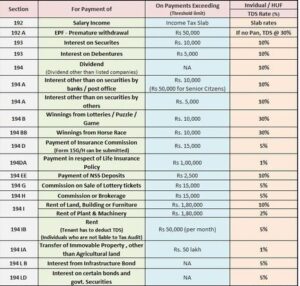

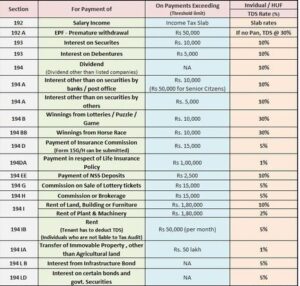

In the Indian context of Tax Deducted at Source (TDS), TDS code denote distinct identification codes assigned to various payment categories for the purpose of reporting.

These codes are use while filing TDS returns to indicate the nature of the payment on which TDS has been deducted.

The TDS code are specify by the Income Tax Department and are listed in the relevant forms and guidelines.

Here are some common TDS code used in India:

Salary: TDS code 192

Interest on securities: TDS code 193

Interest on bank deposits: TDS code 194A

Rent: TDS code 194I

Professional fees: TDS code 194J

Commission or brokerage: TDS code 194H

Contract payment: TDS code 194C

Non-resident payments: TDS code 195

Winnings from lottery, puzzle, etc.: TDS code 194B

Insurance commission: TDS code 194D

These are just a few examples, and there are numerous TDS codes covering various types of payments and deductions. The specific TDS code to be use depends on the nature of the payment and the applicable TDS provision.

While filing TDS returns, it is essential to correctly select the appropriate TDS code to ensure accurate reporting and compliance with the tax regulations. It is recommend to refer to the official TDS return forms (such as Form 24Q, Form 26Q, etc.) and guidelines provide by the tax authorities to identify the correct TDS codes for different payment categories.

To visit: https://www.incometax.gov.in

FAQs

1. What are TDS code?

Answer: TDS code are unique identifiers used in the Indian tax system to classify different types of income subject to Tax Deducted at Source.

2. Why are TDS code important?

Answer: They help track tax deductions on various payments, ensuring compliance with tax laws and facilitating accurate reporting.

3. How many TDS code are there?

Answer: There are numerous TDS code, each corresponding to specific types of payments, such as salaries, interest, or professional fees.

4. Where can I find TDS code?

Answer: TDS code can be found on the official website of the Income Tax Department or in the tax-related notifications issued by the government.

5. How do I use a TDS code?

Answer: When making payments subject to TDS, you must use the correct code to ensure the proper deduction rate is apply.

6. What happens if I use the wrong TDS code?

Answer: Using the wrong TDS code can lead to incorrect tax deductions, potential penalties, and issues with tax filings.

7. Are TDS codes applicable to individuals only?

Answer: No, TDS codes apply to both individuals and businesses making payments subject to TDS.

8. How often are TDS code update?

Answer: TDS codes may be update or revised periodically by the government, usually during the annual budget or tax reforms.

9. Do TDS codes have different rates?

Answer: Yes, each TDS code corresponds to a specific tax rate, which can vary based on the type of payment and the recipient’s status.

10. How do TDS code affect my tax returns?

Answer: Correctly using TDS codes ensures that the deducted tax is accurately reflect in your tax returns, helping you avoid discrepancies.