What is tax planning for corporate?

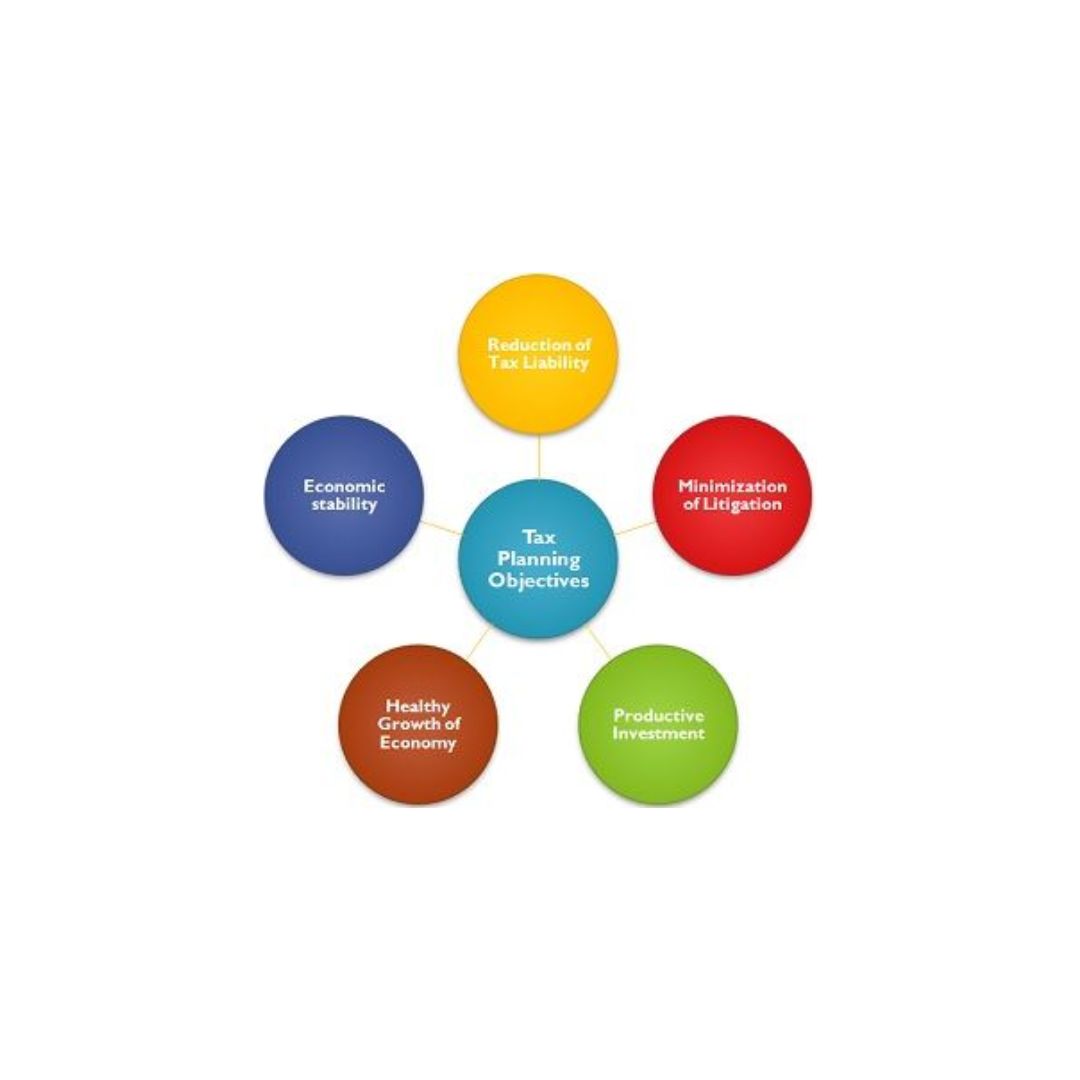

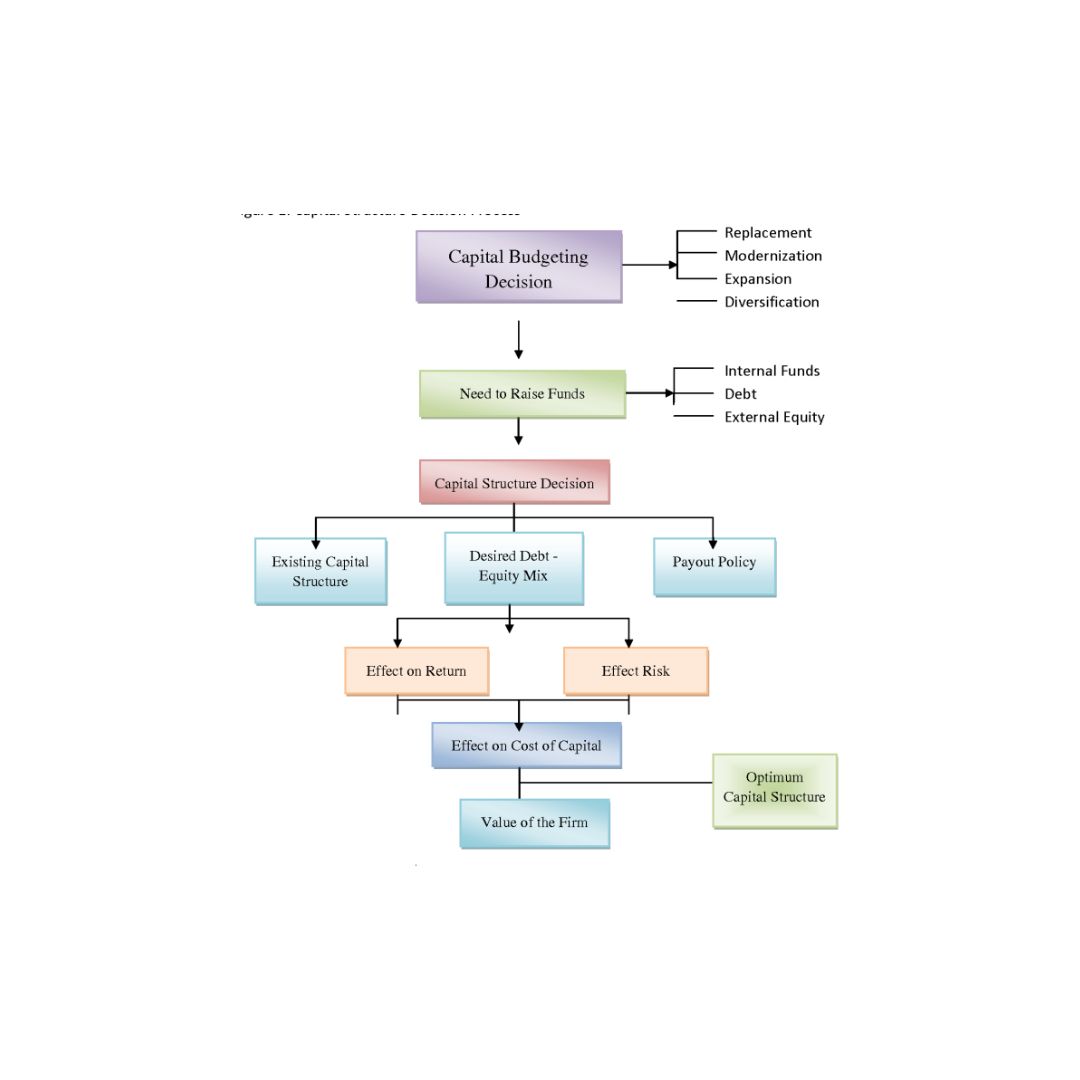

Tax Planning for Corporate Tax planning for corporate encompasses the deliberate formulation and execution of strategies, along with proactive measures taken by businesses, to efficiently handle their tax obligations. This approach ensures compliance with relevant tax laws and regulations while maximizing their tax position and overall financial standing. The goal of corporate tax planning… Read More »