Tax planning with reference to nature of business

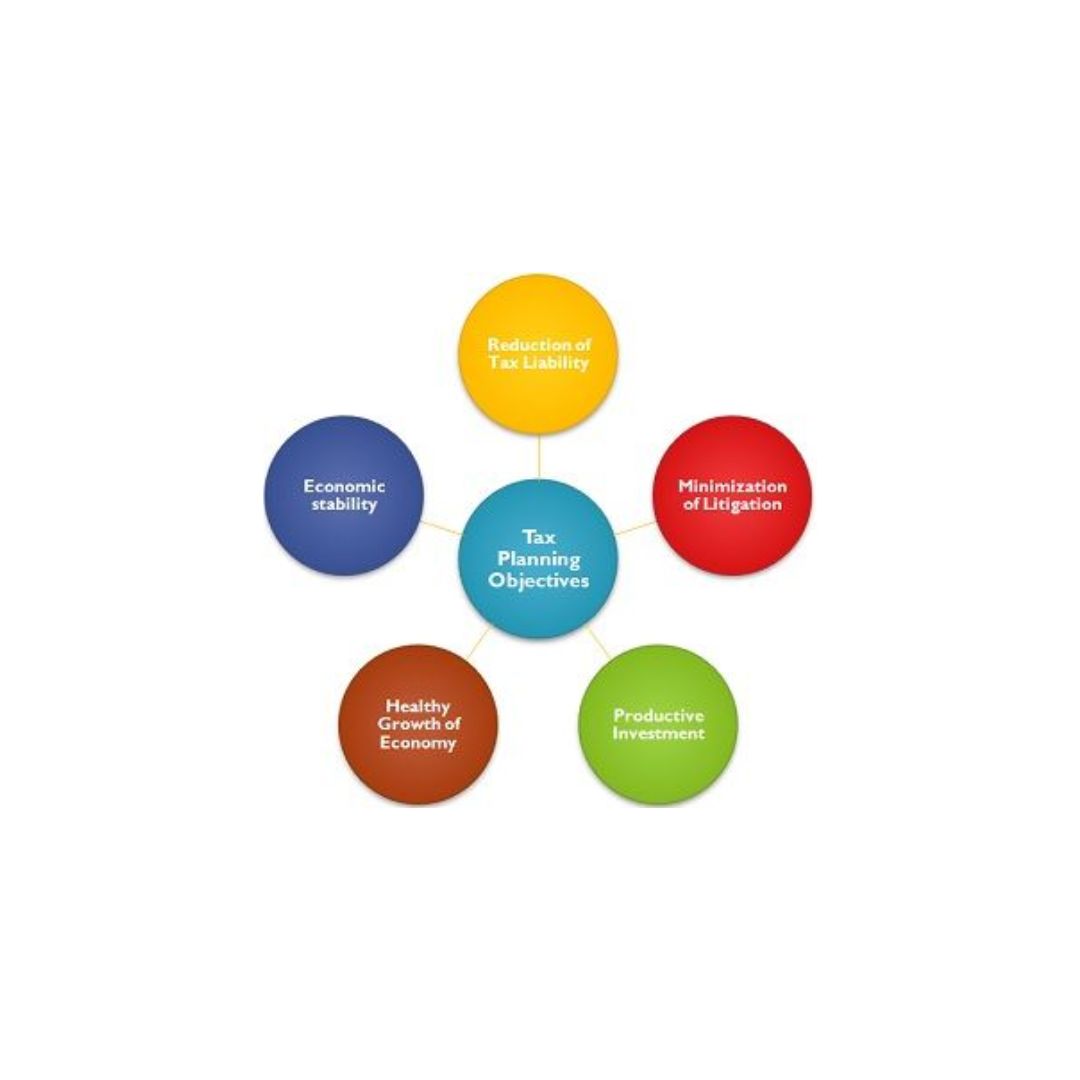

Tax planning with reference to nature of business “Tax Optimization Based on Business Nature” Tax planning, with reference to the nature of business, entails the identification and implementation of strategies tailored to the specific characteristics and operations of the business to optimize tax positions. Here’s a fresh perspective on tax planning with respect to… Read More »