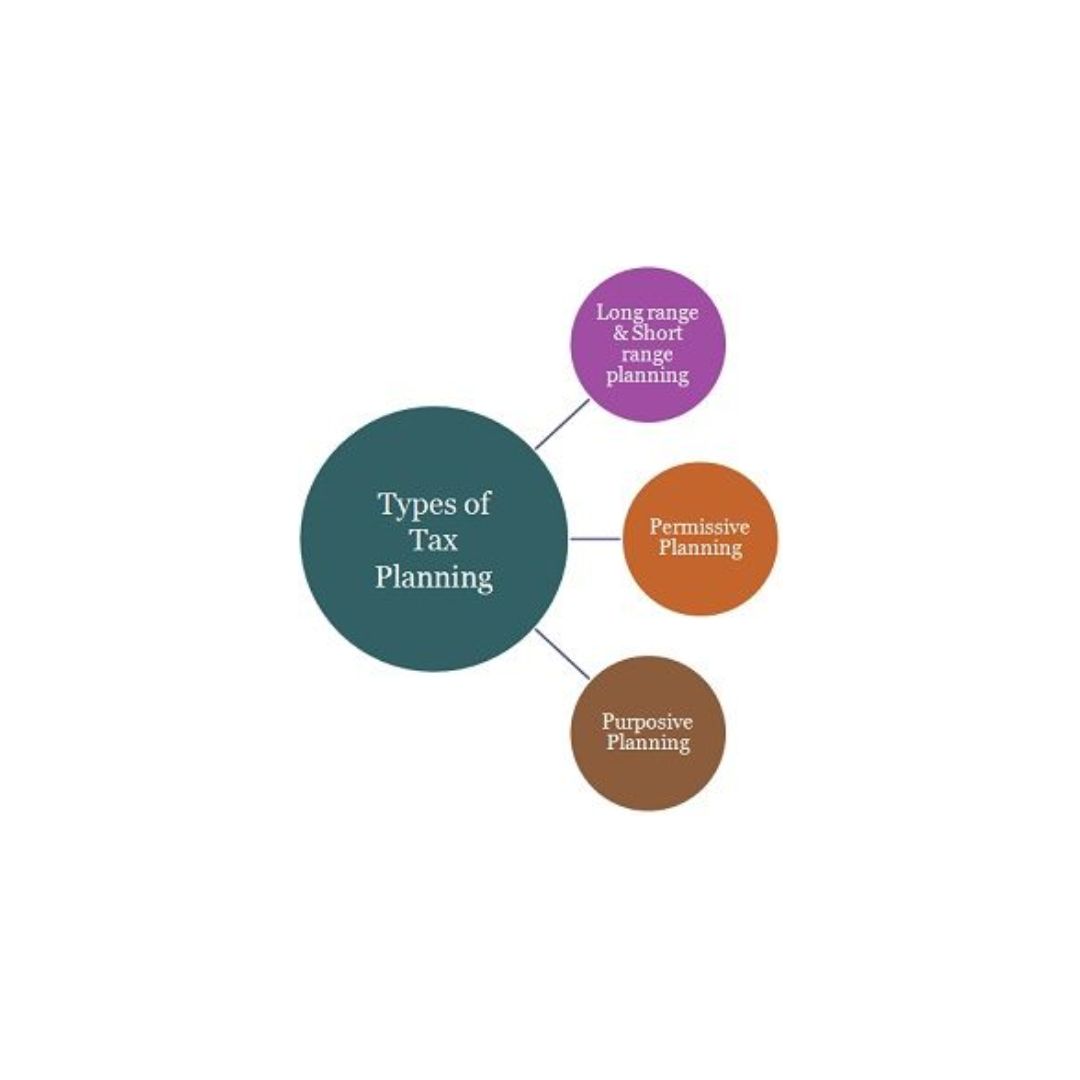

What is tax planning and types?

Tax planning and types Tax planning and types, Tax planning involves strategically arranging financial matters and transactions in a manner that adheres to legal requirements while effectively minimizing tax obligations. It involves making strategic decisions and utilizing available tax provisions, exemptions, deductions, and credits to optimize tax efficiency. Below are several frequently encountered… Read More »