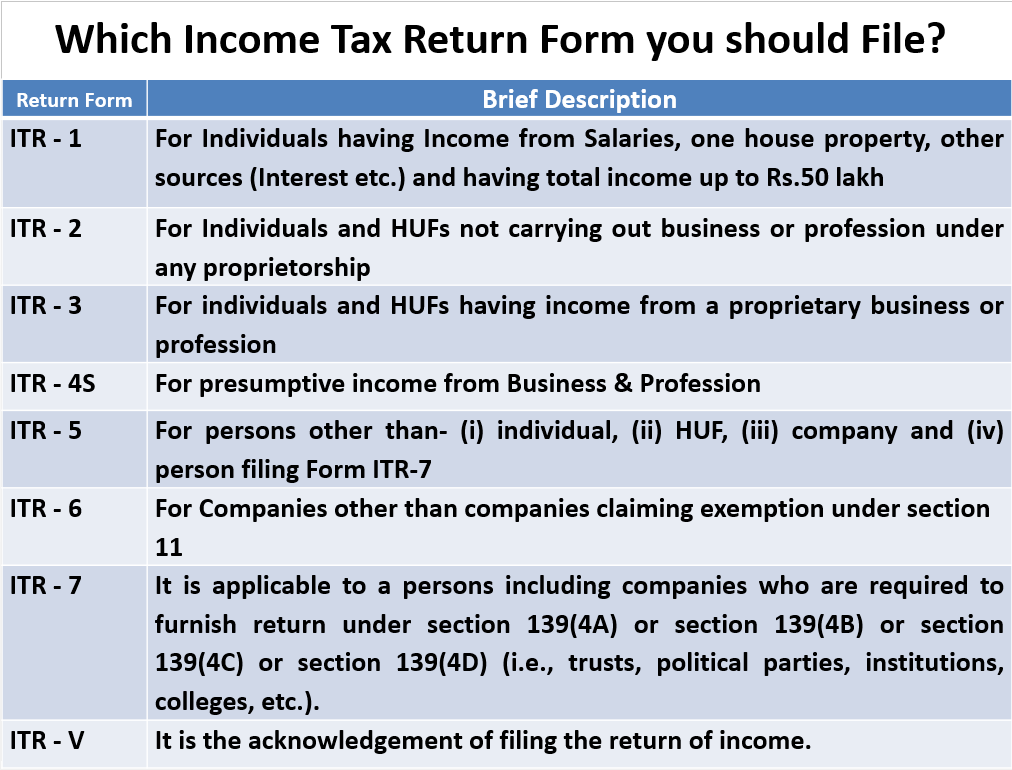

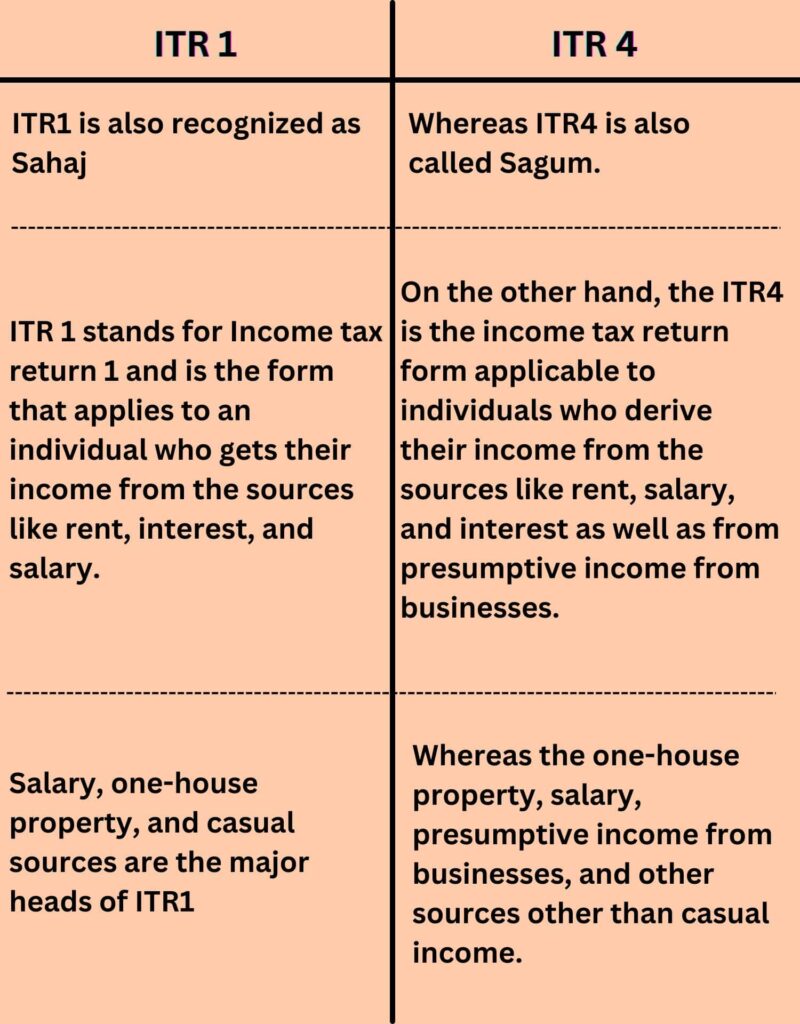

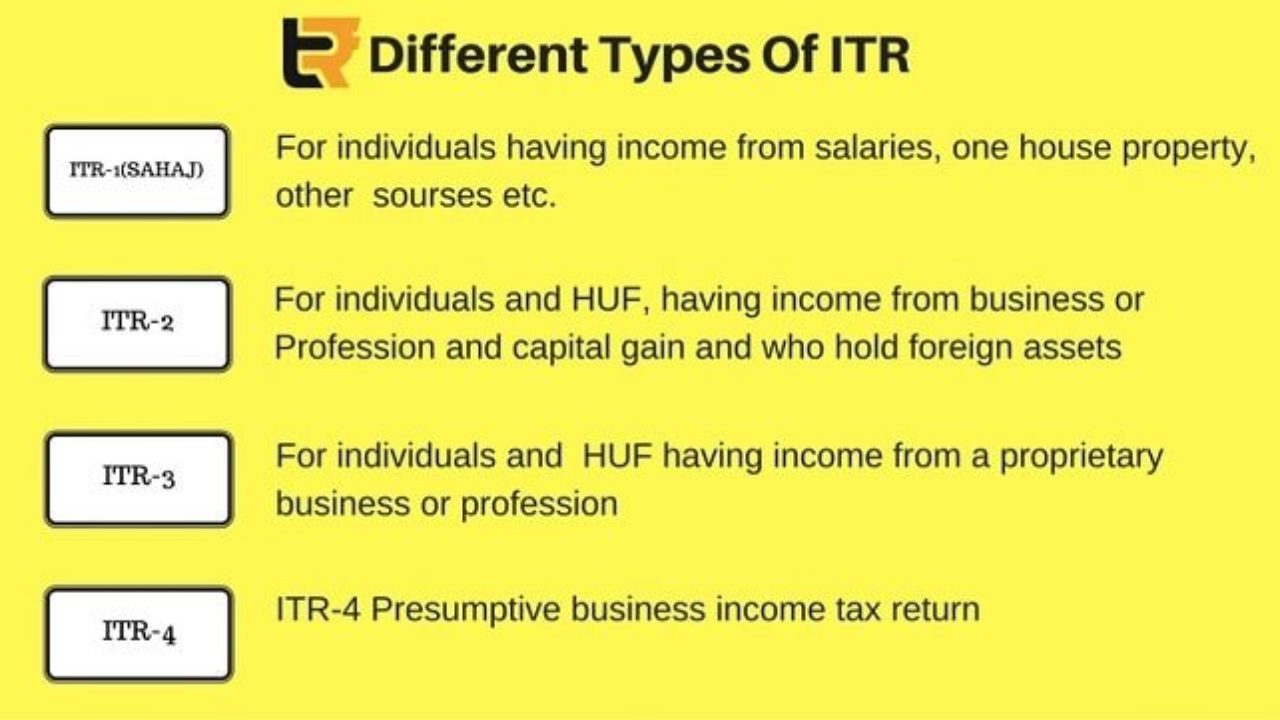

How many types of ITR filing?

Types of ITR filing Types of ITR filing, In India, there are several types of Income Tax Return (ITR) forms available for different categories of taxpayers. The selection of the appropriate ITR form depends on the nature of income, source of income, and the individual’s or entity’s status. As of my knowledge cutoff in… Read More »