What is the applicable tax form for a contractual service provider while filing their ITR?

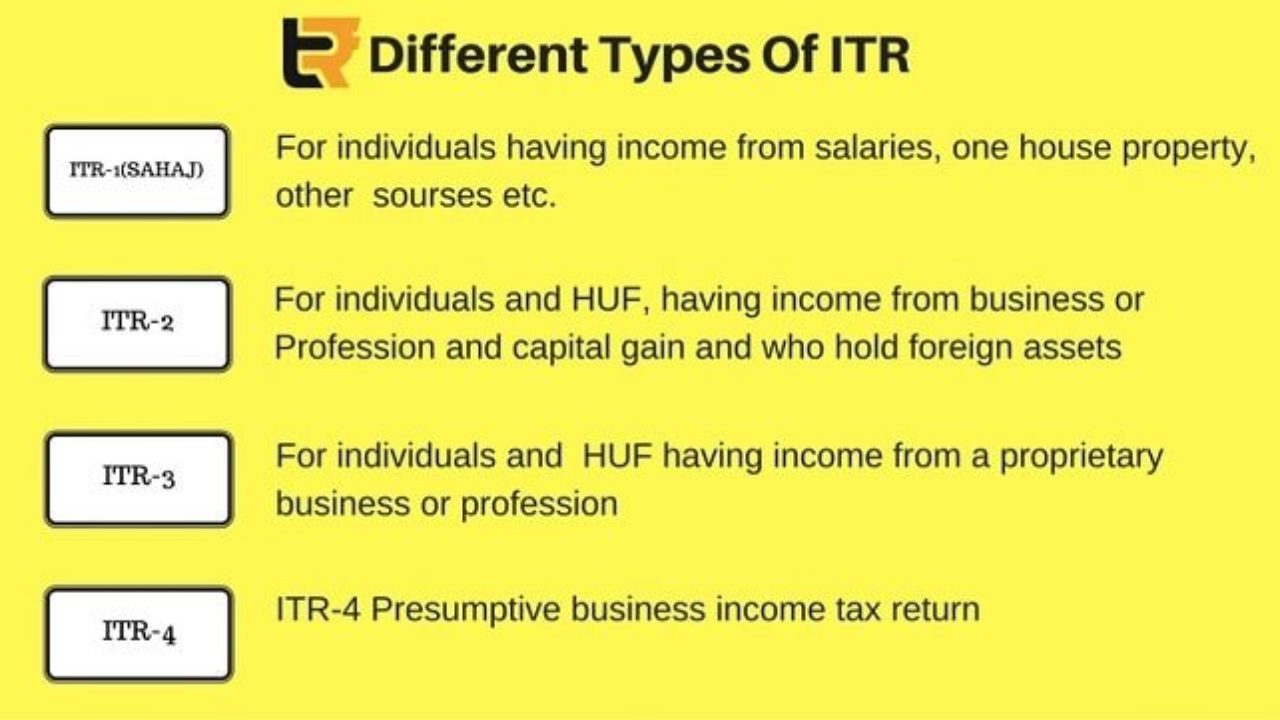

ITR Applicable Form However, if the service provider operates as a business entity, the appropriate form may vary: 1. Sole Proprietorship: If you operate as a sole proprietor providing contractual services, you would typically report your business income and expenses on Schedule C (Profit or Loss From Business) or Schedule C-EZ if… Read More »