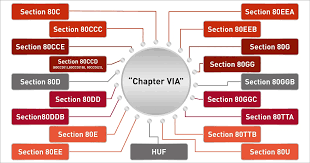

Tax Deductions

Here are the tax deductions available for diagnostic centers during ITR filing in India:

1. Section 80D:

This section allows a deduction of up to Rs. 50,000 on medical expenses incurred by the taxpayer, his/her spouse, children, parents, and dependents. This includes expenses incurred on hospitalization, surgery, consultation fees, diagnostic tests, and medicines.

2. Section 80DDB:

This section allows a deduction of up to Rs. 75,000 on medical expenses incurred for the treatment of certain specified diseases, such as cancer, AIDS, and kidney failure.

3. Section 80E:

This section allows a deduction of up to Rs. 15,000 on the premium paid for health insurance.

4. Section 80TTA:

This section allows a deduction of up to Rs. 10,000 on the interest income earned on savings account.

In addition to these deductions, diagnostic centers may also be eligible for other deductions, such as:

1. Deduction for depreciation on medical equipment.

2. Deduction for rent paid for the premises of the diagnostic center.

3. Deduction for electricity and water expenses.

4. Deduction for repairs and maintenance expenses.

5. Deduction for professional fees.

6. The specific deductions that are available to a diagnostic center will depend on the specific circumstances of the business. It is important to consult with a tax advisor to determine the full range of deductions that may be available.

Here are some additional things to keep in mind when claiming tax deductions for a diagnostic center:

1. All expenses must be incurred for the purpose of the business.

2. All expenses must be supported by receipts.

3. The deductions must be claimed in the correct financial year.

To visit: https://www.mca.gov.in/

For further details access our website: https://vibrantfinserv.com