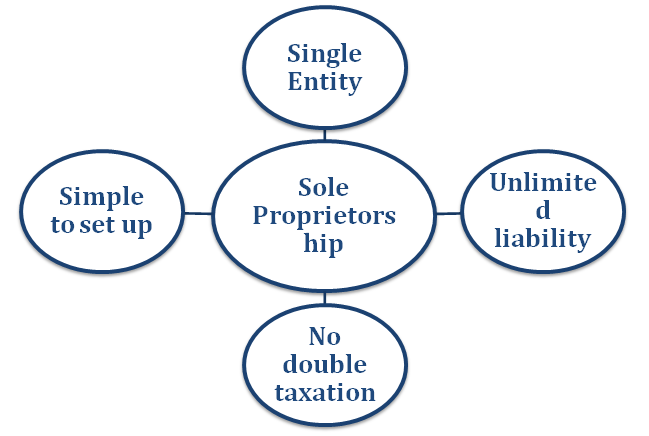

Do you have to register your business as a sole proprietor?

Do you have to register your business as a sole proprietor The requirement to register your business as a sole proprietor can vary depending on the country, state, or region in which you operate. In many jurisdictions, there is no legal requirement to register a sole proprietorship specifically. As a sole proprietor, you can typically… Read More »