TDS Certificate Required

Introduction

Tax Deducted at Source (TDS) is an essential component of tax compliance in many countries. A TDS certificate is issued to the taxpayer as proof that tax has been deducted and deposited with the government. It is an important document for both the deductor and the deductee, ensuring transparency and accuracy in tax filings.

Definition of TDS Certificate

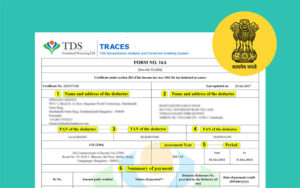

A TDS certificate is an official document issued by the deductor to the deductee, confirming that tax has been deducted at the source and paid to the government. It includes details such as the deductor’s and deductee’s names, PAN (Permanent Account Number), TAN (Tax Deduction and Collection Account Number), amount paid, tax deducted, and deposit details.

User Intent Behind Requiring a TDS Certificate

- Proof of Tax Payment – Ensures that the tax deducted has been deposited with the government.

- Income Tax Return Filing – Helps taxpayers claim credit for the TDS deducted.

- Avoiding Double Taxation – Prevents situations where income is taxed twice.

- Compliance with Tax Laws – Ensures businesses and individuals adhere to tax regulations.

Benefits of a TDS Certificate

- Legal Compliance – Ensures that tax laws are followed properly.

- Prevents Tax Evasion – Keeps a record of taxes deducted and prevents discrepancies.

- Helps in Tax Filing – Assists taxpayers in accurately reporting income and claiming tax credits.

- Proof of Deduction – Provides documented evidence that tax has been paid.

- Ease of Reconciliation – Helps match TDS details with the taxpayer’s records and government database.

Usage of a TDS Certificate

- For Salary Income (Form 16) – Employees use it to file income tax returns.

- For Non-Salary Income (Form 16A) – Issued for payments such as rent, professional fees, interest, etc.

- For Sale of Property (Form 16B) – Required when TDS is deduct on property transactions.

- For Non-Residents (Form 16C) – Used when TDS is deduct on payments to non-residents.

- For Bank and Interest Payments – Helps individuals and businesses track TDS on interest earnings.

Limitations of a TDS Certificate

- Errors and Discrepancies – Mistakes in details can lead to issues in tax filings.

- Delayed Issuance – Some deductors may fail to issue certificates on time.

- Not a Tax Payment Proof for the Deductee – The deductee must verify tax credit in the government database.

- Limited Validity – Only applicable for the financial year in which it is issue.

- Dependent on Dedicator’s Compliance – If the dedicator fails to deposit TDS, the deducted may face tax issues.

Comparative Table: TDS Certificate vs. Tax Payment Receipt

| Feature | TDS Certificate | Tax Payment Receipt |

|---|---|---|

| Issued By | Deductor | Taxpayer |

| Purpose | Proof of TDS deduction | Proof of tax payment made by the taxpayer |

| Applicability | Applicable to deducted taxes | Applicable to direct tax payments |

| Validity | Financial year-wise | Valid indefinitely for the payment period |

| Required For | Claiming tax credit | Verifying self-paid taxes |

Conclusion

A TDS certificate is a crucial document that ensures transparency in tax deductions and deposits. It benefits both taxpayers and tax authorities by preventing tax evasion and ensuring compliance. However, its effectiveness depends on accurate issuance and timely verification. Understanding its usage, limitations, and benefits helps individuals and businesses streamline their tax filings and financial management.

To visit: https://www.incometax.gov.in

FAQs

1.What is a TDS certificate?

Contact:В В В В 8130555124, 8130045124

Whatsapp:В В https://wa.me/918130555124

Mail ID:В В В В В В operations@vibrantfinserv.com

Web Link: В В https://vibrantfinserv.com

FB Link:В В В В В В https://fb.me/vibrantfinserv

Insta Link:В В https://www.instagram.com/vibrantfinserv2/

Twitter:В В В В В В https://twitter.com/VibrantFinserv

Linkedin:В В В https://www.linkedin.com/in/vibrant-finserv-62566a259/