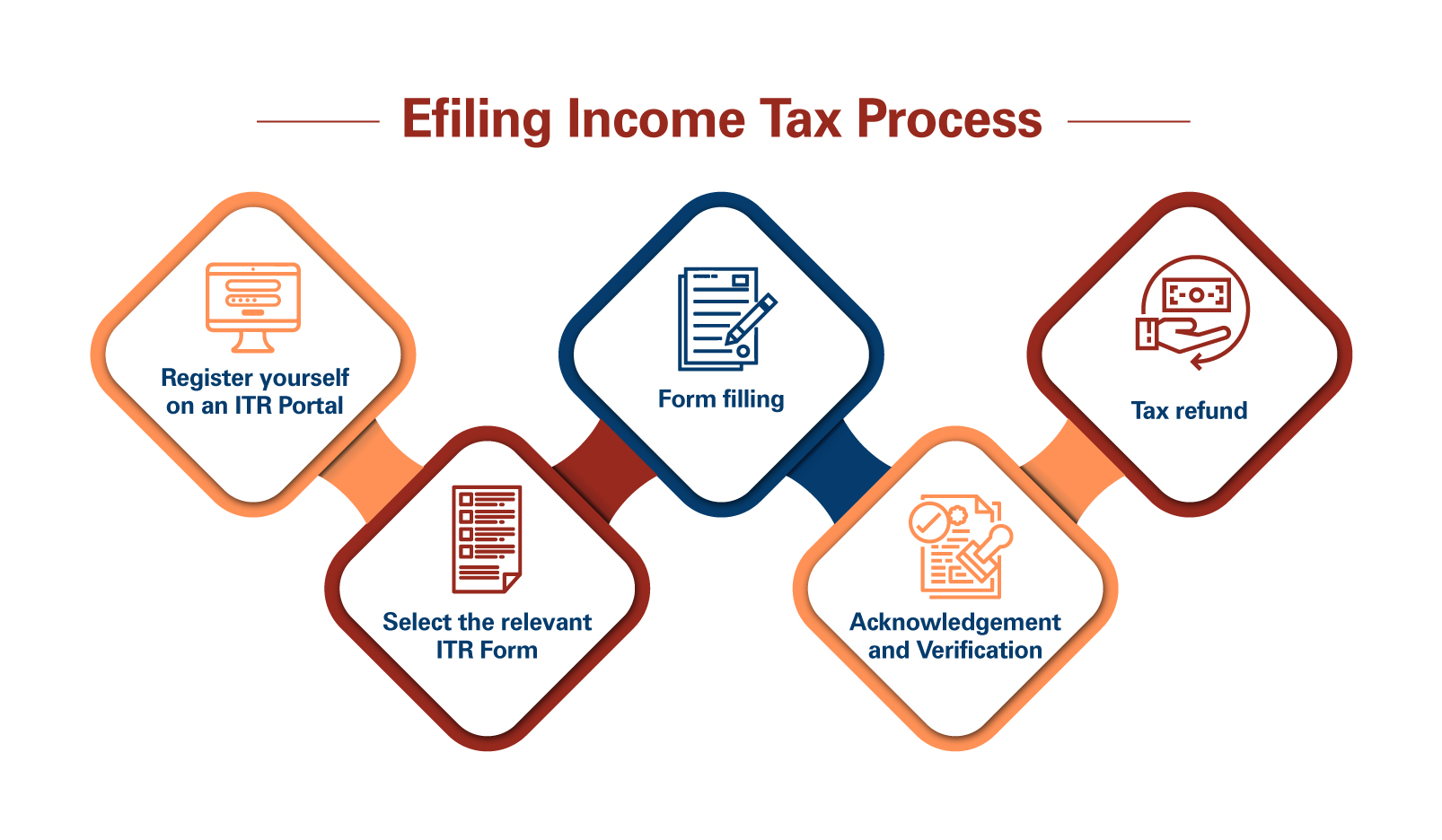

What is ITR filings process?

ITR Filings Process The ITR filings process in India generally involves the following steps: 1. Gather the necessary documents: Collect all the relevant documents such as Form 16 (if applicable), bank statements, investment proofs, rent receipts, and any other supporting documents related to your income, expenses, and deductions. 2. Choose the correct ITR form:… Read More »