Are there any penalties for computer repair and maintenance services if they fail to file their ITR on time?

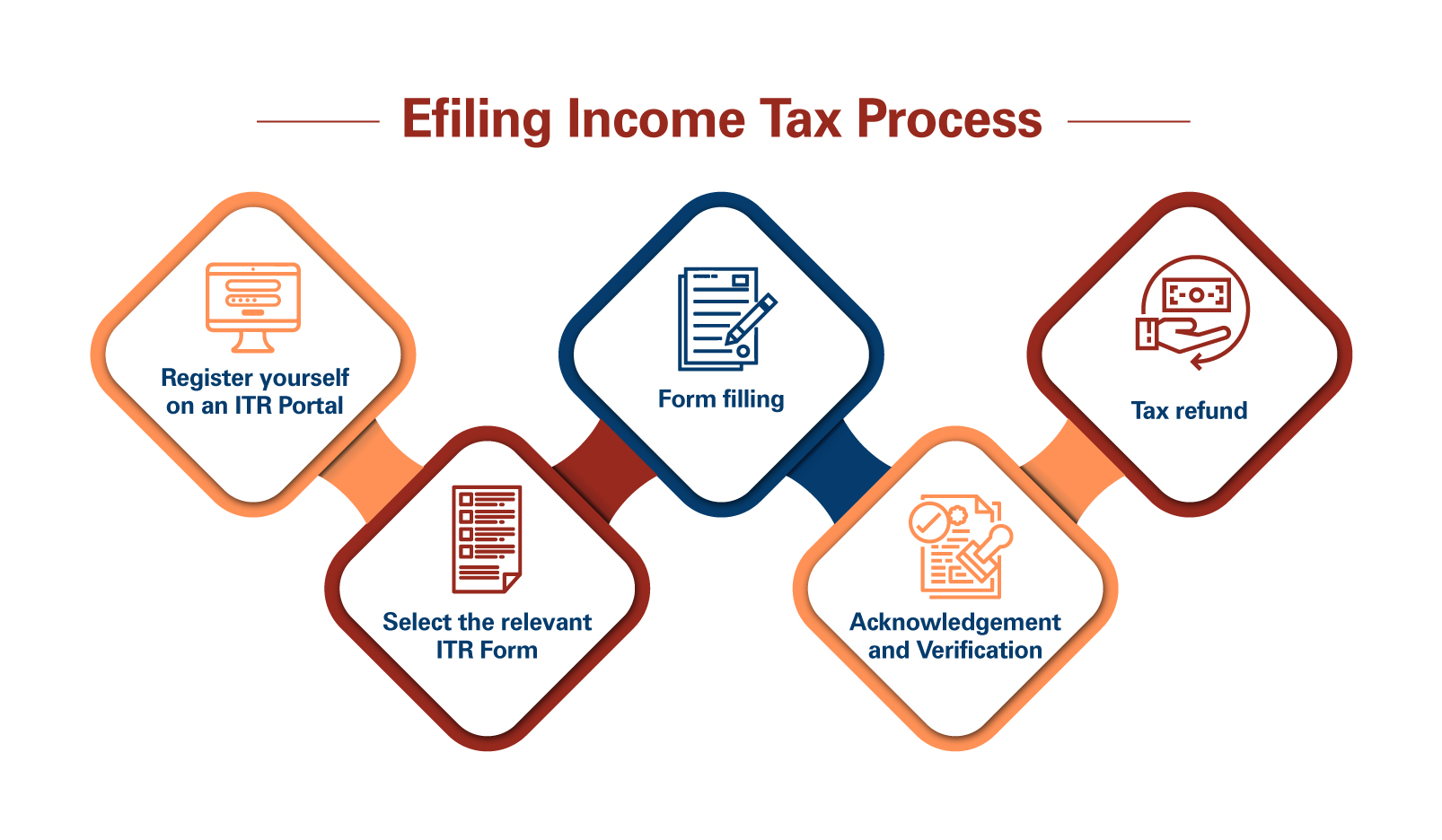

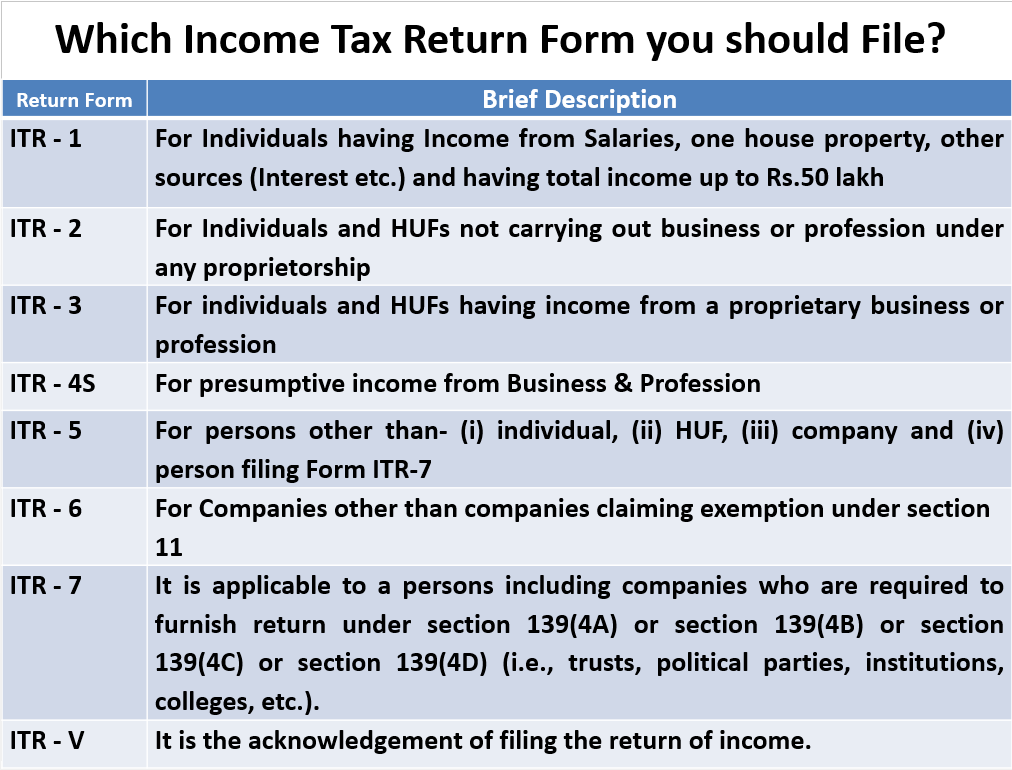

Computer Repair and Maintenance Services Yes, there are penalties for computer repair and maintenance services if they fail to file their Income Tax Return (ITR) on time. The penalties depend on the number of days late the return is filed. Up to 30 days late: A penalty of Rs. 500. 31 to 60 days… Read More »