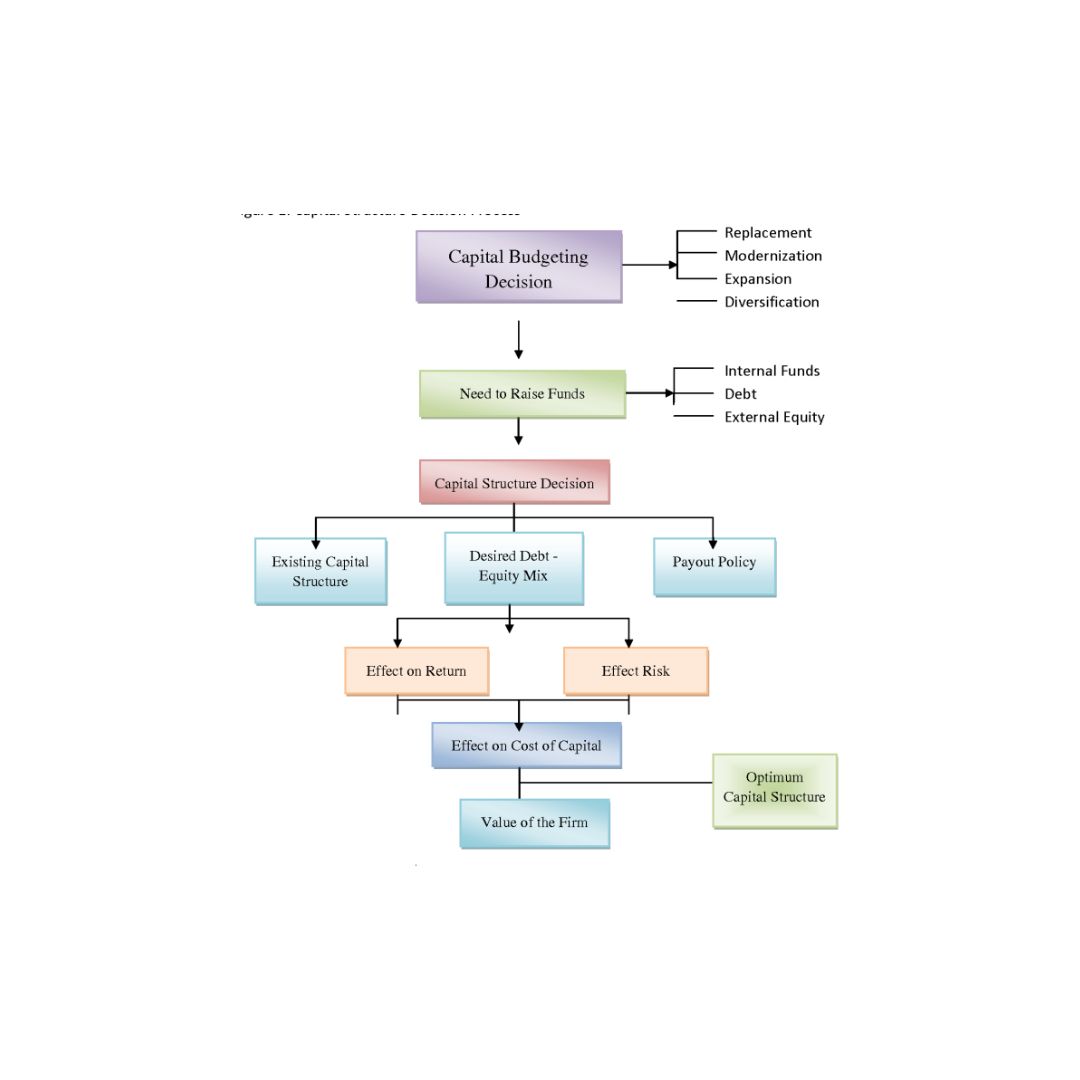

Tax planning to capital structure decision ?

Capital structure decision Capital structure decision: Tax planning has a significant impact on capital structure decisions, which involve determining the composition of a company’s financing sources, such as debt and equity. By integrating tax considerations into capital structure decisions, companies can strategically optimize their tax positions and minimize their overall… Read More »