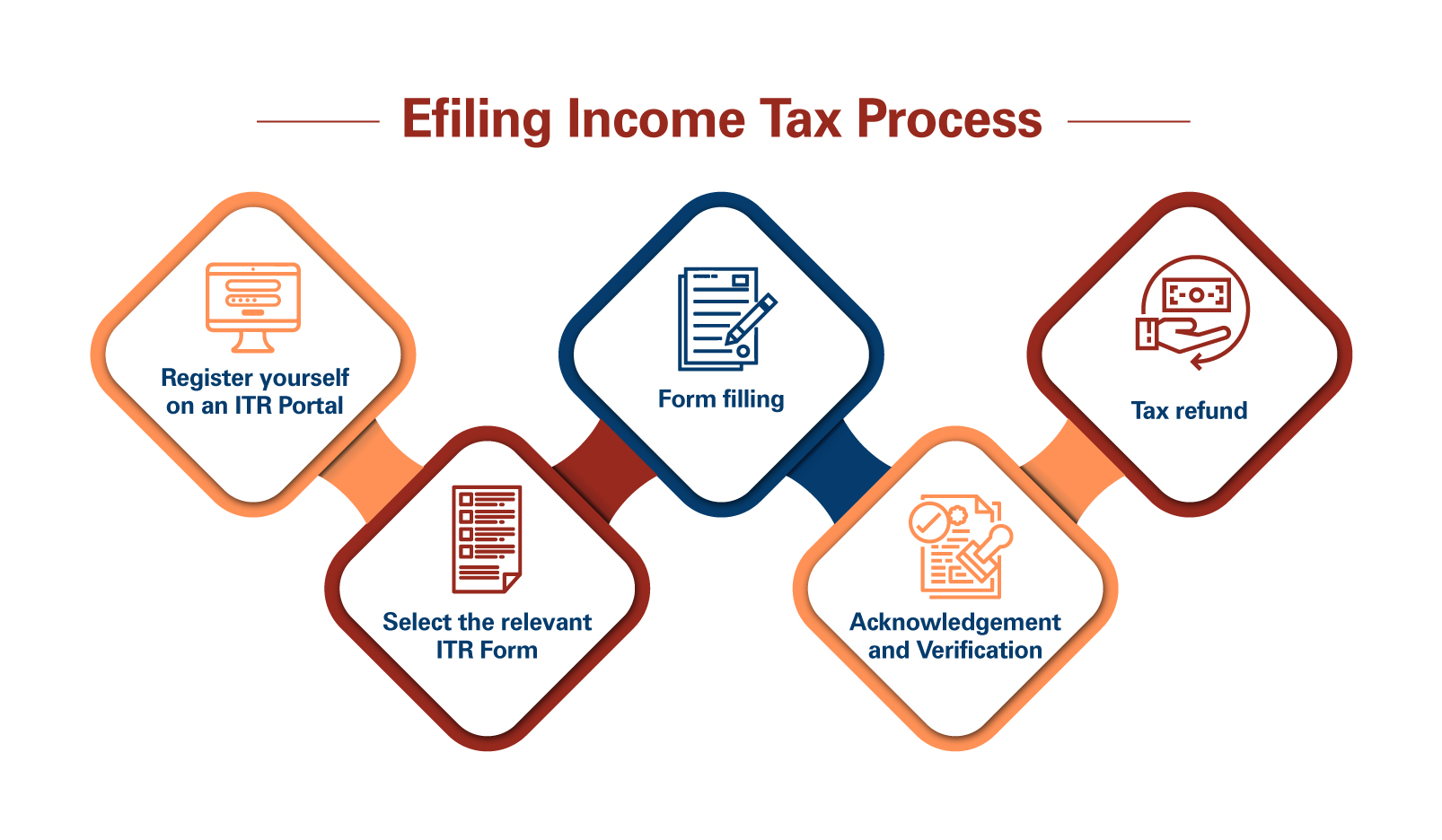

How to ITR file offline?

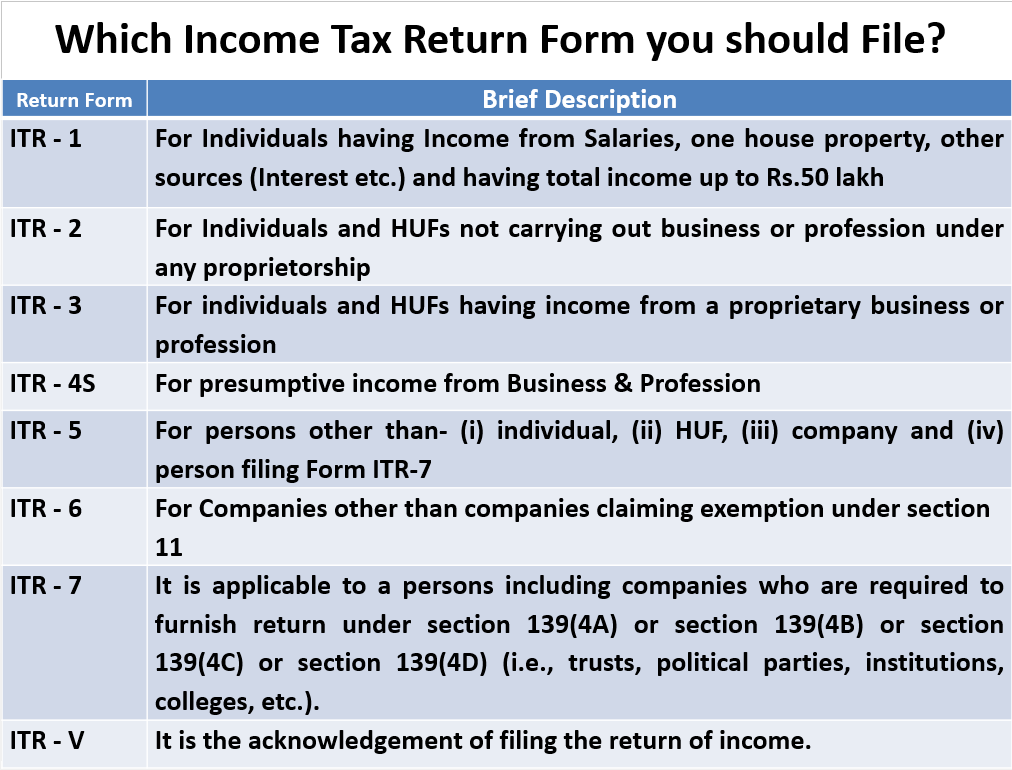

Simple ways to file ITR offline Simple ways to file ITR offline, To file an Income Tax Return (ITR) offline, you can follow these steps: Obtain the required ITR form: Visit the official website of the Income Tax Department of your country (e.g., the Income Tax Department of India) and download the relevant ITR… Read More »