How file ITR 4?

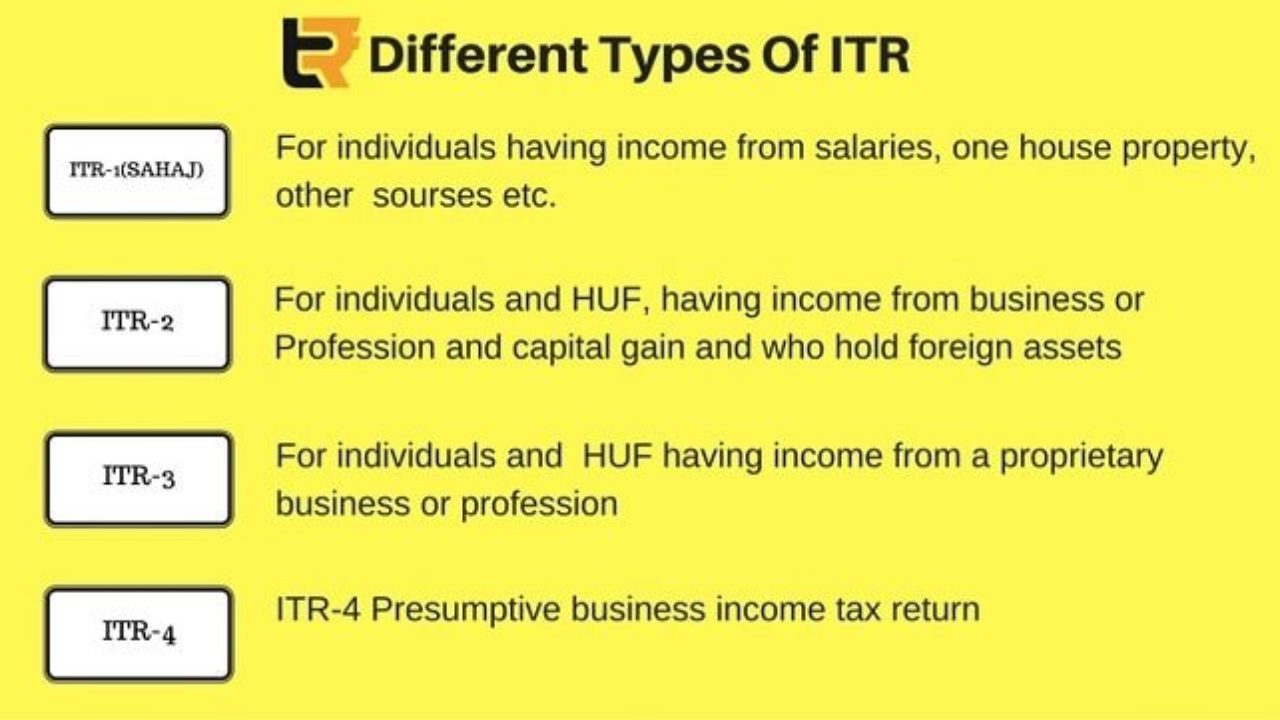

File ITR 4 To file your Income Tax Return (ITR) using ITR-4 form, which is applicable for individuals, Hindu Undivided Families (HUFs), and partnership firms having income from a presumptive business, you can follow these steps: 1.Gather your documents: Collect all the necessary documents, including your business income details, bank statements, invoices, expenses records, and… Read More »