Understanding Tax Benefits Under Section 80C of the Income Tax Act

Tax planning is crucial for optimizing savings and reducing tax liabilities. One of the most popular sections for claiming deductions is Section 80C of the Income Tax Act. To take advantage of these benefits, it’s essential to understand the eligibility criteria for investments.

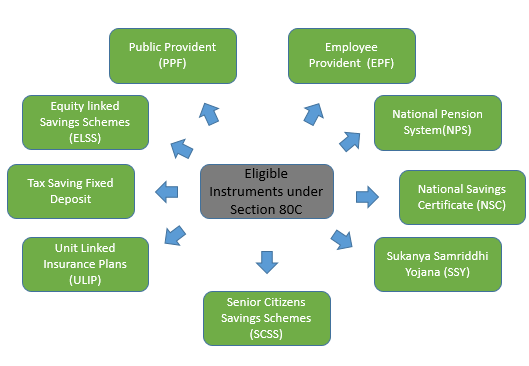

Here’s a brief overview of what makes an investment eligible for tax benefits under Section 80C.

1. Eligible Investments

Section 80C offers deductions for a range of investments and expenses. Some common eligible investments include:

Public Provident Fund (PPF): A long-term savings scheme with attractive interest rates and tax benefits.

Employees’ Provident Fund (EPF): A compulsory savings scheme for salaried employees.

National Savings Certificate (NSC): A fixed-income investment with a guaranteed return.

Life Insurance Premiums: Premiums paid for life insurance policies for self, spouse, or children.

Equity-Linked Savings Scheme (ELSS): A type of mutual fund with equity exposure and tax-saving benefits.

Five-Year Fixed Deposit: Fixed deposits with a tenure of five years with banks or post offices.

Sukanya Samriddhi Yojana: A savings scheme for the girl child with tax benefits.

2. Maximum Deduction Limit

Under Section 80C, the maximum deduction you can claim is ₹1.5 lakh per financial year. This limit includes the total of all eligible investments and expenses combined.

3. Investment Tenure

Many eligible investments, like PPF and NSC, come with specific lock-in periods. The tax benefit is available as long as the investment is within the stipulated tenure. For instance, PPF has a 15-year lock-in period, while ELSS has a 3-year lock-in.

4. Proof of Investment

To claim a deduction under Section 80C, you must provide proof of investment. This can be in the form of receipts, statements, or certificates from the respective financial institutions where the investments are made.

5. Individual and Hindu Undivided Family (HUF)

The tax benefits under Section 80C are available to individuals and Hindu Undivided Families (HUFs). However, the deductions are claimed by the individual or HUF, not by the entity.

6. Investment by Spouse and Children

Premiums paid for life insurance policies for a spouse or children, contributions to EPF or PPF accounts, and ELSS investments can also be claimed under Section 80C. Investments made by the spouse or children can be included in the deduction limit if they are made in the name of the taxpayer.

For more information visit this site: https://www.incometax.gov.in

FAQs

1.What is Section 80C?

Ans: Section 80C allows taxpayers to claim deductions on certain investments up to ₹1.5 lakh per year.

2. Which investments qualify for tax benefits under Section 80C?

Ans: Investments in PPF, EPF, NSC, ELSS, Life Insurance premiums, and Tax-saving FDs are eligible.

3. Is there a maximum limit for claiming tax benefits under Section 80C?

Ans: Yes, the maximum deduction allowed is ₹1.5 lakh per financial year.

4. Can you claim tax benefits on contributions to a Provident Fund (PF)?

Ans: Yes, contributions to both Employee Provident Fund (EPF) and Public Provident Fund (PPF) are eligible.

5. Are premiums paid on life insurance policies eligible for deductions?

Ans: Yes, premiums paid on life insurance policies for yourself, spouse, or children qualify for deductions.

6. Does investing in Equity Linked Savings Schemes (ELSS) qualify for tax benefits?

Ans: Yes, investments in ELSS funds qualify for deductions under Section 80C.

7. Is there a tax benefit for investing in National Savings Certificates (NSC)?

Ans: Yes, investments in NSC are eligible for deductions under Section 80C.

8. Are tax-saving Fixed Deposits (FDs) eligible for tax benefits?

Ans: Yes, tax-saving FDs with a lock-in period of 5 years qualify for deductions.

9. Can you claim deductions for principal repayment on home loans under Section 80C?

Ans: Yes, the principal repayment on home loans is eligible for deductions under Section 80C.

10. Do investments need to be made within the financial year to qualify for deductions?

Ans: Yes, investments must be made within the financial year to be eligible for the tax benefit for that year.

For further details access our website https://vibrantfinserv.com