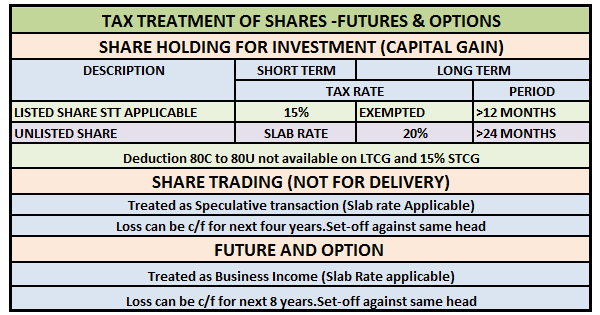

What is a long-term capital gains tax India?

Long-term capital gains tax India It is a tax on long-term capital gains tax India refers to the tax impose on the earnings generate from the sale of assets that are held for a long period of time. In the Indian context, long-term capital gains tax is applicable on the sale of assets such… Read More »