47. What tax deductions are available for Diagnostic Centre during ITR filing?

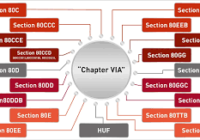

Tax Deductions Here are the tax deductions available for diagnostic centers during ITR filing in India: 1. Section 80D: This section allows a deduction of up to Rs. 50,000 on medical expenses incurred by the taxpayer, his/her spouse, children, parents, and dependents. This includes expenses incurred on hospitalization, surgery, consultation fees, diagnostic… Read More »