TaxPlanning V/s TaxEvasion

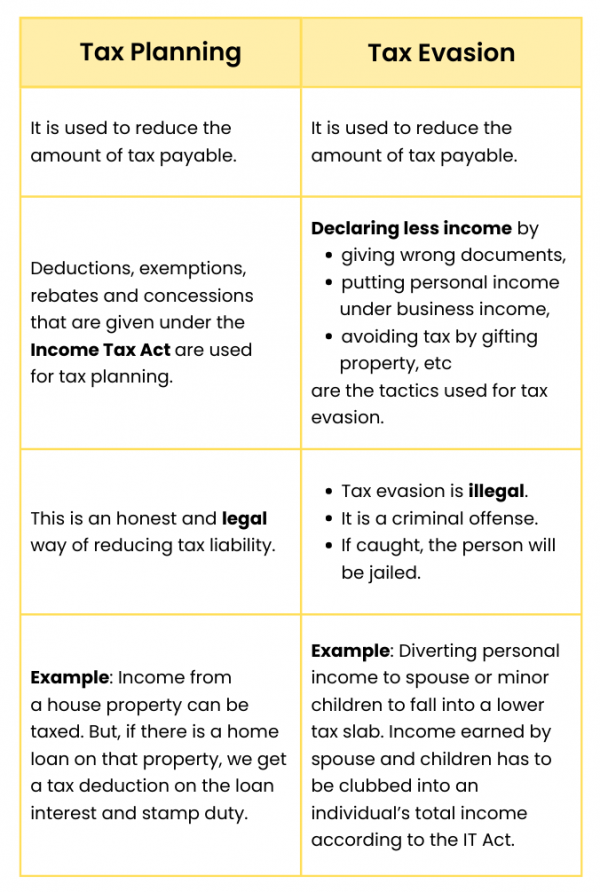

TaxPlanning V/s TaxEvasion are separate concepts with distinct consequences:

Tax Planning:

Tax planning refers to the legal and strategic arrangement of financial affairs to minimize tax liabilities within the boundaries of the law. It involves taking advantage of available tax deductions, exemptions, credits, and incentives to optimize your tax position. It aims to reduce tax liability while remaining compliant with tax laws.

Tax Evasion:

Tax evasion, on the other hand, is an illegal practice of intentionally evading or avoiding paying taxes by using fraudulent or deceptive means. It involves deliberate acts of misrepresenting income, inflating expenses, hiding assets, or manipulating records to intentionally understate tax obligations. Tax evasion is illegal and punishable by law.

The key differences between tax planning and tax evasion are legality and transparency. Tax planning is legal and encourages individuals and businesses to optimize their tax position within the framework of the law. Tax evasion, on the other hand, involves illegal activities and attempts to evade paying the rightful amount of taxes.

It’s important to note that tax planning should always be done in accordance with the tax laws of your jurisdiction and with the guidance of a qualified tax professional. Engaging in tax evasion can lead to severe penalties, legal consequences, and damage to your reputation.

FAQs:

To visit https://www.incometax.gov.in