![]()

Tax Audit Report

The threshold limit for Tax audit report for Manpower & Employment Agencies in India is Rs. 10 crore for the financial year 2023-24, if the cash transactions do not exceed 5% of the total transactions.

This is an increase from the previous threshold limit of Rs. 5 crore, which was applicable for the financial year 2022-23.

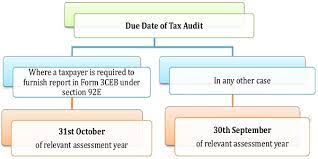

The due date for filing the it is 30th September of the assessment year. For example, the tax audit for the financial year 2023-24 must be filed by 30th September 2024.

If a Manpower & Employment Agency does not meet the threshold limit of Rs. 10 crore, but has cash transactions that exceed 5% of the total transactions, then the threshold limit for tax audit will be Rs. 1 crore.

In addition to the threshold limit, there are other circumstances under which a Manpower &

To visit: https://www.mca.gov.in/

Employment Agency may be required to get their accounts audited. These include:

1. If the agency claims profits or gains lower than the prescribed limit under the presumptive taxation scheme.

2. If the agency is carrying on a business that is eligible for presumptive taxation under Section 44AD.

3. If the agency is a foreign company Tax audit report.

For further details access our website: https://vibrantfinserv.com