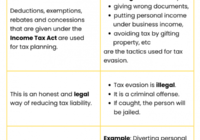

Tax planning with reference to financial management decision?

Financial management decision Financial management decision: Tax planning with reference to involves strategically considering and incorporating tax implications into the broader financial strategies of a company or individual. This approach aims to optimize financial management practices while minimizing tax liabilities. Here are some key considerations for tax planning with respect to financial management decisions:… Read More »