What does tax planning include?

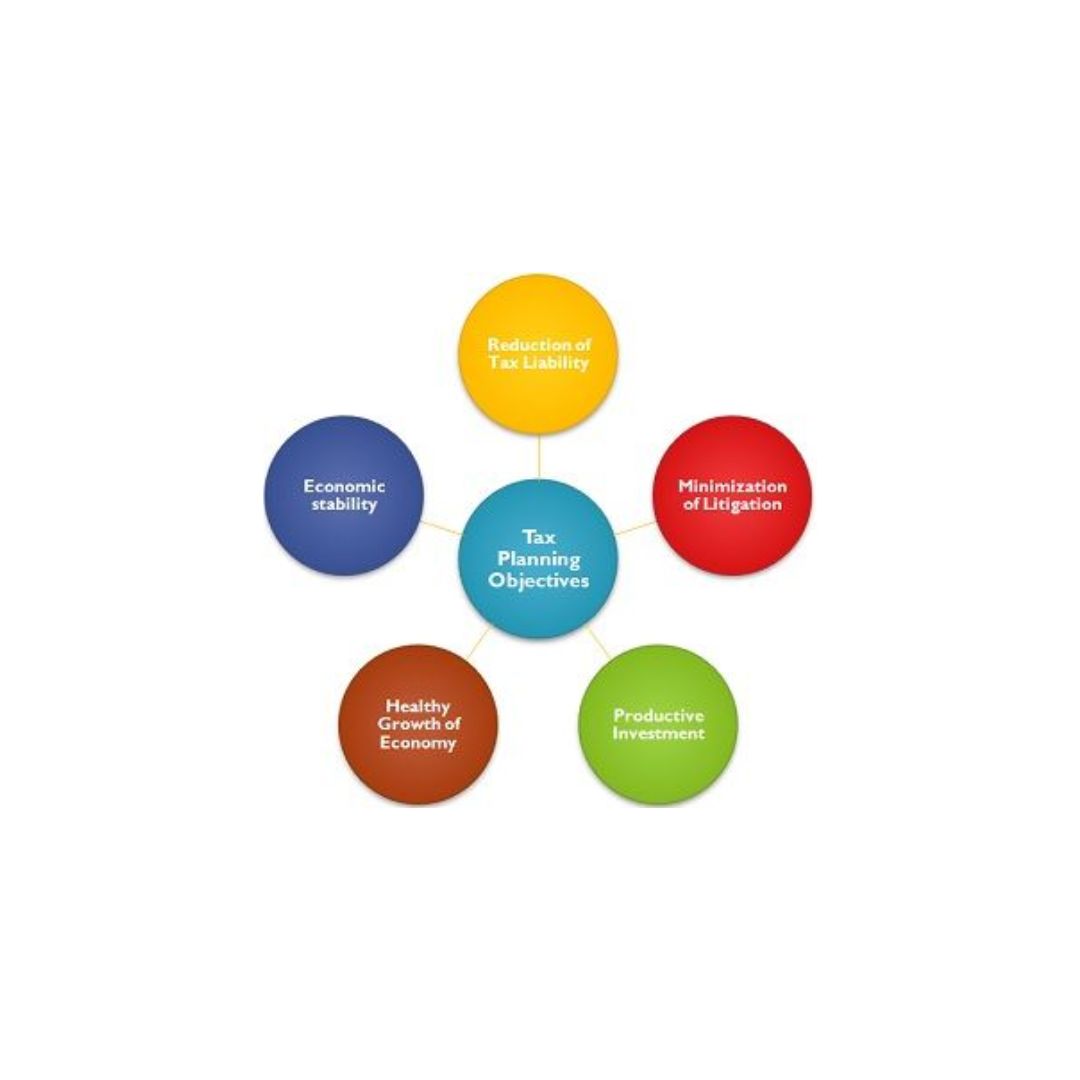

User Intent When people search for “What does tax planning include?” they are looking for a detailed breakdown of tax planning strategies, their applications, benefits, and limitations. They may be taxpayers, business owners, or financial professionals who want to optimize their tax liabilities while staying compliant with regulations. Introduction Tax planning is a… Read More »