What is ITR filing last date?

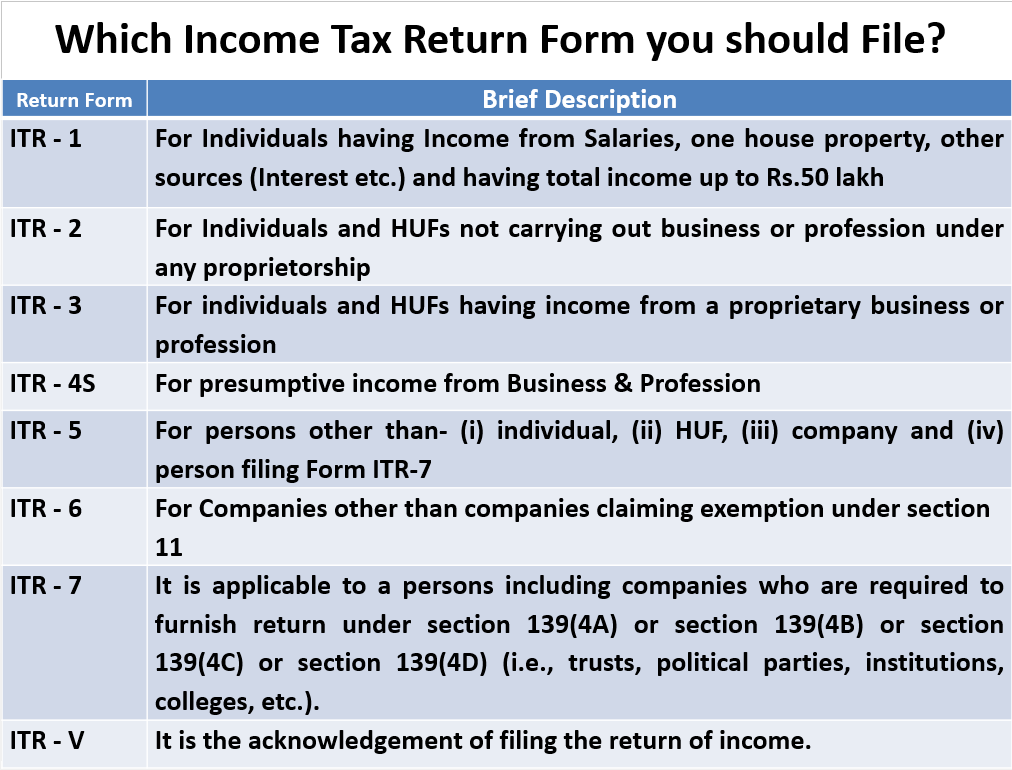

User Intent Users searching for “ITR filing last date” are likely looking for crucial information about the income tax return (ITR) filing deadline, including key dates, penalties, benefits, and a step-by-step guide on how to file ITR on time. This article provides all essential details in a structured manner. Introduction Filing an Income Tax… Read More »