How tax plannings?

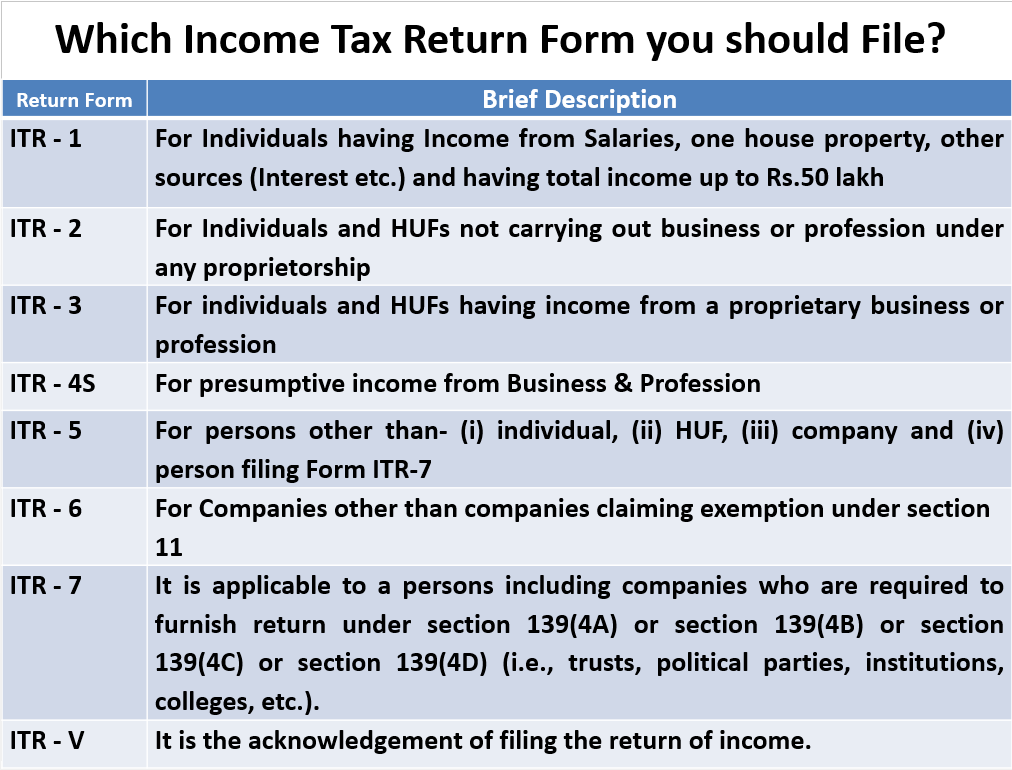

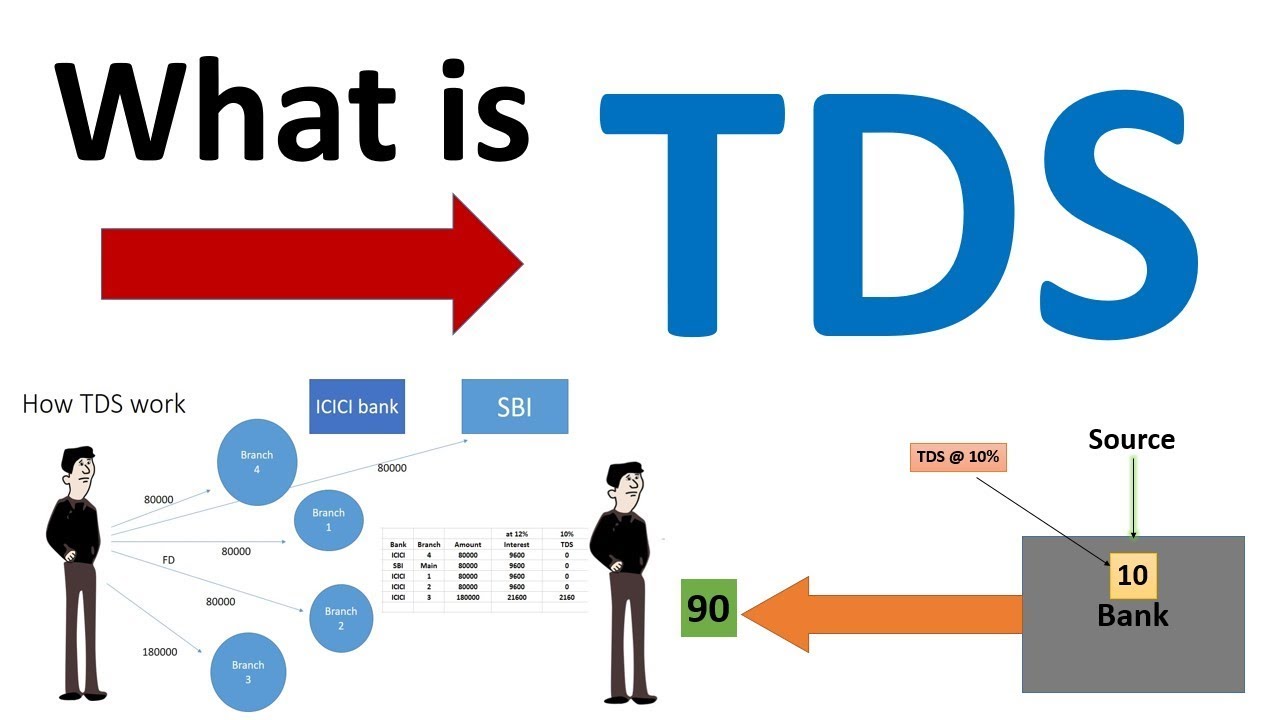

Tax Plannings Tax plannings encompasses various strategies and factors aimed at reducing tax obligations and maximizing your overall financial position. Here are some key steps to effectively implement tax planning n How tax planning: 1. Understand Tax Laws: Gain a comprehensive understanding of the tax laws and regulations applicable to your jurisdiction. This includes knowledge… Read More »