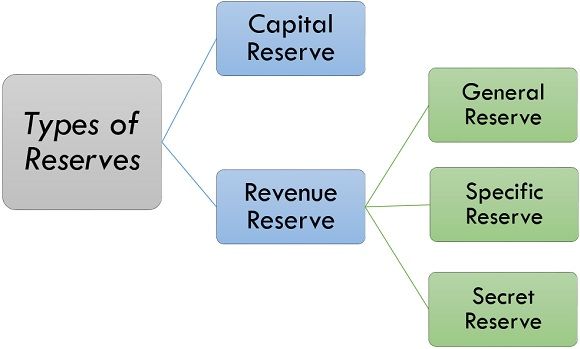

There are typically two types of reserves that can appear on a corporate balance sheet: revenue reserves and capital reserves.

Revenue reserves are create from profits earn by the company and not distributed as dividends to shareholders. These reserves can be used for a variety of purposes, such as reinvesting in the business, paying off debt, or distributing as dividends in the future.

Capital reserves are create from capital transactions, such as the sale of fixed assets or the issuance of shares at a premium. These reserves are not available for distribution as dividends to shareholders.

The advantages of creating reserves that are not mandatory include:

1.Flexibility in using the reserves:

By creating reserves that are not mandatory, a company has more flexibility in how it uses those funds. It can choose to invest in research and development, expand its operations, or pay dividends to shareholders.

2.Improved financial stability:

Reserves can help improve a company’s financial stability by providing a cushion against unforeseen events or economic downturns.

3.Improved creditworthiness:

A company with healthy reserves is often view as a more stable and creditworthy borrower, which can lead to better interest rates and terms when seeking financing.

4.Increased shareholder value:

If a company uses its reserves to invest in growth opportunities or pay dividends to shareholders, this can increase the value of the company and benefit its shareholders.

To visit https://www.mca.gov.in