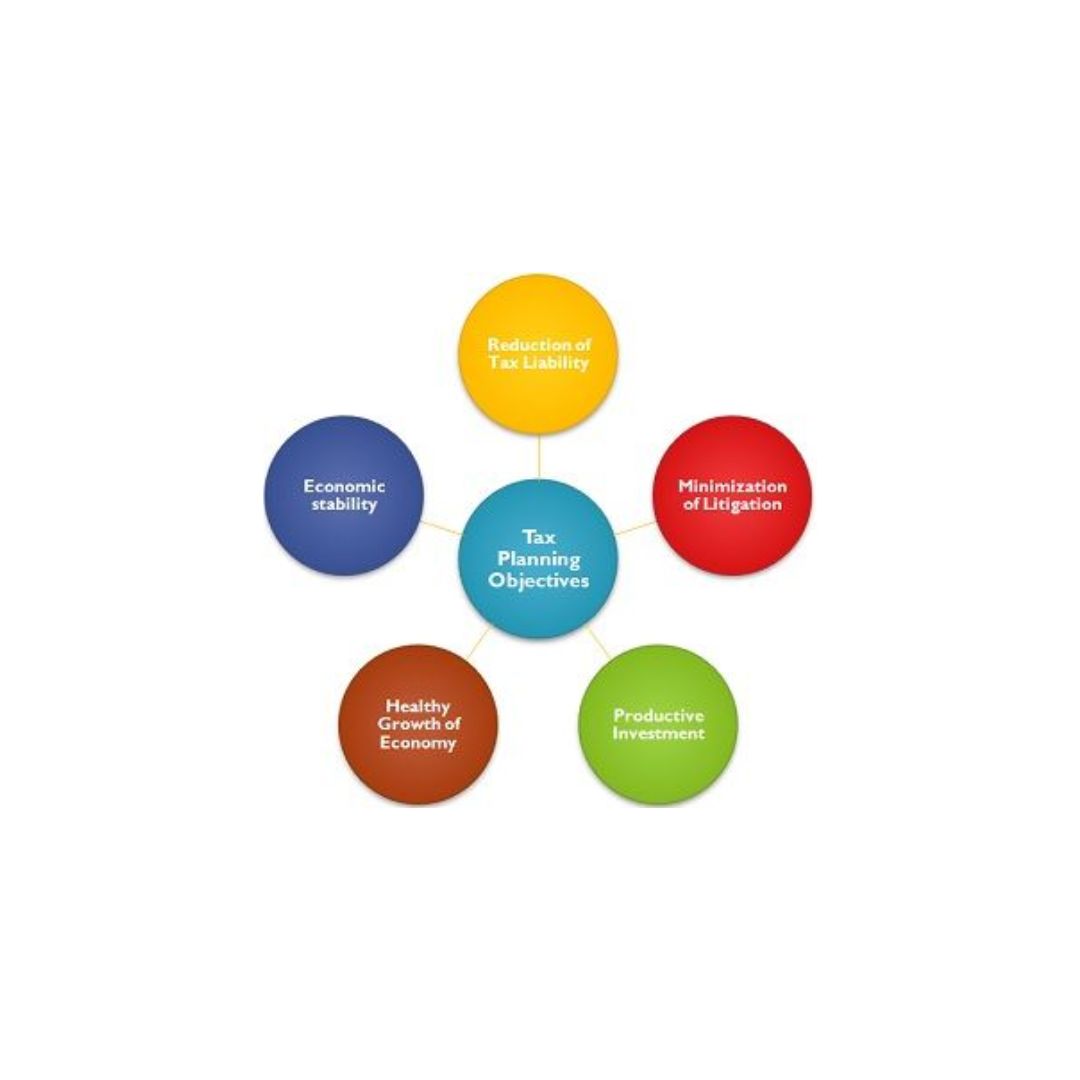

Tax Planning can help?

Tax Planning can help Introduction Tax planning is an essential financial strategy that helps individuals and businesses optimize their tax liabilities legally. It involves analyzing financial situations and structuring transactions to take advantage of tax benefits, deductions, and exemptions. By implementing effective tax planning, taxpayers can maximize their savings while remaining compliant with… Read More »