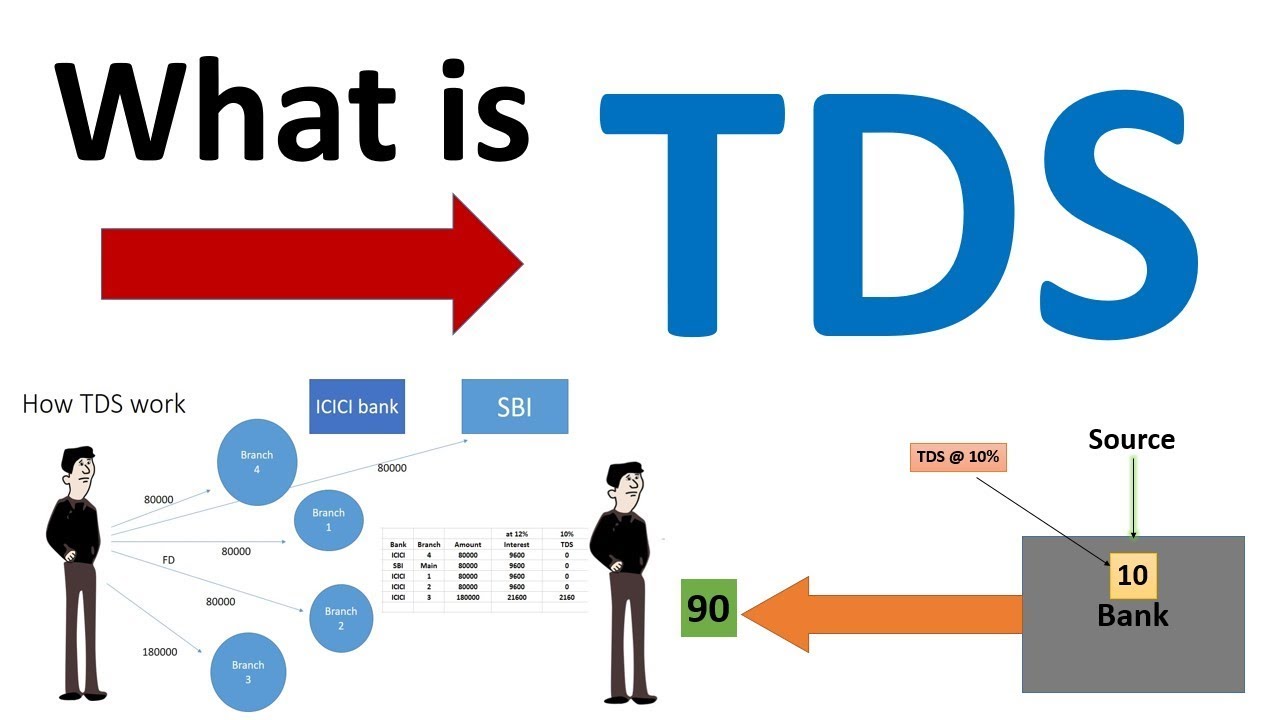

TDS Return compliance?

TDS Return compliance Compliance with TDS (Tax Deducted at Source) return filing is crucial for businesses or individuals who have deducted TDS and are required to report and remit the deducted amounts to the tax authorities. The specific compliance requirements may vary depending on the country and its tax laws. Here are some common aspects… Read More »