Tax Audit for Computer Sales

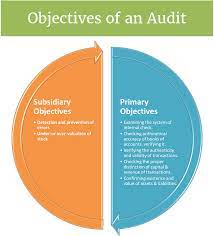

The primary objective of conducting a tax audit for computer sales and services businesses is to ensure that the businesses are complying with all applicable tax laws and regulations.

This includes ensuring that the businesses are correctly reporting their income, deductions, and credits, and that they are paying the correct amount of tax.

Computer sales and services businesses are often targeted for tax audits because they are considered to be a high-risk industry for tax evasion.

This is because the businesses typically deal with large amounts of money, and the transactions can be complex and difficult to track.

During a tax audit, the auditor will examine the businesses’ financial records, including their sales records, purchase records, and tax returns.

The auditor will also interview the businesses’ employees and owners. The goal of the audit is to identify any areas where the businesses may be underpaying their taxes.

If the auditor finds any discrepancies, the businesses might have to pay additional taxes, penalties, and interest.

The businesses may also be subject to criminal prosecution if the auditor finds that they have intentionally evaded taxes.

To visit: https://www.incometax.gov.in

For further details access our website: https://vibrantfinserv.com