How to ITR filing of individual?

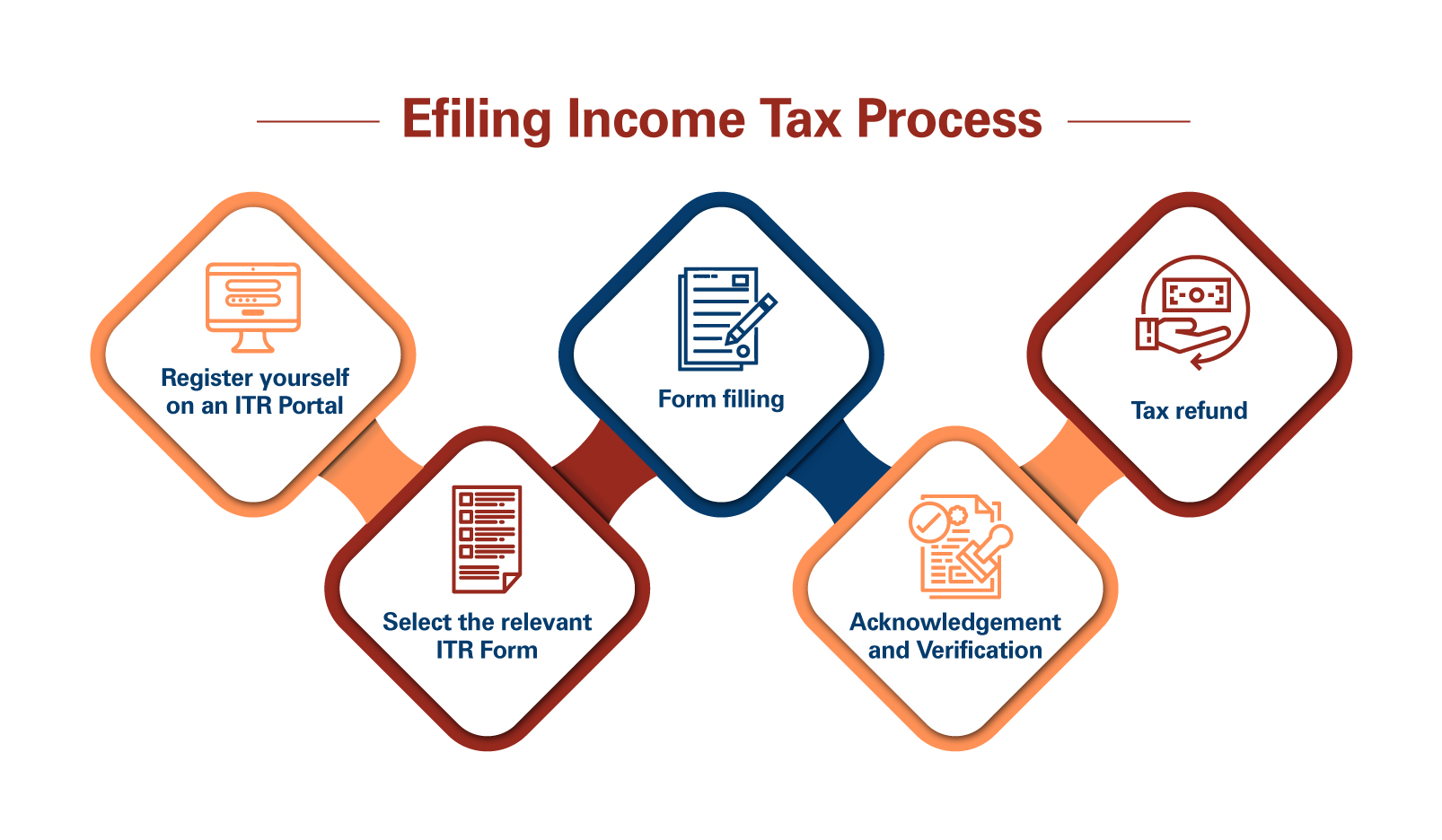

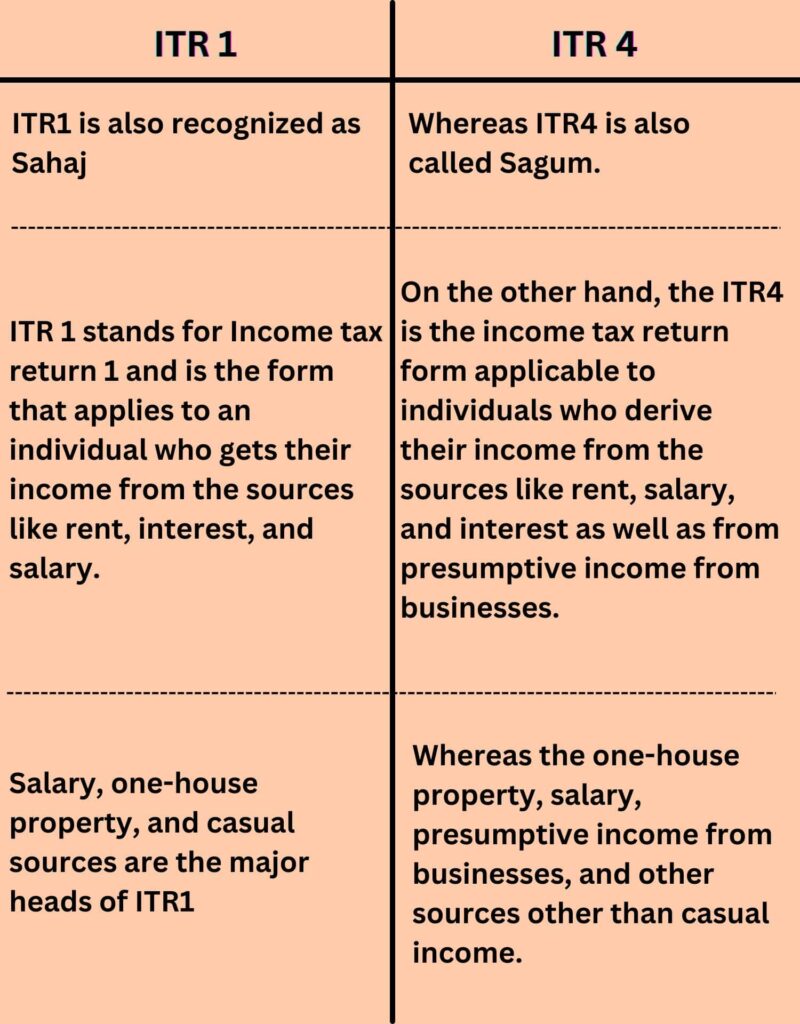

ITR filing of individual ITR filing of individual: To file your Income Tax Return (ITR) as an individual, you can follow these steps: Gather your documents: Collect all the necessary documents, including your PAN (Permanent Account Number), Aadhaar card, bank statements, Form 16 (if applicable), investment statements, and other relevant financial documents. Determine the… Read More »